The Impact of Breaking the 'No Star Marketing' Rule Pays Off

Fourth Quarter Sales Jump 13% Despite Domestic Downturn

Separate Sales Not Disclosed Yet... Fierce Competition with BBQ for Second Place

Kyochon Chicken has poured the groundwork for reclaiming the throne in the chicken industry. The 'star marketing' card, pulled out for the first time in nine years, boosted domestic sales and successfully expanded overseas territories, leading to a rebound in last year's performance. Although it has not yet caught up with the industry leader bhc Chicken, it appears to have fiercely competed with BBQ for the second place. Kyochon Chicken plans to continue expanding its scale this year through new product launches that align with changing consumer trends such as the spread of single-person households.

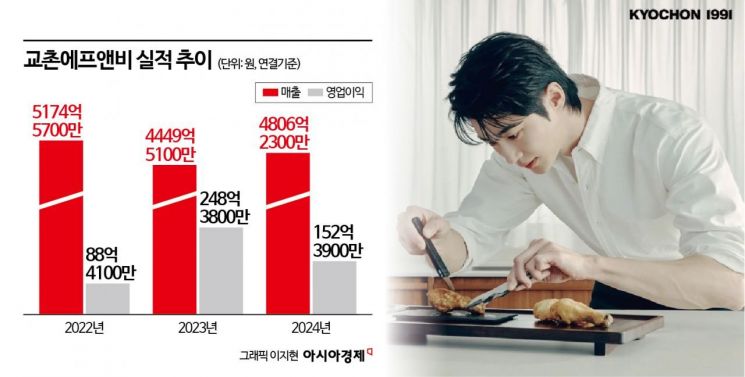

Kyochon F&B, the operator of Kyochon Chicken, announced on the 13th that its consolidated sales last year rose 8% year-on-year to 480.6 billion KRW. Sales, which had fallen from 517.5 billion KRW in 2022 to 445 billion KRW in 2023, rebounded within a year. However, due to a one-time expense of 22.9 billion KRW related to the direct management conversion of franchise regional headquarters, the annual operating profit was recorded at 15.2 billion KRW, down 38.6% from the previous year. Excluding the cost of the direct management conversion of franchise regional headquarters, operating profit increased by 53.6% (13.3 billion KRW) from the previous year to 38.1 billion KRW.

Kyochon F&B's strong performance is attributed to the effective impact of the 'star marketing' card pulled out for the first time in nine years. Kyochon Chicken, which had been shunned by consumers due to the chicken price hike issue, broke its ironclad rule of 'not doing star marketing' in October last year and appointed actor Byeon Woo-seok as its brand model for the first time in nine years. Since then, it has succeeded in improving its image, and sales in the domestic chicken franchise business surged. Of the increased 35.6 billion KRW in Kyochon F&B's sales, 33.3 billion KRW came from the domestic chicken franchise business, demonstrating the significant ripple effect of star marketing.

A Kyochon F&B official explained, "Consumer demand is showing a full recovery trend, and above all, thanks to the 'Byeon Woo-seok effect,' sales in Kyochon's core business area, the domestic chicken franchise business, have increased."

The Byeon Woo-seok effect was particularly evident in the fourth-quarter sales. Kyochon F&B's sales in the fourth quarter of last year recorded 125.9 billion KRW, up 13.2% year-on-year, which is considered a considerable achievement given the severe domestic economic downturn during that period.

There is also significance in the qualitative aspect of sales. As the use of Kyochon Chicken's own app became active, the dependence on delivery apps, which impose heavy commission burdens on franchisees, was reduced. The cumulative number of members of the proprietary app reached 6.2 million as of December last year, nearly 900,000 more than the 5.31 million in the previous year.

The full-scale expansion of overseas territories also contributed to the sales increase. Kyochon Chicken opened new stores last year in Hangzhou, China; Taoyuan and Kaohsiung, Taiwan; Malaysia; and Indonesia, reaching a total of 84 global stores as of the end of December last year. Accordingly, direct sales, franchise royalties, and export of materials also increased.

In addition, various new businesses such as the launch of new brands like Memil Danpyeon, sauce business, craft beer, and eco-friendly packaging have stabilized, leading to increased related sales.

With this performance rebound, attention is focused on whether Kyochon, which held the top spot for about 10 years until 2021 but fell to third place, can surpass bhc Chicken and BBQ again in the future. Although the results of bhc Chicken and BBQ have not yet been disclosed, it is highly likely that Kyochon Chicken fiercely competed with BBQ for second place.

Kyochon Chicken plans to continue its sales growth this year by launching new products reflecting new consumer trends, including the single-person tailored menu 'Single Series,' and expanding the number of overseas markets. A Kyochon F&B official said, "Due to steady growth in domestic and overseas businesses, we have maintained solid growth, recording sales in the 120 billion KRW range for two consecutive quarters," adding, "We plan to enhance the purchasing and logistics processes following the direct management conversion of franchise regional headquarters to improve the profit structure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)