Binggrae Solidifies Top Position After Haitai Ice Cream Acquisition

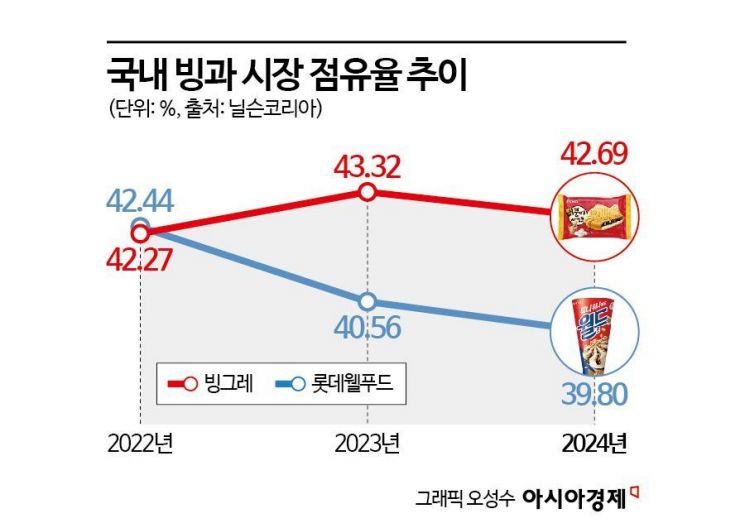

Last Year’s Market Share at 42.69%... Lotte Wellfood Follows with 39.80%

Ice Cream Market Sees Modest Growth Despite Low Birthrate Crisis

Both Companies Seek Overseas Expansion Amid Domestic Market Limitations

Binggrae surpassed Lotte Wellfood to maintain its position as the number one domestic ice cream market leader for two consecutive years. It appears to have solidified its throne since acquiring Haitai Ice Cream in 2020. Last year, with the early heatwave and the development of new products aligned with the healthy pleasure trend, the domestic ice cream market, which had been melting due to the low birthrate impact, succeeded in rebounding for the third consecutive year.

According to market research firm Nielsen Korea on the 15th, Binggrae (including Haitai Ice Cream) recorded a 42.69% market share in the domestic ice cream market last year, ranking first. This figure combines Binggrae's own 28.10% share and the 14.59% from Haitai Ice Cream acquired in 2020. Lotte Wellfood ranked second with 39.80%.

Thus, Binggrae has secured the top spot in the domestic ice cream market for two consecutive years based on Nielsen Korea's data. Binggrae and Lotte Wellfood have been competing closely for the number one position for several years. In 2022, Lotte Wellfood narrowly took first place.

The product with the highest sales proportion based on retail sales was Lotte Wellfood's World Cone (5.47%). Close behind was Binggrae's Bungeoppang Samanco (5.47%), and third place was Haagen-Dazs (4.74%). Fourth place was Binggrae's Melona, and fifth was Binggrae's Bravo Cone.

Last year, the domestic ice cream market size grew slightly. Total sales reached 1.4457 trillion KRW, a 1.28% increase from the previous year. The domestic ice cream market size nearly reached 2 trillion KRW until 2015. However, due to the low birthrate impact, the population of key consumer groups such as infants and adolescents decreased, and with the ongoing health-conscious trend, the market shrank to 1.2934 trillion KRW in 2021. Fortunately, since 2022, it has rebounded for three consecutive years, regaining its position.

Last year, with the early heatwave, ice cream manufacturers engaged in fierce competition early on. Additionally, the healthy pleasure trend, which values both taste and health, led to the release of low-calorie new products one after another, revitalizing the ice cream market. In May last year, Lotte Wellfood launched the industry's first zero-calorie ice creams, 'Screw Bar 0 kcal' and 'Jaws Bar 0 kcal,' which sold about 7.2 million units within a month of release. This was more than twice the initial planned quantity of 3.2 million units. Binggrae responded by launching products such as 'Heat Hunt Zero Decaffeinated Coffee' and 'Fresh Tangerine Zero Citrus,' successfully attracting young female consumers who had left the ice cream market.

Binggrae is estimated to have achieved sales of around 1.47 trillion KRW last year, a 5% increase compared to the previous year. Operating profit is expected to have increased by 13% to 126.6 billion KRW. Since acquiring Haitai Ice Cream, it has integrated production, logistics, and sales networks and engaged in joint marketing, achieving rapid external growth.

Lotte Wellfood's ice cream division sales remained at the previous year's level due to the domestic recession despite the success of zero-calorie products. Last year, ice cream division sales were 610.1 billion KRW, similar to 608.8 billion KRW the previous year.

Binggrae Melona Export Package

Binggrae Melona Export Package

Meanwhile, both Binggrae and Lotte Wellfood are accelerating overseas expansion to secure future growth engines. As K-food rapidly globalizes, now is the right time to expand overseas territories. Binggrae plans to continue its external growth centered on the U.S. this year. In addition to its flagship product Melona, it plans to secure distribution channels for products like Banana Flavored Milk. It also plans to expand export regions to Europe and other areas. Lotte Wellfood has completed a new factory in Pune, central-west India, to produce ice cream products such as Pig Bar and Jaws Bar, and will operate it in full scale to increase ice cream sales in India by 15% compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.