'Daks Shirts' License Nearing Expiration

Attention on LF Networks' Next Move

Photo by Daks Shirts

Photo by Daks Shirts

Attention is focused on the fate of the 'Daks Shirts license' owned by LF, a lifestyle culture company under the 범LG family (家).

According to the fashion industry on the 12th, the license contract for 'Daks Shirts' between LF and Tribones, a subsidiary of LF Networks, will expire in July. LF holds the master license contract related to design and manufacturing technology for the Daks brand, granting it exclusive sales and distribution rights. In this process, LF delegated the rights by granting sub-licenses to its related special affiliates.

Tribones recorded sales of 83 billion KRW and an operating loss of 300 million KRW in 2023. Among total sales, the sales proportion of 'Daks Shirts' accounts for about 80%. Typically, fashion brand license contracts are discussed 6 to 9 months before the contract ends, but it is reported that the Daks Shirts license contract has not yet been renewed. If Tribones fails to renew the Daks Shirts license contract, it may lose its business foundation.

The fashion industry is concerned that Tribones might follow the same path as Pastel Sesang. Pastel Sesang, another children's clothing subsidiary of LF Networks, is undergoing closure after LF withdrew license contracts for Daks and Hazzys Kids last year. The two brands accounted for over 80% of the company's total sales of 100 billion KRW. The company has laid off all employees and is currently closing its department store outlets.

Shareholding Relationship between LF and LF Networks

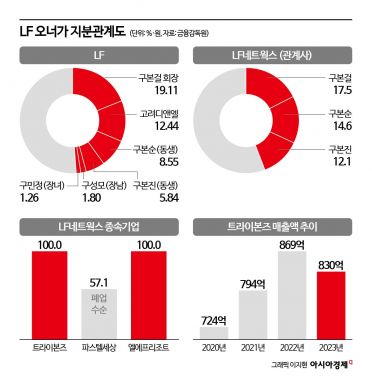

LF and LF Networks are undergoing a separation process. In 2022, LF reorganized its governance structure by spinning off LF Networks. The landscaping division of LF Networks was separated to establish Goryeo D&L. As of the end of 2023, the largest shareholder of Goryeo D&L is Koo Seong-mo, son of Chairman Koo Bon-geol, holding 91.58% of shares.

Goryeo D&L holds the second-largest stake in LF after Chairman Koo Bon-geol. After receiving 6.18% of LF shares from LF Networks, Goryeo D&L steadily increased its stake through on-market purchases. As of February, it holds 12.44% of LF shares. LF Networks holds no shares entangled with LF. However, representatives Koo Bon-soon and Koo Bon-jin hold 8.55% and 5.84% of LF shares respectively, categorizing them as related parties. The largest shareholder of LF is Chairman Koo Bon-geol (19.11%). Although the largest individual shareholder of LF Networks is still Chairman Koo Bon-geol (17.5%), combining the shares of representatives Koo Bon-soon (14.6%) and Koo Bon-jin (12.6%) exceeds 25%.

Fashion Group Hyungji Eyes Daks Shirts

Photo by Daks Shirts

Photo by Daks Shirts

Fashion Group Hyungji's interest in the 'Daks Shirts license' could also pose an obstacle to Tribones renewing the contract. Operating Daks Shirts, the number one brand in the shirt market, could create synergy with its affiliate Hyungji I&C. Recently, Hyungji I&C has experienced declining sales due to weakened brand competitiveness and insufficient response to online consumer trends. Hyungji I&C's sales were 70.4 billion KRW in 2022, 65.3 billion KRW in 2023, and 40.6 billion KRW for the first nine months of last year, showing a downward trend.

Hyungji I&C also has a deep connection with 'Daks Shirts.' From 1993 to 2008, the license holder of 'Daks Shirts' was Woosung I&C. Woosung I&C operated the men's shirt brand Daks Shirts Yejak and the menswear brand Bon. When Chairman Koo Bon-geol separated LF (formerly LG Fashion) from LG, LF terminated Woosung I&C's Daks Shirts license contract because LF held the master license for Daks. Subsequently, LF established Tribones to directly operate Daks Shirts. Fashion Group Hyungji acquired Woosung I&C, which was struggling financially around 2012, and renamed it Hyungji I&C.

An LF official stated, "After fair negotiations with multiple companies that showed interest in the license based on established criteria, we decided to proceed with a renewal contract with the existing company that offered the most favorable terms. The process is currently in the final stages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.