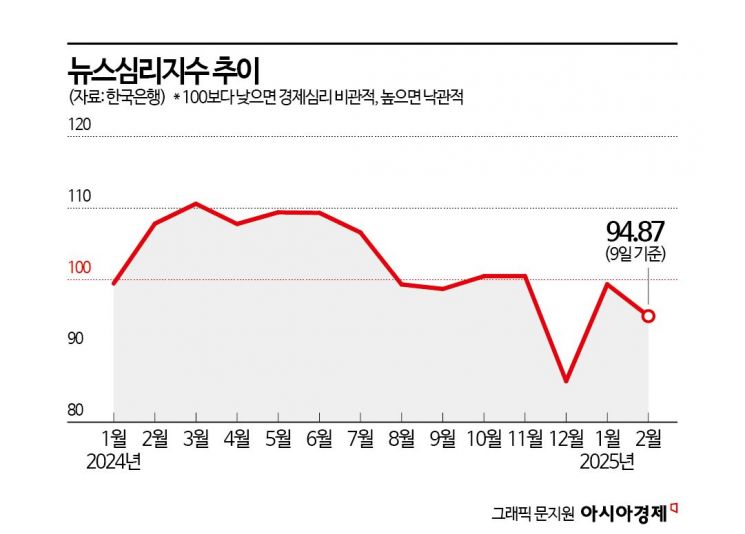

February News Sentiment Index at 94.87, Below Long-Term Average of 100

Household and Business Sentiment Indices Remain Below 100, Indicating Pessimism

Trump Tariff Setbacks and Repeated Downgrades of South Korea's Growth Outlook Have Impact

Economic sentiment continues to weaken amid uncertainties both domestically and internationally. With consecutive Trump-led 'tariff punches' causing downward revisions in South Korea's economic growth forecasts this year, it is difficult to expect a clear recovery in sentiment.

According to the Bank of Korea on the 12th, the News Sentiment Index (NSI) for the period from the 1st to the 9th of this month was recorded at 94.87. Although this is an increase compared to December last year (85.75), when martial law was declared, it fell from last month's 99.32 and remains below the baseline of 100. An index below 100 indicates that economic sentiment is more pessimistic than the long-term average.

On a daily basis, the index plunged to 77.08 on December 10 last year, then gradually recovered, surpassing the long-term average again on the 7th of last month and fluctuated around that level. However, immediately after the Lunar New Year holiday, it dropped again to the 80s by reflecting the shock from the Chinese AI startup DeepSeek and the news of the U.S. policy interest rate freeze all at once. Since then, volatility has increased depending on concerns over U.S.-imposed tariffs. The News Sentiment Index quantifies economic sentiment appearing in online economic news articles. Although it is not an official Bank of Korea statistic, it reflects economic conditions promptly and helps predict the sentiment of economic agents.

This shows that the slowly recovering sentiment indices of households and businesses are unlikely to turn clearly optimistic. Previously, the Consumer Confidence Index (CCSI) announced by the Bank of Korea last month was 91.2, improved from 88.2 in December last year but still below the long-term average of 100. Business sentiment also worsened. The January All-Industry Business Sentiment Index (CBSI) was 85.9, the lowest level since September 2020 when COVID-19 was at its peak. The contraction in economic sentiment raises concerns as it can lead to deterioration in real economic indicators and hinder economic growth.

In fact, South Korea's economic growth forecasts for this year have been repeatedly revised downward recently. According to the International Finance Center, the average growth forecast for South Korea by eight global investment banks (IBs) as of the end of January is 1.6%. JP Morgan lowered its forecast to 1.2%. The Bank of Korea also suggested a range of 1.6?1.7% last month and has announced it will officially revise downward the domestic economic growth forecast for this year on the 25th of this month. The Korea Development Institute (KDI) also lowered its growth forecast for this year from 2.0% to 1.6%, a 0.4 percentage point cut, the day before.

Although financial market sensitivity to U.S. President Trump's tariff measures has somewhat decreased recently, it remains a factor increasing uncertainty in economic sentiment. Huh Jae-hwan, a researcher at Eugene Investment & Securities, said, "The tariff disputes involving reciprocal tariffs, tariffs against the European Union (EU), and additional tariffs on China are expected to continue at least until the second quarter of this year." Experts believe that resolving domestic political issues and the government's preparation of an additional supplementary budget (Chugyeong) will be factors contributing to sentiment improvement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)