410 Reports and Tips Last Year... Up 25% from Previous Year

"Don't Be Fooled by 'Principal Guarantee and High Returns'"

#Mr. A saw a video on YouTube around December last year claiming to earn 5 million KRW per month through gift card investments. After reviewing blog investment reviews and articles related to the company, he checked the business structure and principal guarantee agreement on the website. He deposited 10 million KRW into the account provided by the company but lost the entire amount except for the initial profits. The company then cut off contact.

#Mr. B invested after hearing from an acquaintance about a company that would pay 15 million KRW in installments over 365 days if he entrusted 10 million KRW. The company promised to give 150% of the investment amount in points on their own electronic payment platform and said a certain amount could be cashed out monthly. After confirming withdrawal facts from many people including his acquaintance, he invested and received fixed payments for three months, but the company disappeared afterward.

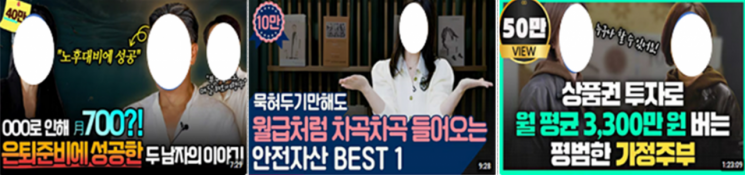

Illegal Ponzi scheme and fraud promotional video posted on YouTube. Provided by the Financial Supervisory Service

Illegal Ponzi scheme and fraud promotional video posted on YouTube. Provided by the Financial Supervisory Service

On the 11th, the Financial Supervisory Service (FSS) announced that it received 410 reports related to fraudulent fundraising last year. This is a 25% (82 cases) increase compared to the previous year (328 cases). Among them, 35 companies were caught and handed over to the police. Although the number of companies decreased by 12 (26%) from the previous year (47 companies), the number of individuals caught increased by 3 (3%) to 90. Fraudulent fundraising refers to acts of soliciting funds such as investments, deposits, or savings from unspecified many people without permits or registration, promising payments exceeding the principal.

According to the FSS, the types of fraudulent fundraising cases referred to the police for investigation were new technology and new business investments (17 cases, 48.6%), virtual assets and financial product investments such as stocks and bonds (12 cases, 34.3%), and real estate investments (6 cases, 17.1%) in that order. Recently, illegal online scams guaranteeing high returns on social networking services (SNS) have increased. An FSS official said, "Once victims fall for online scams, recovery is virtually impossible."

The FSS disclosed four representative fraudulent fundraising scams. Illegal operators pretended to be ▲promising businesses online ▲real estate practical investment targeting auction academy students ▲multi-level marketing recruitment targeting seniors ▲and used financial industry workers to disguise as financial planners to sweep up funds from ordinary citizens.

Key keywords used to lure consumers included 'principal guarantee,' 'real estate auction,' 'lifetime pension,' 'virtual asset listing,' and 'large sum management.' They especially emphasized caution against online "ghost" fraudulent fundraising scams that post fake investment success stories to collect funds and then disappear, and scams targeting seniors by impersonating virtual asset operators or coin issuing foundation executives.

The FSS presented six consumer precautions and response guidelines: ▲remember the truth that 'high returns and principal-guaranteed investments' do not exist ▲keep in mind that online investment success stories may be temptations from illegal companies ▲verify carefully investments that are difficult to value ▲be suspicious even if acquaintances recommend high returns ▲do not blindly trust financial workers such as insurance planners ▲report promptly if illegal activities are suspected.

An FSS official stated, "We plan to strengthen cooperation with investigative agencies and actively issue consumer alerts to lead the eradication of financial crimes," and urged, "If you suffer damage from fraudulent fundraising companies or suspect fraudulent activities, please report and provide information without delay."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.