Mirae Asset Securities announced on the 11th that it has become the first in the industry to achieve 30 trillion KRW in retirement pension assets (as of the 23rd of last month).

Mirae Asset Securities' retirement pension assets consist of 6.13 trillion KRW in Defined Benefit (DB) plans, 11.97 trillion KRW in Defined Contribution (DC) plans, and 11.9 trillion KRW in Individual Retirement Pensions (IRP). Retirement pension assets, which were 13 trillion KRW at the end of 2020, increased by about 17 trillion KRW over approximately four years to reach 30 trillion KRW. As of the end of last month, Mirae Asset Securities' total pension assets (retirement pension + personal pension) amounted to 44.35 trillion KRW.

According to the Financial Supervisory Service’s Integrated Pension Portal, about 6 trillion KRW of retirement pension (DC·IRP) assets were concentrated in Mirae Asset Securities during the year 2024. In particular, approximately 2 trillion KRW in reserves increased in the fourth quarter of 2024 alone, when the in-kind transfer system was implemented.

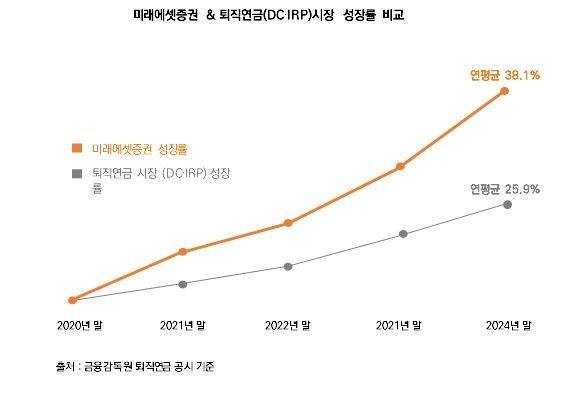

This trend aligns with the growth of the retirement pension market. Based on the Ministry of Employment and Labor’s retirement pension disclosure standards, the market size of retirement pensions (DC·IRP) has steadily expanded, growing at an average annual rate of 25.9% from 2020 through the end of the fourth quarter of 2024. Mirae Asset Securities’ growth rate is much steeper. During the same period, Mirae Asset Securities’ reserve growth rate increased by an average of 38.1% annually, significantly outperforming the market average.

Mirae Asset Securities also stands out in terms of profitability. According to the Financial Supervisory Service’s retirement pension disclosure for the fourth quarter of 2024, the 1-year returns of Mirae Asset Securities’ DC·IRP principal-guarantee non-guaranteed products were 12.17% and 12.48%, respectively, ranking first in the industry and demonstrating strong pension management performance.

To further enhance convenience for pension subscribers, various new services will be introduced. In the first half of the year, a retirement pension robo-advisor wrap service will be launched, and installment purchase services for Exchange-Traded Funds (ETFs) will be expanded to retirement pensions. Later, a bond trading system on the exchange will be established within the mobile app M-STOCK to provide subscribers with a more efficient and convenient investment environment.

Jung Hyo-young, Head of the Pension Consulting Division at Mirae Asset Securities, stated, "We will spare no effort to support pension customers in successfully managing their assets and preparing for a stable retirement through Mirae Asset Securities." He added, "We will continue to do our best as a leader in the pension market by providing various customer-centered customized services and innovative support measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)