KOSDAQ Closes with a Turnaround in Gains

Despite the 'tariff concerns' amplified by U.S. President Donald Trump, the KOSPI successfully held the 2520 level on the 10th.

On that day, the KOSPI closed at 2521.27, down 0.65 points (0.03%) from the previous trading day. The KOSPI index started at 2510.64, down 811.28 points (0.45%), but rose after 11 a.m. and entered a stable range. Foreign investors sold stocks worth 277.2 billion KRW, and individual investors sold 74 billion KRW, while institutions bought stocks worth 266.9 billion KRW.

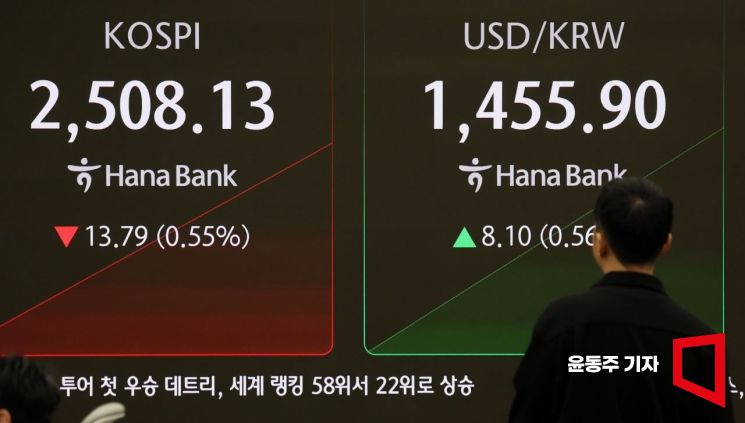

On the 10th, amid concerns of a US-originated 'tariff war,' the KOSPI started the day on a downward trend, with stock indices and exchange rates displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-joo

On the 10th, amid concerns of a US-originated 'tariff war,' the KOSPI started the day on a downward trend, with stock indices and exchange rates displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-joo

Among the top market capitalization stocks, Samsung Electronics (3.18%), LG Energy Solution (3.12%), Samsung Electronics Preferred (2.60%), NAVER (0.89%), and SK Innovation (0.83%) rose. On the other hand, Kakao (-4.49%), HD Hyundai Heavy Industries (-3.22%), Samsung Biologics (-2.59%), SK Hynix (-2.41%), Kia (-1.97%), Krafton (-1.44%), KB Financial Group (-1.28%), Hanwha Aerospace (-1.20%), and Samsung C&T (-1.17%) fell.

By sector, electronics (1.55%), entertainment and culture (0.78%), textiles and apparel (0.73%), chemicals (0.63%), and paper and wood (0.63%) sectors rose. Conversely, machinery equipment (-1.94%), transportation equipment parts (-1.85%), general services (-1.42%), pharmaceuticals (-1.33%), metals (-1.21%), and insurance (-1.01%) sectors declined.

Initially, there were significant concerns in the securities market about tariff risks from President Trump's remarks even before the market opened that day. According to U.S. AP News and others, on the 9th (local time), President Trump told reporters aboard Air Force One while traveling to New Orleans for the Super Bowl, the U.S. professional football final, that "any steel entering the U.S. will be subject to a 25% tariff," adding, "the same applies to aluminum." Furthermore, a 'reciprocal tariff' imposing equal tariff rates between trading partners was scheduled to be announced on the 11th-12th, leading to widespread expectations of strong downward pressure on the Korean stock market.

The KOSDAQ index recorded 749.67, up 6.77 points (0.91%) from the previous session. Amid ongoing uncertainties such as tariffs, investment sentiment improved more noticeably in mid- and small-cap stocks than in large-cap stocks. The index started at 740.12, down 2.78 points (0.37%), but successfully rebounded after 10 a.m. Foreign investors and institutions sold stocks worth 106.9 billion KRW and 2 billion KRW respectively, while individual investors bought stocks worth 133.2 billion KRW alone.

Among the top market capitalization stocks, Voronoi (13.75%), Peptron (6.69%), Enchem (5.49%), SM Entertainment (5.37%), Lino Industrial (5.10%), Hugel (2.99%), Pharma Research (2.82%), JYP Entertainment (1.42%), and Kolon TissueGene (1.10%) rose. Conversely, Rainbow Robotics (-8.16%), Samchundang Pharm (-6.82%), Shinseong Delta Tech (-4.04%), Ligand Chem Bio (-2.12%), and HLB (-1.70%) fell.

Ji-won Kim, a researcher at KB Securities, said, "Following concerns over Trump's reciprocal tariffs, the KOSPI started weak but narrowed its losses, while the KOSDAQ rose nearly 1%. Trump's remarks initially widened the losses early in the session, but the market rebounded in the afternoon due to currency stabilization and the influx of rebound buying."

He added, "Entertainment-related stocks rose on expectations of China's lifting of the ban on Korean content. The ruling and opposition parties agreed to resume discussions on the semiconductor 'K-Chips Act (Amendment to the Restriction of Special Taxation Act),' and with growing expectations for Tesla's humanoid robot business, semiconductor materials, parts, and equipment stocks, as well as domestic robot-related stocks, also showed upward trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.