Stock Surges 60% in Six Days on OpenAI Effect

5% of Total Shares Converted... 11% Still Remaining

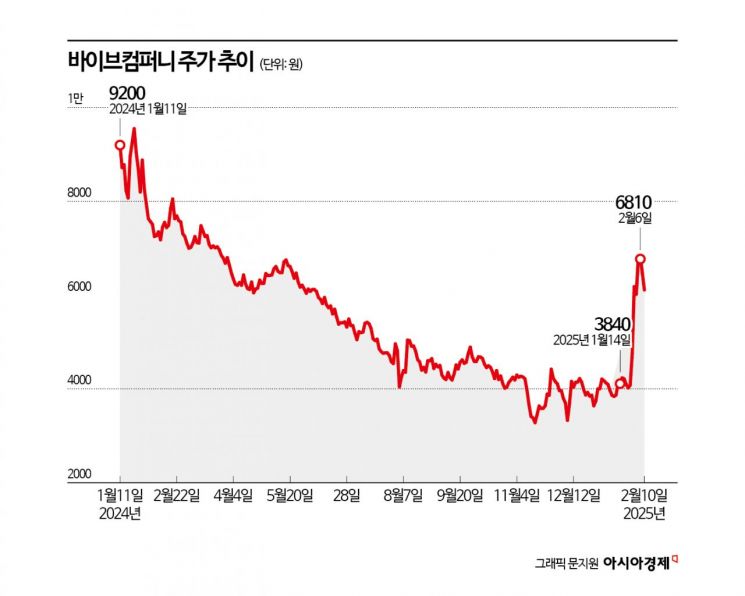

The stock price of VIVE Company, an artificial intelligence (AI) specialist firm, surged sharply after Sam Altman, CEO of OpenAI, visited South Korea. This was thanks to OpenAI's surprise alliance announcement with Kakao, the second-largest shareholder of VIVE Company. Taking advantage of this opportunity, investors holding convertible bonds (CB) of VIVE Company are now requesting stock conversions.

According to the Financial Supervisory Service's electronic disclosure system on the 11th, VIVE Company announced that a conversion request was made on the 7th for the second series of convertible bonds worth 3.3 billion KRW. The convertible shares amount to 666,530 shares, representing 5.38% of the total issued shares.

The second series of CBs was issued on December 7, 2023, with a total value of 10.5 billion KRW. The nominal interest rate is 0%, and the maturity interest rate is 2%. The recipients include A-One Asset Management, Won Asset Management, and Lambda Asset Management. VIVE Company issued the CBs to invest in facilities such as graphics processing units (GPU) and neural processing units (NPU).

The conversion period for these CBs began on December 8 of last year. However, conversion requests were not made as VIVE Company's stock price remained below the conversion price. The initial conversion price of these CBs was 7,072 KRW, with a minimum adjusted price set at 70% of the original conversion price, which is 4,951 KRW.

Over the past year, VIVE Company's stock price continuously trended downward. At the time of the CB issuance, the stock price was in the 7,000 KRW range but plummeted to the 3,200 KRW range by November 18 of last year. Although the CB conversion price was adjusted to the minimum limit, it still remained higher than the stock price.

Then, on the 31st of last month, VIVE Company's stock price began to surge. This is interpreted as being influenced by the news of CEO Altman's visit to South Korea. On the 4th, CEO Altman officially announced a partnership with Kakao. The announcement detailed that Kakao would actively utilize OpenAI models in its own models and jointly conduct business and development in the Korean and Asian markets.

VIVE Company was founded in 2000 as Daumsoft through in-house incubation at Daum Communications (now Kakao), specializing in AI. Kakao still holds an 8.07% stake as the second-largest shareholder of VIVE Company.

Following this news, VIVE Company's stock price soared approximately 60% within six trading days. For CB investors, if the current stock price is maintained, they could realize an evaluation gain of over 20% compared to the conversion price. This is the reason investors are rapidly requesting conversions.

However, the remaining 7.2 billion KRW worth of CBs that have not yet been converted could pose a burden. If all remaining CBs are converted into shares, an additional 1,454,251 shares could be released into the market. This corresponds to 11.7% of the current total issued shares.

An industry insider in financial investment commented, “Although the stock price exceeds the conversion price, considering the new convertible shares and the remaining volume, it may not be a level where high profits can be expected. However, if expectations about the company's future direction due to the cooperation between Kakao and OpenAI come into play, the overhang (potential waiting volume) issue could be easily resolved.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.