Dining Industry Business Index Drops to 71.5 in Q4 Last Year, Down 4.5 Points from Previous Quarter

Employment Index Also Falls Amid Economic Downturn... Pub Sector Faces Worst Business Conditions

Last year's fourth quarter dining industry business index significantly deteriorated. Amid ongoing consumer sentiment contraction due to the economic recession, political uncertainty has increased, and rising prices caused by a high exchange rate have worsened domestic demand sluggishness.

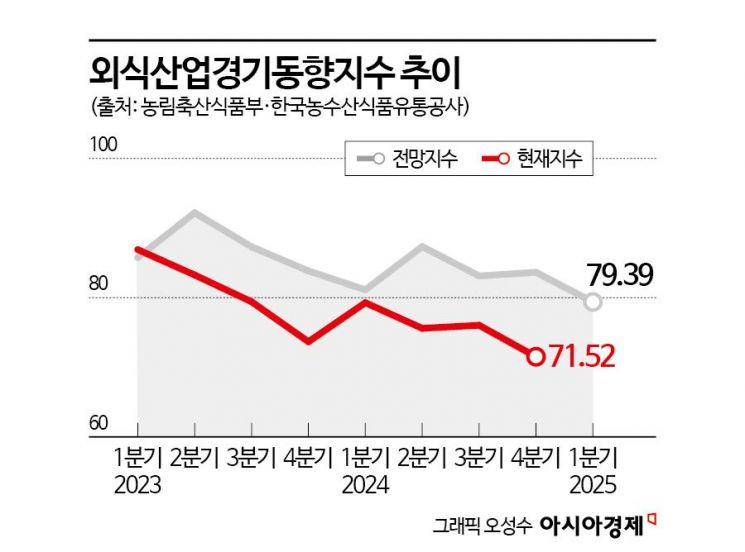

According to the Ministry of Agriculture, Food and Rural Affairs and the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 11th, the dining industry business trend index for the fourth quarter of last year was 71.52, down 4.52 points from the previous quarter, marking a downward trend. The dining industry business trend index had maintained a level in the high 70s in the 70-point range for five consecutive quarters until the third quarter of last year after falling to the 70-point range in the third quarter of 2023 (79.42), but it dropped to the low 70s in the fourth quarter, experiencing a relatively large decline.

Furthermore, the outlook index for the first quarter of this year, which predicts the dining industry business for the next quarter, was 79.39, down 4.26 points from the previous quarter (83.65), indicating that the downward trend in the business index is expected to continue. Considering that the outlook index tends to be higher than the actual business index due to optimistic expectations about the future, even the 70-point level is under threat. This index is based on 100, and a value below this means that the number of places with decreased sales exceeds those with increased sales. The dining industry business trend index last fell below 70 points during the COVID-19 pandemic in the third quarter of 2021 (65.72).

The employment index also declined. The dining industry employment index dropped 1.10 points from 96.02 in the third quarter of last year to 94.92 in the fourth quarter. This is interpreted as a continuation of workforce reductions due to the economic downturn seen across all industries, affecting the dining industry as well. Among all sectors, the business trip food service sector showed the largest decline, decreasing by 2.22 points. This appears to be a complex result of reduced demand for large gatherings and labor shortages.

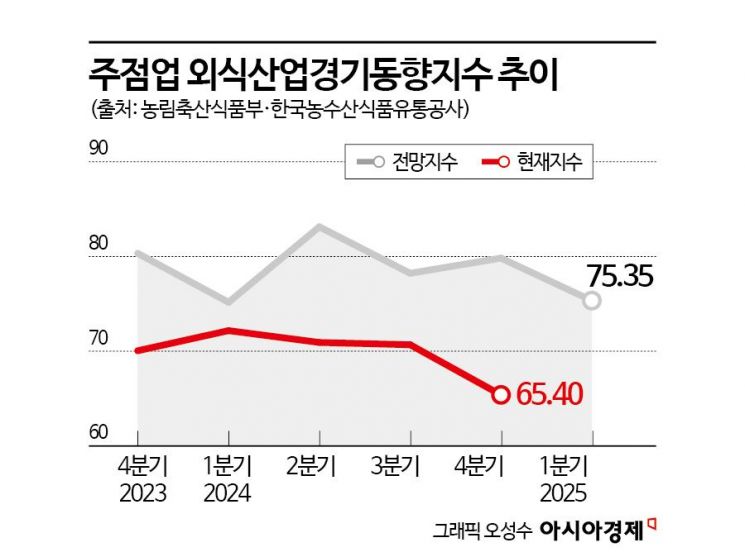

By industry, the decline in the pub sector was notable. The dining industry business trend index for the pub sector in the fourth quarter of last year was 65.40, down 5.29 points from the third quarter, recording the lowest index. This is understood to be caused by the actual business and operating conditions not meeting expectations for year-end demand. Additionally, the Korean cuisine restaurant sector's index also fell 4.32 points to 68.34, showing the second-lowest level after the pub sector, indicating that business conditions are gradually becoming more difficult.

Last year's economic recession severely dampened consumer sentiment, and with continued price increases due to the high exchange rate, the dining industry was directly hit by the resulting domestic demand slump. From the fourth quarter of 2021 to early 2023, as the COVID-19 pandemic transitioned to an endemic, suppressed dining demand surged explosively. However, due to global supply chain instability caused by the Russia-Ukraine war and the Israel-Hamas war, inflation, and high interest rates, consumer spending declined from mid-2023, causing dining sales to stagnate. Along with this, rising food ingredient prices and labor costs have increased operating expenses, leading to continued food price hikes, further worsening the dining business climate.

Professor Jin Hyun-jung of the Department of Economics at Chung-Ang University said, "The government should actively utilize support measures for the dining industry, such as tax benefits and policy funds, to help the sector overcome difficulties." She added, "Efforts within the dining industry itself are also necessary," emphasizing, "By analyzing customer data to provide personalized menu recommendations and promotions, loyalty customers can be secured, and diversification efforts such as healthy meals, vegan menus, and local food are needed."

Additionally, there is an opinion that consumer experience-centered differentiation strategies are the key to recovery. Professor Kim Young-gap of the Graduate School of Business at Hanyang Cyber University said, "As consumers facing increased economic burdens reduce dining frequency, mid-to-low price sectors have been severely impacted. This shows that consumers have shifted to sectors offering higher value for the cost rather than simply seeking cheaper dining options," and pointed out, "It is necessary to restore the connection with consumers by enhancing quality and experience rather than relying solely on low prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.