Hyundai Motor, Over the Mobility (6)

When Semiconductors Stumble, Automobiles Support the Korean Economy

Samsung Electronics Tied Down by Owner's Legal Risks

Regret Over the 'Lost Decade' and Missed Opportunities

Hyundai Motor's Thorough Preparation for Future Growth Engines

Active New Business M&A Investment Under Strong Leadership

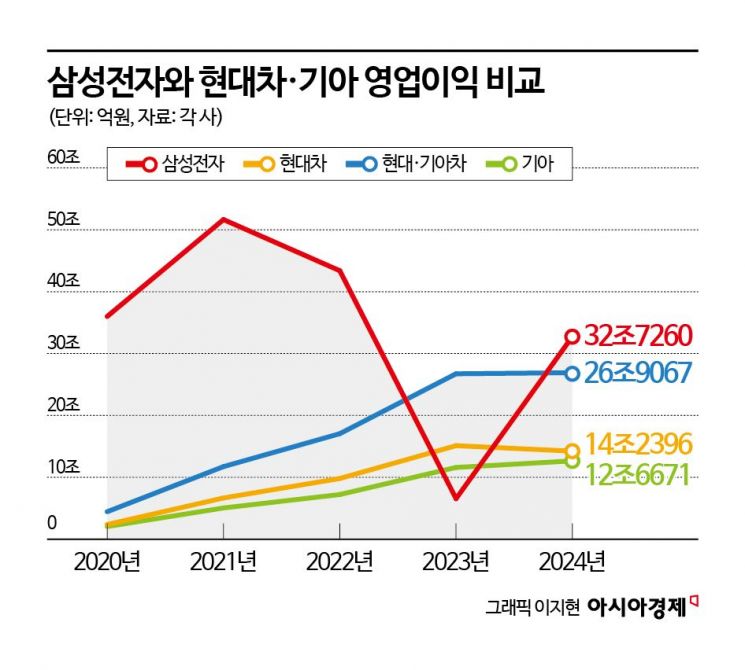

In 2023, Hyundai Motor Company ranked first in operating profit among domestic listed companies. It surpassed Samsung Electronics, which had held the top spot for 14 consecutive years. At that time, Hyundai Motor's operating profit was 15 trillion won, while Samsung Electronics was around 6.5 trillion won, less than half. Combined, Hyundai Motor and Kia recorded 26 trillion won, four times that of Samsung Electronics. Of course, Hyundai Motor's title as 'No.1 in operating profit among domestic listed companies' did not last long. As the semiconductor industry rebounded, Samsung Electronics' operating profit recovered to the 32 trillion won range in 2024. In the same year, Hyundai Motor and Kia maintained operating profits in the 26 trillion won range, setting record highs for three consecutive years. This reaffirmed that when the typical cyclical semiconductor industry falters, the automobile industry is another pillar supporting the Korean economy.

Recent media headlines often mention 'crisis' for Samsung Electronics and 'opportunity' for Hyundai Motor Group. It is ironic to talk about crisis for a company with 32 trillion won in operating profit and opportunity for one with 26 trillion won. Evaluations of a company depend not only on current figures but also on growth speed and preparation for future business. Future value is immediately reflected in stock prices. Over the past three years (as of closing on February 5, 2025), Samsung Electronics' stock price fell by 28%, while Hyundai Motor and Kia rose by 7% and 21%, respectively.

The status of Samsung and Hyundai Motor in the domestic business community has also changed. This change in status is evident in the recruitment market. Until just five years ago, cases of employees moving from Samsung Electronics to Hyundai Motor were rare. However, recently, especially among research positions, there have been increasing cases of moves from Samsung Electronics to Hyundai Motor. Reasons cited include Hyundai Motor Group's rise in global rankings, increased investment in new businesses, and a stable work environment. In a survey titled 'Companies People Want to Change Jobs to in 2024' conducted by the recruitment platform Jinhaksa Catch with 3,460 job seekers and employees, SK Hynix ranked first. Samsung Electronics, which was second the previous year, dropped to sixth, while Hyundai Motor ranked fifth, one step above Samsung.

1. Difference in Leadership

Many business insiders agree that the changes seen in the two companies in recent years ultimately come down to 'difference in leadership.' A senior official from the Ministry of Trade, Industry and Energy said, "Hyundai Motor's owner pays attention to the details of work, showing clear leadership style and direction, whereas Samsung does not," adding, "Samsung's owner's judicial risks have led to missed opportunities in management strategy."

The perspective from the financial market is similar. A value investment fund manager said, "Fundamentally, the two companies are the same in the market's eyes. There are concerns about 'peak out' (reaching a peak and showing signs of decline) in their main businesses, fierce competition from China, and neither has firmly established itself as a global leader in new businesses. The difference lies in the management's attitude and speed in responding to crises."

Samsung Electronics is facing its worst crisis as its core semiconductor business falters. In the memory sector, its main business, aggressive pricing policies have reduced profitability, and in the high-bandwidth memory (HBM) business, which has surged in the AI era, it lost leadership to competitor SK Hynix. In the non-memory sector, the foundry (semiconductor contract manufacturing) business is losing ground to Taiwan's TSMC, expanding losses. The bigger problem is the lack of a clear direction to overcome the current situation. Although Samsung replaced the head of the semiconductor division and the memory business unit and the management issued an unusual letter of reflection, these measures failed to satisfy the market. In January 2025, credit rating agency Moody's maintained Samsung Electronics' credit rating at Aa2 but changed the outlook from 'stable' to 'negative.' This downgrade signals a warning that the credit rating could be lowered in the future. Moody's cited 'weakening AI semiconductor technology leadership' as the reason for the outlook downgrade.

Samsung Electronics Chairman Lee Jae-yong, who is on trial for unfair merger and accounting fraud charges related to management succession, is attending the appellate sentencing hearing held at the Seoul High Court in Seocho-gu, Seoul. Photo by Kang Jin-hyung

Samsung Electronics Chairman Lee Jae-yong, who is on trial for unfair merger and accounting fraud charges related to management succession, is attending the appellate sentencing hearing held at the Seoul High Court in Seocho-gu, Seoul. Photo by Kang Jin-hyung

What is most regrettable is the absence of a leader to guide through the crisis. Samsung Electronics Chairman Lee Jae-yong has been plagued by judicial risks over the past decade, starting with the 2016 political scandal, including allegations of unfair mergers related to succession and accounting fraud. Since stepping down as a registered director in 2019, he has not been prominently involved in management. Although he was acquitted in a recent appellate trial, raising expectations that he would return to active management, the prosecution's appeal has made this difficult.

Samsung is paying a heavy price for the 'lost decade' of leadership. As leadership faded, Samsung has had no aggressive mergers and acquisitions (M&A) since 2017 and failed to anticipate rapid market changes centered on AI. In other words, Lee's judicial risks have become a shield behind which Samsung's management has made passive decisions.

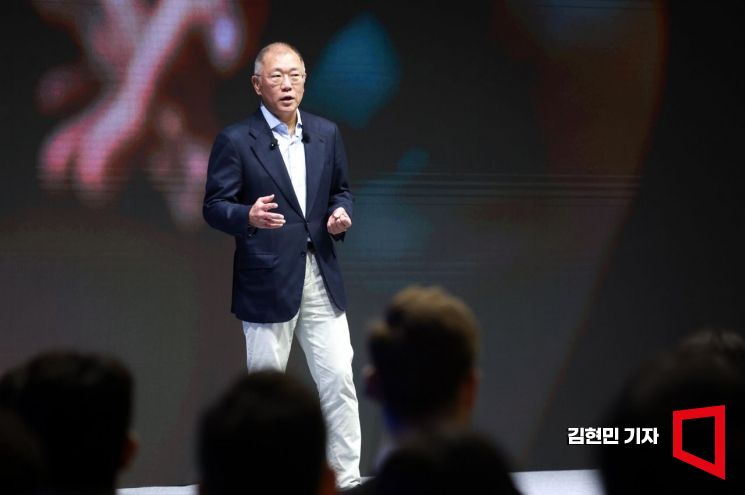

Chung Euisun, Chairman of Hyundai Motor Group, is speaking at the '2025 Hyundai Motor Group New Year Meeting' held at Hyundai Motorstudio in Goyang, Gyeonggi Province. Photo by Kim Hyunmin

Chung Euisun, Chairman of Hyundai Motor Group, is speaking at the '2025 Hyundai Motor Group New Year Meeting' held at Hyundai Motorstudio in Goyang, Gyeonggi Province. Photo by Kim Hyunmin

In contrast, Hyundai Motor Group, free from judicial risks for its owner, has been able to focus on future business through active M&A and investment. Hyundai Motor Group Chairman Chung Eui-sun solidified his position as the group's top leader when he became Vice Chairman in 2018. In a 2019 town hall meeting with employees, Chairman Chung revealed a vision for Hyundai Motor Group's future revenue portfolio: 50% automobiles, 30% urban air mobility (UAM), and 20% robotics. Subsequent investments followed immediately. In 2021, Hyundai Motor Group acquired robotics company Boston Dynamics and established the UAM independent subsidiary Supernal in the U.S. Both businesses have received over one trillion won in funding and are currently operating at a loss. The owner's firm commitment to robotics and UAM explains the willingness to invest such large sums despite ongoing losses.

Moreover, recent personnel policies clearly reflect Chairman Chung's style. Hyundai Motor has moved away from pure-bloodism, actively recruiting talent regardless of nationality or background. Appointing Jose Munoz as CEO of Hyundai Motor was an unprecedented bold move for the company. While hiring Munoz as CEO of the North American sales division and appointing him as an internal director was within expectations, Chairman Chung's decision to appoint an outsider and foreigner as CEO of Hyundai Motor, a core group company, was groundbreaking. This personnel move sends a message about increasing the importance of the U.S. market in global business.

2. Difference in Technology Strategy

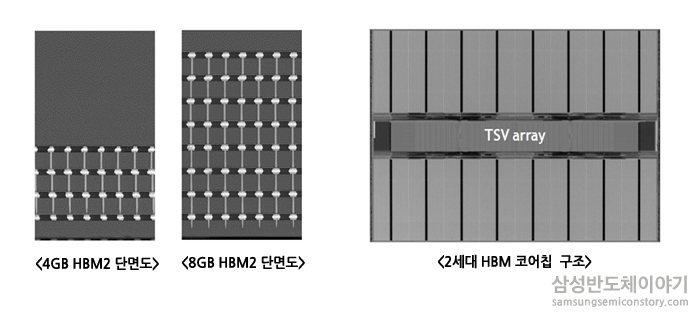

Was Samsung's crisis due to a lack of technological capability? The answer is no. It is more accurate to say it was a failure in technology strategy rather than a lack of technology. High-bandwidth memory (HBM), regarded as a game changer in the semiconductor market, saw SK Hynix lead in the development (2013) and mass production (2015) of the first-generation model. However, Samsung Electronics was faster than SK Hynix (2018) in developing and mass-producing the second-generation model (4GB standard, January 2016). This means Samsung had enough room to catch up in the early market. However, Samsung ceased meaningful progress in the HBM market after mass-producing the 8GB HBM2 in August 2018, temporarily halting HBM development due to unclear profitability and market potential. Meanwhile, the AI market blossomed, and Nvidia, the biggest beneficiary and a major HBM customer, surged. As Nvidia rose, SK Hynix's advantage in third-generation HBM became clear. This shows how momentary management decisions and strategies can determine a company's fate. In the fast-changing semiconductor industry, missing the right timing leads to immediate obsolescence in advanced competition.

Samsung Electronics began mass production of the '4GB HBM2' in January 2016. Provided by Samsung Electronics Semiconductor Newsroom.

Samsung Electronics began mass production of the '4GB HBM2' in January 2016. Provided by Samsung Electronics Semiconductor Newsroom.

Hyundai Motor also struggled in the rapidly changing market. Until the early 2020s, global automakers anticipated a rapid shift from internal combustion engines to electric vehicles and prepared accordingly. In 2020, Hyundai Motor declared it would stop selling new internal combustion engine vehicles in major markets such as the U.S., Europe, and China from 2040. The premium brand Genesis planned to leap directly from internal combustion engines to electric vehicles without a hybrid bridge. However, around 2023, a chasm (temporary demand slowdown before mass adoption) appeared in the global electric vehicle market, highlighting the importance of hybrids. Fortunately, Hyundai Motor had already developed hybrid technology. Since developing the first hybrid model, the 'Avante LPi Hybrid,' in 2009, Hyundai Motor has steadily advanced its parallel hybrid system. Although development costs were astronomical, hybrids did not generate significant profits in Hyundai Motor Group's portfolio until the mid-2010s.

However, market conditions changed rapidly. The global electric vehicle market share exceeded 10%, and growth stagnated. Inconveniences in charging and fire risks became prominent, leading to the notion that "those who want electric vehicles have already bought them." Although the public recognized eco-friendly cars, actual usage inconveniences made them hesitant to choose electric vehicles. Hybrids, which are eco-friendly and offset charging inconveniences, began to attract attention.

Around 2023, Hyundai Motor and Kia rapidly shifted their strategy toward hybrids. They actively utilized hybrids in their global eco-friendly vehicle sales strategy and resumed development of hybrid systems, which had been sidelined. Development of extended-range electric vehicles (EREV) and next-generation hybrid systems for the Genesis brand is underway. Fortunately, Hyundai Motor had the option of hybrids already developed, enabling faster strategic adjustments than market changes. But the real challenge lies ahead. As the automobile industry fully integrates AI, market changes will accelerate beyond control. A momentary strategic failure can determine a company's fate. While hybrids were just turning the page from electric vehicles, AI and autonomous driving will change the entire chapter.

3. Difference in Organizational Culture and Workforce Structure

There are also differences in changing organizational culture and workforce structure between the two companies. Samsung Electronics remains stuck in a rigid organizational culture, whereas Hyundai Motor has transitioned to a flexible organizational culture in recent years. Regarding workforce structure, Samsung has seen a steady increase in employees aged 40 and above, while Hyundai Motor's workforce is getting younger due to large-scale retirement of production workers aged 50 and above.

One cause of Samsung Electronics' semiconductor crisis is repeatedly cited as its 'rigid organizational culture.' It is criticized for prioritizing stable, profitability-focused tasks and resisting challenging ideas. The emphasis on vertical organization and complex reporting systems has slowed decision-making. The conservative corporate culture, which avoids risks and prefers cautious strategies, caused Samsung to fall behind in the fast-paced semiconductor industry.

The shift in Samsung Electronics' global workforce structure toward older employees has also contributed to the conservative culture. According to an analysis by the Korea CXO Institute of Samsung Electronics' global age distribution, in 2023, for the first time, employees aged 40 and above (81,461) outnumbered those aged 20 and below (72,525). The proportion of employees aged 20 and below dropped sharply from 60% in 2015 to 27% in 2023, while employees aged 40 and above increased from 12% in 2015 to 30% in 2023.

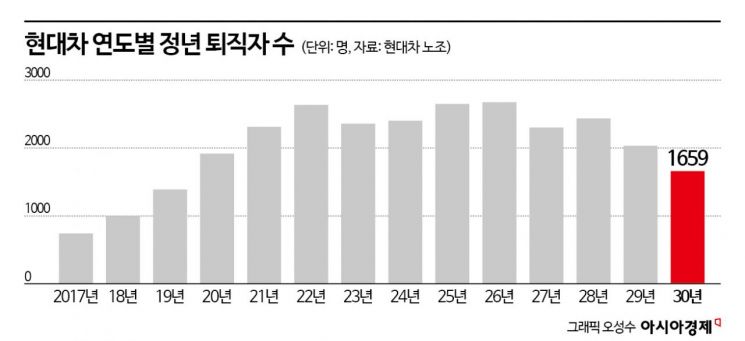

In contrast, Hyundai Motor's organization has been getting younger since 2020, with about 2,000 retirees annually. According to Hyundai Motor's labor union, over 13,000 employees are expected to retire between 2025 and 2030, accounting for 20% of Hyundai Motor's domestic workforce as of 2025. Hyundai Motor rehires retirees as contract workers and simultaneously recruits new employees in their 20s. Hyundai Motor Group announced plans to hire 80,000 people domestically over the next three years starting in 2025, a feasible number given the expected large-scale retirements.

Since becoming Vice Chairman in 2018, Chairman Chung Eui-sun has continuously emphasized 'innovation in work methods.' He introduced a casual dress code, promoted flexible working hours, and simplified reporting systems. A Kia executive said, "To respond to rapid market changes, we must not miss the 'golden time' for decision-making," adding, "Kia President Song Ho-sung and other executives instructed managers to judge the importance of matters and, if necessary, report afterward." Minimizing face-to-face reporting and simplifying email reports have accelerated work. A Hyundai Motor Group official said, "Vice Chairman Jang Jae-hoon sends emails to Chairman Chung, who comments on them, streamlining reporting," adding, "Unnecessary tasks like preparing thick document files and coordinating all executives' meetings have disappeared, improving work efficiency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.