Half of the 31 Trillion Won Tax Revenue Shortfall Attributed to Corporate Tax

"Utilizing Funds and Unused Budgets"

National Household Account Shows 2 Trillion Won Surplus

But Insufficient Ammunition for a Supplementary Budget

Last year, a tax revenue shortfall of 31 trillion won occurred. For the second consecutive year, tax revenue collected fell short of the original budget, with half of the shortfall in national taxes stemming from a corporate tax shock. While the economic downturn increased spending needs, revenue declined, worsening the country's financial situation. The government's global surplus, which is the amount left after collecting and spending taxes, was only 2 trillion won. Moreover, according to the National Finance Act, after sequentially using it for local allocation tax and debt repayment, there is insufficient ammunition to use as resources for supplementary budgets, leading to forecasts that issuing government bonds will be inevitable.

Half of the 31 Trillion Won Tax Revenue Error Comes from Corporate Tax: "Utilizing Funds and Unused Budgets"

On the 10th, the Ministry of Economy and Finance announced the '2024 Fiscal Year Total Revenue and Total Expenditure Closing Results' containing these details. This is a household account book-like report that confirms the income collected through tax collection and other means, and the expenditures spent by each government department over the past year, allowing an assessment of how much the government collected and spent compared to the plan set the previous year.

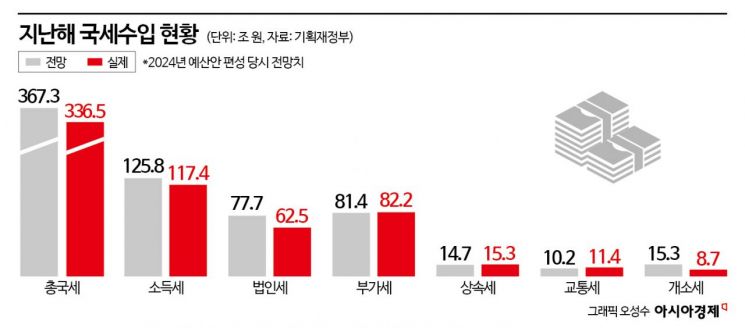

Last year's annual national tax revenue was 336.5324 trillion won, a decrease of 30.7816 trillion won compared to the original budget of 367.314 trillion won. This means that actual revenue was nearly 31 trillion won less than the expected national tax revenue when the budget was drafted last year. The tax revenue error rate recorded was 8.4%. When a tax revenue shortfall appeared in the first half of last year, the government announced a revised tax revenue estimate in September, but even this forecast was short by 1.1715 trillion won (0.3%). Regarding this, Jo Moon-gyun, head of the Tax Analysis Division at the Ministry of Economy and Finance, explained, "The increase in value-added tax refunds was due to semiconductor companies increasing investments after expecting the semiconductor market to recover after the third quarter."

Of the approximately 31 trillion won tax revenue shortfall, the decrease in corporate tax accounted for half. Corporate tax was 62.5113 trillion won, down 15.1536 trillion won (19.5%) from the budgeted 77.6649 trillion won. The impact of a greater-than-expected economic slowdown caused operating profits of listed companies (on an individual basis) to plummet by 44.2%. Other taxes such as capital gains tax (-5.7313 trillion won), earned income tax (-9.836 trillion won), and securities transaction tax (-6.227 trillion won) also deviated from expectations.

Compared to 2023's actual results, corporate tax decreased by 17.9082 trillion won (22.3%), making the corporate tax gap even larger. The tax revenue gap caused by the corporate tax shock was partially offset by interest income tax (2 trillion won) and earned income tax (1.9 trillion won). In particular, due to factors such as an increase in the number of employed persons, earned income tax paid by workers (61.0491 trillion won) surged to nearly match corporate tax (62.5113 trillion won).

Non-tax revenue, or extra-tax revenue, amounted to 199.4 trillion won. Extra-tax revenue refers to income from local finances excluding local taxes, local allocation tax, and subsidies, such as road usage fees and fines. A Ministry of Economy and Finance official explained, "This increased by 16.7 trillion won compared to the original budget due to the expansion of public fund deposits and an increase in current transfer income." Total revenue, combining national tax revenue and extra-tax revenue, was tallied at 535.9 trillion won. Although extra-tax revenue increased by 16.7 trillion won from the initial plan, the nearly 31 trillion won tax revenue shortfall resulted in total revenue being 14.1 trillion won less than the original budget.

Park Bong-yong, director of the Fiscal Management Bureau at the Ministry of Economy and Finance, explained, "Of the 30.8 trillion won tax revenue shortfall, we offset 16.7 trillion won with the increase in extra-tax revenue and responded by utilizing available resources such as funds and unused budgets."

National Household Account Posted a 2 Trillion Won Surplus... But Supplementary Budget Ammunition Is Insufficient

Total expenditure was 529.5 trillion won, an increase of 39 trillion won from the previous year. After subtracting total expenditure and the budget carryover to next year (4.5 trillion won) from total revenue, the global surplus recorded a 2 trillion won surplus. Of this, the general account global surplus of 400 billion won, which can be used for the state's own finances, is used sequentially according to the National Finance Act for local allocation tax and grant settlements, contributions to the public fund repayment fund, and debt repayment. If money remains after these uses, it can be used for supplementary budget formation. Inside and outside the government, since funds available for supplementary budgets to adjust the economy are limited due to restrictions under the National Finance Act, it is expected that issuing government bonds for supplementary budgets promoted by the ruling party, opposition, and government will be inevitable.

Although the national household account posted a surplus, unused budgets in the settlement exceeded 20 trillion won, indicating inefficiencies in executing the government's planned expenditures. The unused budget in the settlement included adjustments to local allocation tax and grants linked to the decrease in national tax revenue (6.5 trillion won) and internal government transactions (4.3 trillion won). The actual unused amount, including unused project funds and unexecuted contingency funds, was 9.3 trillion won. A Ministry of Economy and Finance official said, "The unused amount in the settlement decreased to less than half of last year's 45.7 trillion won," and explained, "The unused budget in the settlement is a simple sum of unused amounts in accounting, so it structurally decreased as the tax revenue shortfall shrank compared to the previous year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.