The Chinese government has warned that it will impose tariffs on U.S. crude oil as a countermeasure against the so-called 'Trump tariffs,' but there is an analysis that such retaliatory measures are unlikely to be prolonged. This is because China inevitably faces accumulating cost burdens due to difficulties in securing substitutes. Accordingly, there is an expectation that oil prices could rebound if a small deal is reached between the U.S. and China.

On the 10th, Jinyoung Choi, a researcher at Daishin Securities, revealed this in a report titled "Oil Prices Threatened by Tariffs from China, Yet a Small Deal is Expected."

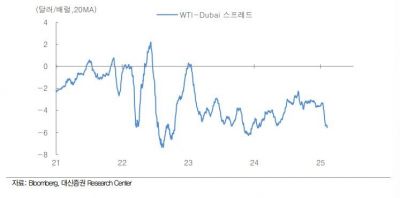

Researcher Choi mentioned that the Chinese government decided to impose tariffs of 10% and 15% on U.S. crude oil and LNG respectively, effective from that day, as a response to the Trump administration's 10% tariffs on Chinese goods. He diagnosed, "China's retaliation, as the second-largest importer of U.S. crude oil, is clearly a negative factor for demand. The resulting uncertainty is reflected in the narrowing price spread between West Texas Intermediate (WTI) and Dubai crude."

However, Researcher Choi analyzed that the possibility of this retaliation being prolonged is somewhat limited. He pointed out that "there is a risk of tightening supply of substitutes," noting that the U.S. Treasury Department imposed export network sanctions on Iranian crude oil on the 6th. Since Chinese private refineries have been sourcing 90% of Iranian crude oil by exploiting the Biden administration's relaxed sanctions, it is expected that cost burdens will arise.

In addition, Choi said, "To make matters worse, discounted Russian heavy crude oil is also becoming difficult to procure due to U.S. sanctions," and evaluated that "India, which had expanded imports of Russian crude, participated in Middle Eastern crude oil tenders for the first time since 2022, which reflects the reality of procurement difficulties." Meanwhile, Saudi Arabia, a major oil-producing country, also plans to maintain its current production cut policy. Saudi Aramco significantly raised its official selling price (OSP) for Asia in March.

Researcher Choi emphasized that "even considering the internal situation in China, the Chinese government's tariff threat is unlikely to be prolonged," highlighting that the policy priority was shifted to expanding domestic demand at the local government sessions. He analyzed that this was based on the judgment that GDP growth through net exports alone is difficult amid heightened U.S. tariff threats.

In particular, Choi pointed out, "The problem is inventory," noting that "China's crude oil inventory is below the range of the same period over the past five years." Considering the upcoming restocking season, increasingly difficult imports of substitutes, the need for additional stimulus, and domestic and international supply and demand conditions, he diagnosed that China is the one facing difficulties. He advised, "From a long-term perspective, U.S.-China conflicts will continue to intensify, but in the short term, China is in a position where it must minimize clashes with the U.S. In that regard, it is recommended to keep open the possibility of an oil price rebound if a small deal is reached."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.