Woohyeong Applies Uniform 3% Prepaid Payment Commission Rate Regardless of Merchant Size

Simple Payment Providers' Commission Rates Remain Higher Than Card Companies Even Considering 'PG Fees'

Financial Services Commission: "Plan to Announce Expanded Disclosure Items in the First Half of the Year to Encourage Autonomous Competition and Rate Reductions"

The commission rates for simple payments by big tech companies (large information technology firms) were found to be up to seven times higher than those of card companies. The gap in commission rates between simple payment providers and card companies was larger for small merchants. Financial authorities plan to increase the disclosure items for simple payment providers in the first half of the year to strengthen autonomous competition among companies and encourage commission rate reductions.

At the entrance of a convenience store in Seoul, various stickers indicating available mobile payment options are displayed. Photo by Yoon Dong-ju.

At the entrance of a convenience store in Seoul, various stickers indicating available mobile payment options are displayed. Photo by Yoon Dong-ju.

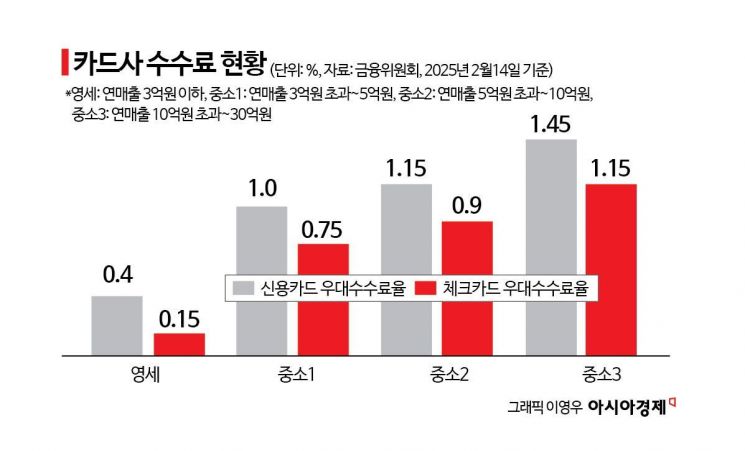

According to the Korea Fintech Industry Association on the 10th, as of July 31 last year, the prepaid electronic payment commission rate (prepaid payment commission rate) and card payment commission rate of Woowa Brothers (Woohyeong, operator of Baedal Minjok) were 3%, which was 1.4 to 7.5 times higher than the card companies' preferential credit card commission rates of 0.4% to 2.07% by merchant segment (effective from the 14th). The card company commission rates will be lowered by 0.05 to 0.1 percentage points from the 14th, as proposed by the Financial Services Commission on December 17 last year. The prepaid payment commission rate applies to payment methods where cash is preloaded and used through simple payment provider applications (apps). The card payment commission rate relates to payment methods where funds are withdrawn from credit or debit card-linked accounts registered in the app, similar to swiping a card.

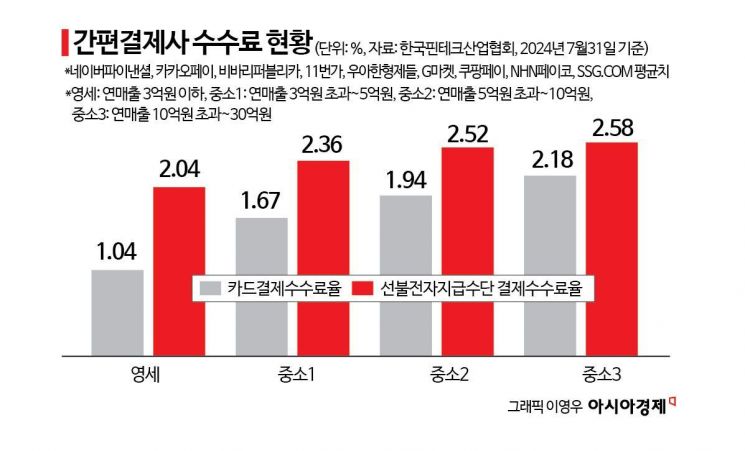

The average prepaid payment commission rates by merchant segment for the nine simple payment providers subject to disclosure (Naver Financial, Kakao Pay, Viva Republica, 11st, Woohyeong, Gmarket, Coupang Pay, NHN Payco, SSG.COM) ranged from 2.04% to 2.58%, which was 1.2 to 5.1 times higher than card companies. The average card payment commission rates for the nine simple payment providers were 1.04% to 2.60%, 1.3 to 2.6 times higher than card companies.

According to the Financial Services Commission and the fintech industry, Toss Payments and KG Inicis will also be added to the mandatory disclosure list for simple payments by the end of this month, which may further widen the commission rate gap with card companies. Toss and KG have achieved the disclosure threshold of a monthly average transaction amount exceeding 100 billion KRW and will be considered mandatory disclosure companies from the end of this month.

Based on comprehensive coverage of the fintech (simple payment) and credit (card) industries, even considering commission rate types, merchant annual sales segments, and payment providers' commission payment practices, simple payment providers' commission rates were found to be higher than those of card companies. Simple payment providers are required to disclose prepaid payment commission rates and card payment commission rates twice a year. The merchant annual sales segments are the same as those of card companies, divided into small (annual sales of 300 million KRW or less), small-medium 1 (over 300 million KRW to 500 million KRW), small-medium 2 (over 500 million KRW to 1 billion KRW), small-medium 3 (over 1 billion KRW to 3 billion KRW), and general (over 3 billion KRW) segments.

To compare simple payment and card company commissions uniformly, one can look at the card payment commission rates. The average card payment commission rates for the nine simple payment providers range from 1.04% to 2.60%, while card companies range from 0.4% to 2.07%. In the small segment, simple payment providers (1.04%) are 2.6 times higher than card companies (0.4%). For small-medium 1, the rate is 1.67 times higher; small-medium 2, 1.69 times; small-medium 3, 1.5 times; and general, 1.26 times higher. However, simple payment providers argue that since they perform electronic payment agency (PG) services for card companies online and must pay about 80% of the merchant commission to card companies, they actually earn less than card companies, and the higher disclosed commission rates do not indicate profiteering.

The issue is that when considering the prepaid payment commission rate, which applies various points, the commission rate becomes much higher than that of card companies. Unlike card payments, most prepaid payment commission revenue is earned by simple payment providers. The average prepaid payment commission rates for the nine simple payment providers range from 2.04% to 2.58%, which is 1.4 to 7.5 times higher than the card companies' card payment commission rates of 0.4% to 2.07%. In the small segment, simple payment providers (2.04%) are 5.1 times higher than card companies (0.4%). For small-medium 1, the rate is 2.36 times higher; small-medium 2, 2.19 times; small-medium 3, 1.78 times; and general, 1.2 times higher. In particular, Woohyeong applied a uniform prepaid payment commission rate of '3%' regardless of merchant size. Woohyeong has explained that unlike the other eight simple payment providers who only pay commissions to card companies as first-level PGs, it is a 'second-level PG' that must also pay commissions to first-level PGs, resulting in higher commission rates. They stated that if authorities or politicians establish legal grounds to favor small businesses in the prepaid payment sector, commission rates could be lowered in the future.

Authorities recognize that even considering the fact that simple payment providers must pay PG commissions, the commission rate gap with card companies is significant. However, rather than intervening uniformly in simple payment providers' commission rate policies, they plan to expand mandatory disclosure items to encourage voluntary reductions by companies. The goal is to announce this in the first half of the year. In addition to prepaid payment commission rates and card payment commission rates, various soundness and profitability indicators may be added to the disclosure items.

On the 8th of last month, the Financial Services Commission announced its work plan for this year, stating it will "improve the simple payment commission disclosure system to alleviate the commission burden on self-employed business owners." A Financial Services Commission official said, "The goal is to announce improvements to the simple payment commission disclosure system in the first half of the year," adding, "It is difficult to disclose now what additional disclosure indicators will be increased in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.