Patent Applications by Top 10 Companies Increase Every Year

Significant Growth in Semiconductors, Batteries, and Displays

The number of patent applications by battery companies has surged significantly, intensifying technological competition. As the race to secure next-generation battery technologies such as solid-state batteries and lithium-sulfur batteries heats up, companies are accelerating their research and development efforts. Samsung SDI and LG Energy Solution are actively securing a large number of patents through vigorous R&D, competing to gain technological supremacy.

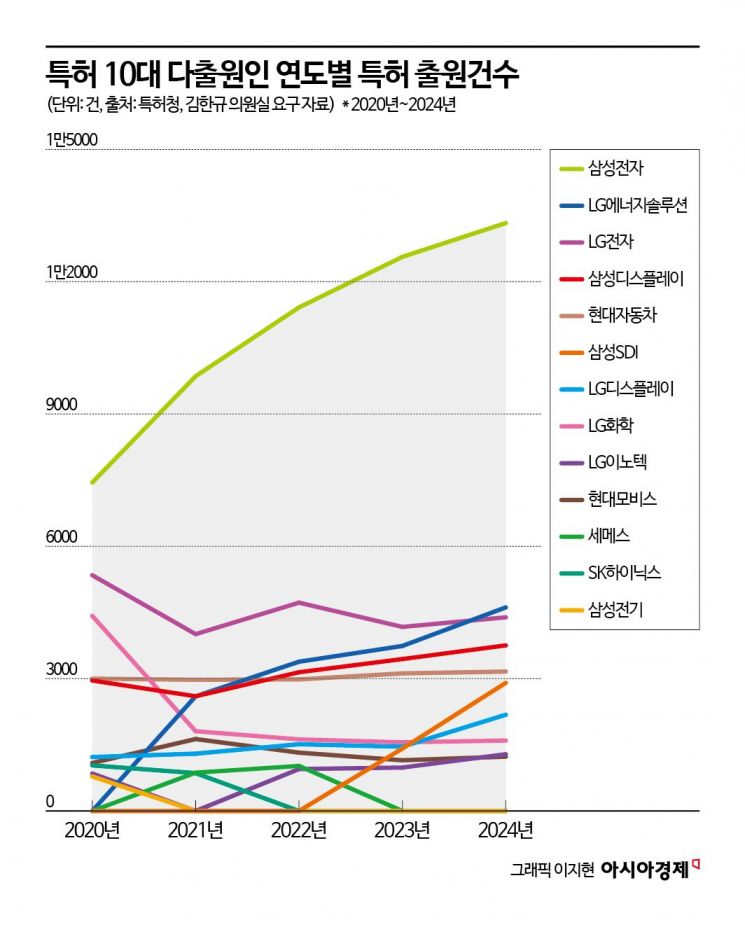

According to data titled "Patent Application Status by Top 10 Applicants Annually Over the Past 5 Years (2020?2024)" received on the 10th from the Korean Intellectual Property Office by the office of Kim Han-kyu, a member of the Democratic Party of Korea, the number of patent applications by the top 10 companies has increased every year over the past five years. In 2020, the top 10 companies filed 28,146 patent applications, which rose to 38,448 in 2024, marking an approximate 36.7% increase. This is interpreted as a result of companies’ proactive patent strategies aimed at securing technological superiority amid intensifying global technology hegemony competition.

Notably, LG Electronics ranked second in total patent applications in 2020, but in 2024, LG Energy Solution rose to second place. This indicates how fierce the technological competition in the battery industry has become. The increase in patent applications by battery companies such as Samsung SDI and LG Energy Solution was particularly prominent. Samsung SDI’s applications jumped from 1,414 in 2023 to 2,904 in 2024. LG Energy Solution also increased from 2,599 in 2021 to 4,615 in 2024, recording about a 78% growth over four years. This is because battery companies are strengthening competition in next-generation battery technologies and expanding R&D in various areas such as production processes, material innovation, and energy density improvement. Especially, with the growth of the global electric vehicle market and rising demand for high-performance, long-life batteries, patent applications aimed at securing technological capabilities are rapidly increasing.

Patent applications have also increased in the display sector. LG Display’s applications rose from 1,222 in 2020 to 2,181 in 2024, a 78.5% increase. Samsung Display also showed active technology development, increasing from 2,957 to 3,754 applications during the same period, a 27.0% rise.

On the other hand, SK Hynix and Samsung Electro-Mechanics were excluded from the top 10 companies list starting in 2022 and 2021, respectively. SK Hynix shifted its focus from memory-centric to research on HBM (High Bandwidth Memory) and AI (Artificial Intelligence) semiconductors, adopting a strategy emphasizing qualitative aspects of research. A SK Hynix official explained, "The memory industry has already undergone significant technological advancement, so qualitative improvement is more important than quantitative growth at this point."

Samsung Electro-Mechanics, which previously relied heavily on the MLCC (Multilayer Ceramic Capacitor) business, has recently focused on next-generation semiconductor packaging and automotive components development, leading to a decrease in patent applications. While the MLCC market has matured and the pace of new patent applications has slowed, the semiconductor packaging and automotive components fields are still in early stages with ongoing R&D, which appears to have influenced the overall patent application numbers.

LG Chem’s patent applications sharply declined after LG Energy Solution spun off in 2020. Patent applications, which were in the 4,000 range in 2020, have recently dropped to the 1,000 range. This is interpreted as a shift in R&D focus away from the battery business toward petrochemicals, bio, and eco-friendly materials. However, there is a growing trend in patent applications related to eco-friendly plastics, biodegradable materials, and carbon neutrality technologies.

Hyundai Motor Company and Hyundai Mobis have maintained top rankings annually. Hyundai Motor files between 2,000 and 3,000 patents each year, while Hyundai Mobis files around 1,000 patents, continuously developing technologies related to electric vehicles, autonomous driving, and eco-friendly cars.

Lee Chang-han, former vice chairman of the Korea Semiconductor Industry Association, emphasized, "The number of patent applications is closely related to the scale of R&D investment. While the number of patent applications itself is important, the ratio of original patents (first-filed patents) and the qualitative level of patents must also be considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.