CATL of China to Raise Up to 11 Trillion Won in Funding

Three Major Korean Firms Post 841.6 Billion Won Loss in Q4 Last Year

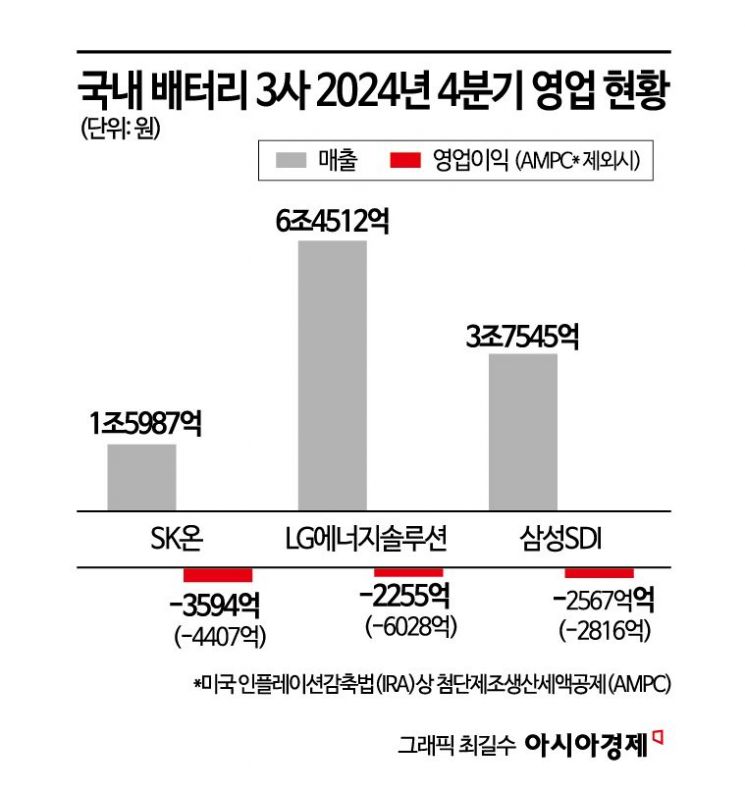

Losses Rise to 1.3251 Trillion Won Excluding U.S. AMPC Benefits

China's Ningde Shidai (CATL), the world's number one battery manufacturer, is set to raise up to 11 trillion won in funding. Concerns are rising that this will become a threatening war chest for the domestic industry, which has entered a 'holding pattern' by drastically cutting investment costs and halting facilities due to poor performance. LG Energy Solution, Samsung SDI, and SK On, the three major domestic battery companies, recorded losses of around 840 billion won in the fourth quarter of last year alone, struggling to overcome difficulties.

According to major foreign media including Bloomberg on the 7th, CATL is expected to submit an initial public offering (IPO) application to list on the Hong Kong Stock Exchange as early as this month. Bloomberg predicted that through this, CATL could raise more than $5 billion (about 7.234 trillion won) within the first half of this year, while Morgan Stanley estimated the amount could reach up to $7.8 billion. The company's market capitalization, already listed on the Shenzhen Stock Exchange in mainland China, stands at 1.1145 trillion yuan (about 221.3209 trillion won).

Earlier, CATL had selected JP Morgan and Bank of America as lead underwriters and was expected to go public within the first half of the year. The decision to advance the listing schedule earlier than initially anticipated is interpreted as a swift response to the deteriorating market conditions such as declining electric vehicle demand and the Chinese economic downturn. Recently, CATL announced that it is actively investing in technology research and development to strengthen product competitiveness.

Last month, CATL disclosed preliminary earnings on the Shenzhen Stock Exchange, forecasting revenue of 356 billion to 366 billion yuan (approximately 70.6944 trillion to 72.6082 trillion won), a decrease of 8.71% to 11.2% compared to the previous year. Net profit is expected to be 49 billion to 53 billion yuan, an increase of 11.1% to 20.1% year-on-year. Although profits are expected to rise compared to the previous year, the growth rate is the lowest since 2019, raising concerns within the company.

CATL's preparation of war funds amid the 'harsh winter' in the battery market is expected to pose a threat to our companies, which have tightened their belts due to losses. Domestic battery companies, which recorded a combined operating loss of 841.6 billion won in the fourth quarter of last year and about 1.3251 trillion won excluding the Advanced Manufacturing Production Credit (AMPC) benefits under the U.S. Inflation Reduction Act (IRA), have reduced investments and even delayed the operation of overseas facilities, lowering their profiles significantly.

LG Energy Solution, facing increased business uncertainty, set its facility investment scale at the 10 trillion won level this year, a 20-30% reduction compared to the previous year. The company also issued corporate bonds worth 800 billion won to fund production facility investments.

SK Innovation's battery subsidiary SK On plans to minimize investment by delaying the start of plant operations. The operation of the Tennessee plant in the U.S., originally scheduled for this year, will be postponed to next year as a response to market conditions. Battery investment has sharply dropped to 3.5 trillion won from 9 trillion won last year.

Samsung SDI explained that it is planning investments under a conservative stance considering market conditions. The company aims to improve investment efficiency by utilizing existing lines to reduce costs for new line expansions and adjusting the timing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.