Hanwha Asset Management announced on the 6th that investing in the 'PLUS High Dividend Stocks' exchange-traded fund (ETF) through tax-advantaged accounts such as pension accounts and Individual Savings Accounts (ISA) can consistently provide tax deferral benefits.

According to the Korea Exchange, the net individual purchase of 'PLUS High Dividend Stocks' on the 5th amounted to approximately 3.9 billion KRW. As of the closing price on the 5th, the net asset value of 'PLUS High Dividend Stocks' was 483 billion KRW, making it the largest ETF investing in domestic high dividend stocks.

The inflow of funds is interpreted as a result of the recent reduction in tax deferral benefits previously available when investing in overseas funds through pension accounts (retirement pensions, personal pensions) and ISAs. This change is due to the reform of the foreign tax credit system, which was fully implemented from January this year, raising concerns about double taxation where taxes are paid both abroad and domestically.

For example, if an investor purchases a U.S. equity ETF (subject to a 15% dividend income tax) through a pension account and receives dividends of 1 million KRW, previously, no dividend income tax was incurred (deferred), and only a 3-5% pension income tax was paid depending on the timing of income receipt. Under the newly implemented system, the investor may first pay about 150,000 KRW in dividend income tax in the U.S. and then an additional 3-5% pension income tax upon pension receipt.

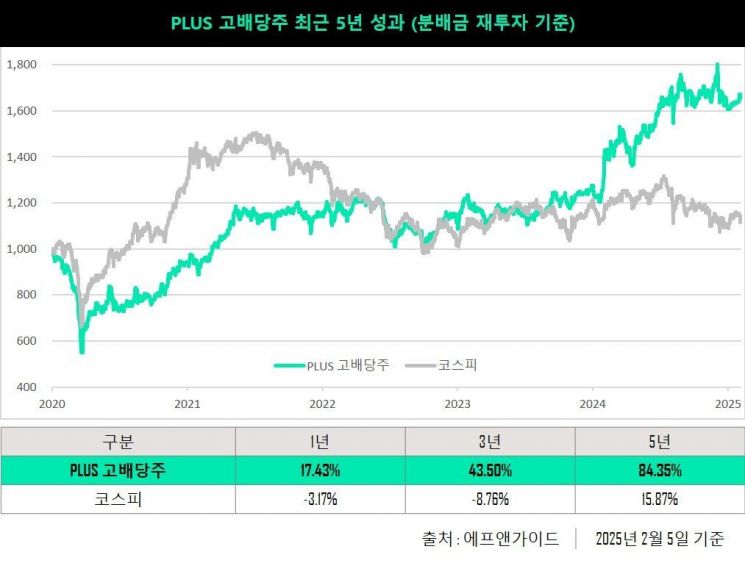

Hanwha Asset Management's 'PLUS High Dividend Stocks' is the largest ETF investing in domestic high dividend stocks. Since dividends from domestic companies are not subject to foreign tax credits, investors can reinvest all dividends received through pension accounts without additional taxation. Considering the reinvestment of dividends, the performance returns of 'PLUS High Dividend Stocks' over the past 1, 3, and 5 years are 17.4%, 43.5%, and 84.4%, respectively.

'PLUS High Dividend Stocks' pays stable dividends annually at an annualized rate of 5-6%, with a dividend growth rate averaging 15.4% per year since its listing in 2012. Since May last year, the dividend payment frequency changed from once a year to once a month, providing a fixed amount of 63 KRW per share monthly.

The main constituent stocks include Kia, Industrial Bank of Korea, Woori Financial Group, Samsung Securities, DB Insurance, SK Telecom, and Samsung Card. Financial stocks, considered a key beneficiary sector for value-up, account for about 67%, the highest proportion. The ETF is characterized by diversified investment in high dividend companies across various sectors such as communication services (12.8%), consumer discretionary (6.3%), consumer staples (5.7%), and energy (3.7%).

Geum Jeong-seop, Head of the ETF Business Division at Hanwha Asset Management, said, "Given recent changes in the investment environment, it is an important time to reconsider investment strategies within pension accounts," adding, "The PLUS High Dividend Stocks ETF is an attractive option for pension investors seeking stable dividend income with lower tax burdens."

He further added, "PLUS High Dividend Stocks not only offers high dividend yields but is also a dividend growth ETF with an average annual dividend growth of 15.4%, making it the Korean version of SCHD."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.