Stock Price Surges 14.9% on the 6th, Exceeding 800,000 KRW

Last Year's Record-Breaking Performance Drives Stock Higher

Growth Expected to Continue This Year... Attention on Whether It Will Become an 'Emperor Stock'

Samyang Foods' stock price surpassed 800,000 KRW, fueled by last year's record-breaking performance. Having surged 250% last year to become the leading stock in the food and beverage sector, attention is focused on whether Samyang Foods can continue its strong stock price momentum this year, driven by the global 'Buldak craze.'

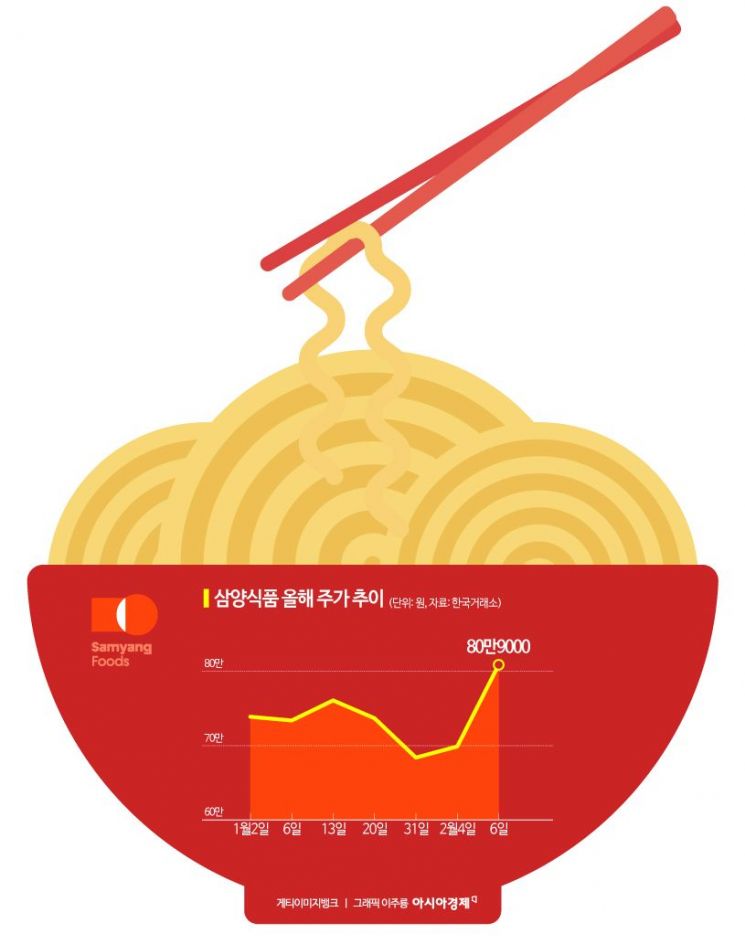

According to the Korea Exchange on the 7th, Samyang Foods closed the previous day at 809,000 KRW, up 105,000 KRW (14.91%) from the previous session. During the day, it rose to 828,000 KRW, setting a new all-time high.

Last year, Samyang Foods recorded a 254% increase in its stock price, ranking second in the KOSPI market's growth rate, but showed some hesitation this year. At the end of last month, the price even fell below 700,000 KRW.

The factor that quickly pushed the stock price back into the 800,000 KRW range was its performance. On the 5th, Samyang Foods announced that its operating profit last year reached 344.2 billion KRW, a 133.36% increase compared to the previous year. During the same period, sales rose 45.02% to 1.7299 trillion KRW, and net profit increased 115% to 272.2 billion KRW. This represents the highest performance since the company's founding, marking eight consecutive years of growth since the export of 'Buldak Bokkeummyeon' began in 2016. In particular, as the proportion of highly profitable overseas sales increased, operating profit exceeded 300 billion KRW for the first time ever. Samyang Foods' export ratio expanded from 68% in 2023 to 77% as of the third quarter of last year.

Researcher Kang Eun-ji from Korea Investment & Securities said, "Within the food and beverage sector, visibility of performance growth is the highest, and compared to global instant noodle companies, an overwhelmingly high operating profit margin and steep performance growth are expected."

With the operation of the Miryang Plant 2 and the expansion of high-margin supply to North America and Europe, performance growth is expected to continue this year. Researcher Ryu Eun-ae from KB Securities stated, "The completion of Miryang Plant 2 in May and its commercial production scheduled for July will accelerate the increase in sales proportion in North America and Europe, and the improvement of the average selling price (ASP) mix will become more apparent," adding, "Based on strong demand, the operating rate of Miryang Plant 2 is expected to rise rapidly."

Researcher Jung Han-sol from Daishin Securities also said, "Upon completion of Plant 2 in May, Samyang Foods' production capacity will expand from about 1.8 billion units to 2.5 billion units," and added, "After the production capacity expansion in the second half of the year, the performance momentum will be strengthened through increased supply to North America and Europe, where prices are higher, and the launch of new products tailored to local tastes."

There is also interest in whether the stock price will exceed 1,000,000 KRW this year and join the ranks of 'emperor stocks.' Securities firms are increasingly raising their target price for Samyang Foods to 1,000,000 KRW. In December last year, Hanwha Investment & Securities set the target at 1,000,000 KRW, and last month, Kiwoom Securities and DS Securities each raised their target to 1,000,000 KRW. Researcher Jang Ji-hye from DS Securities said, "This year, differentiated performance growth within the sector will continue," adding, "Samyang Foods' overseas sales ratio is expected to expand from 67% in 2022 and 78% in 2024 to 81% this year, improving profitability. Additionally, with the operation of the China plant expected in 2027, further performance momentum is anticipated, so we maintain our top sector pick rating."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)