Lee Youngjong, CEO of Shinhan Life, and Jung Mooncheol, CEO of KB Life

Alumni of Seoul National University Business Administration Department

Full-scale Competition in New Business Initiatives

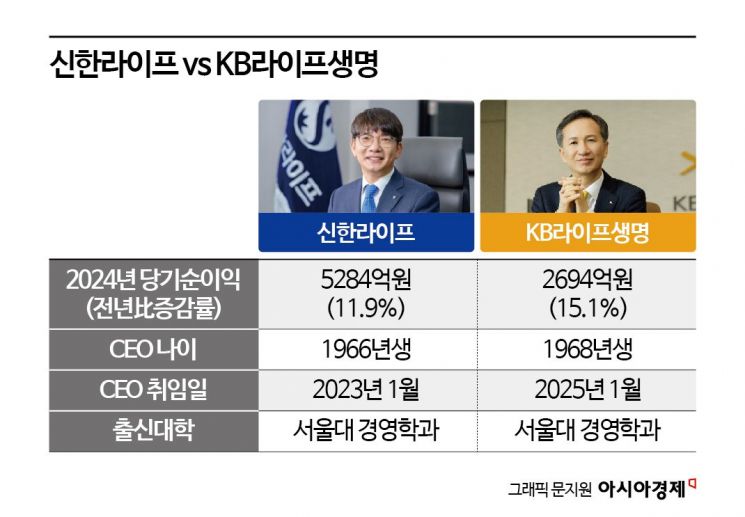

Shinhan Life and KB Life Insurance, the life insurance subsidiaries of the two major financial holding companies, drove the holding companies' performance last year by posting record-breaking results. The CEOs of both companies are alumni of Seoul National University's Business Administration Department, and they are expected to engage in a fierce competition over pride in the senior business this year.

According to the financial sector on the 7th, Shinhan Life's consolidated net profit last year was 528.4 billion KRW, an increase of 11.9% compared to the previous year. This is the highest performance since the merger of Shinhan Life Insurance and Orange Life in July 2021, which launched the integrated corporation. A Shinhan Life official said, "Insurance profit and loss remained at the previous year's level, and financial profit and loss increased due to the rise in interest and dividend income," adding, "This year, we plan to focus on mid- to long-term value growth by expanding customer convenience and preparing proactive and effective internal control measures."

Although KB Life's net profit size still lags behind Shinhan Life, its growth rate surpassed that of the previous year. KB Life's separate net profit last year was 269.4 billion KRW, up 15.1% from the previous year. This is the highest performance since the launch of the integrated corporation combining Prudential Life and KB Life Insurance in 2023. A KB Life official said, "The driving forces behind last year's performance increase were the expansion of new contract sales and the effect of reducing business expenses," adding, "This year, amid an expected slowdown in the insurance industry's growth, we will secure leadership in the nursing care market and acquire high-quality investment assets to establish a stable foundation for future growth."

The two companies share many similarities befitting the top life insurers of the two major financial holding companies. Lee Young-jong, CEO of Shinhan Life, and Jung Moon-chul, CEO of KB Life, are university alumni. Both CEOs rose to the head of the insurance companies after working at the banks, which are key affiliates of their holding companies. Both have expertise in strategy and planning. Lee succeeded in his reappointment this year, while Jung is newly appointed.

Another commonality is that both companies are promoting the senior business as a key new business alongside their core life insurance operations. KB Life is the leader. In October 2023, KB Life entered the senior business for the first time among life insurers by acquiring KB Golden Life Care, a nursing care subsidiary, from its affiliate KB Insurance. Since opening the Gangdong Care Center (daycare facility) in Gangdong-gu, Seoul in 2017, it has successively opened senior welfare medical facilities such as Wirye Village (2019) and Seocho Village (2021), as well as Silver Town (senior welfare housing) Pyeongchang County (2023). This year, Eunpyeong Village (April), Gwanggyo Village (September), and Gangdong Village (second half of the year) are scheduled to open in sequence. Jung is expected to pour company-wide efforts into harvesting the senior business foundation laid by Lee Hwan-joo, former KB Life CEO who became the head of KB Kookmin Bank this year.

Shinhan Life entered the nursing care business by launching its subsidiary Shinhan Life Care in January last year. In November last year, it opened its first nursing facility, Bundang Daycare Center, in Bundang-gu, Seongnam-si, Gyeonggi Province. This year, it plans to introduce an urban-type nursing facility near Misa New Town in Hanam-si, Gyeonggi Province. In 2027, it plans to open a Silver Town in Eunpyeong-gu, Seoul.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.