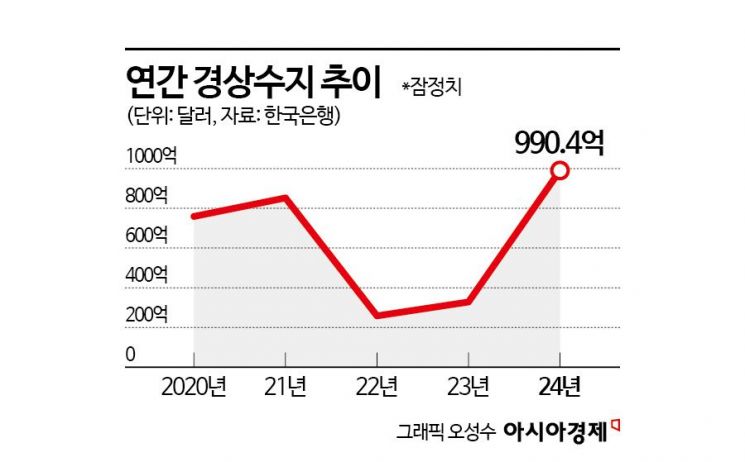

Last Year's Current Account Surplus Exceeds Expectations at $99.04 Billion

Highest Level in Nine Years Since 2015

Concerns Over Export Growth Slowdown This Year... Surplus Expected at $80 Billion

Last year, South Korea's current account surplus exceeded expectations, surpassing $99 billion and marking the second-highest record ever. Thanks to strong semiconductor exports, it achieved the highest level in nine years since 2015 ($105.12 billion). However, this year, the surplus is expected to shrink due to a slowdown in export growth amid the global low-growth trend and high tariff policies initiated by the Trump administration.

Last Year's Current Account Surplus Hits $99.04 Billion... Record High Exports

According to the Bank of Korea's preliminary international balance of payments statistics released on the 6th, South Korea's annual current account surplus last year was recorded at $99.04 billion. This not only exceeded the Bank of Korea's initial forecast of $90 billion but also surpassed the 2016 record of $97.92 billion. Earlier this year, when the Bank of Korea announced the November international balance of payments data, it predicted an annual surplus of $90 billion, leading the market to expect the third-highest level following 2015 and 2016. Compared to the previous year’s 2023 figure of $32.82 billion, it more than tripled.

The surplus exceeded expectations due to strong exports driven by expanding demand for AI-related semiconductors. Despite continued sluggishness in petrochemicals, steel, and petroleum, customs-cleared exports centered on AI-related IT products expanded, surpassing $696.2 billion and setting a record high. Imports of goods decreased for the second consecutive year, mainly due to reductions in IT imports, raw materials, and consumer goods. As a result, the goods balance surplus widened significantly to $100.13 billion, the highest since 2018 ($110.08 billion). Shin Seung-chul, head of the Bank of Korea's Economic Statistics Department 1, explained, "The current account surplus was supported by a steady primary income balance and a goods balance surplus. Both price and volume increased mainly in IT products, leading to record-high goods exports."

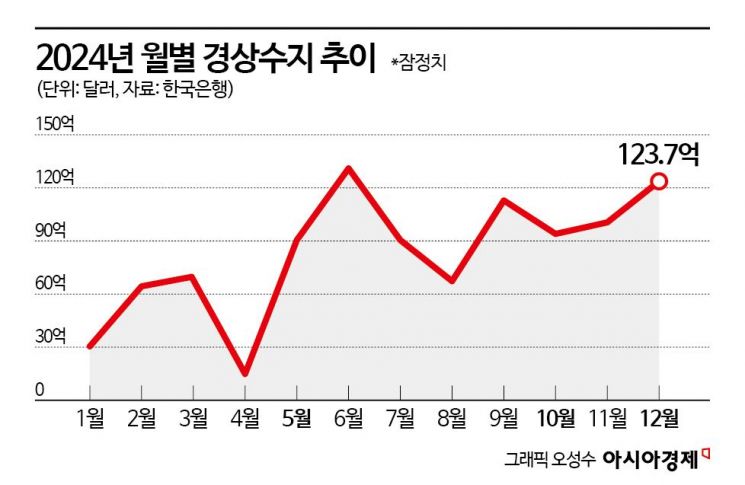

December Current Account Surplus $12.37 Billion... Third Highest Ever

The current account surplus for December was $12.37 billion. This marks 20 consecutive months of surplus and is the third-highest record after $13.1 billion in June 2024 and $12.41 billion in June 2016. It is also the highest ever for December. Compared to the $8.93 billion surplus in the same month last year, it increased by $344 million. The continued strong export trend centered on semiconductors and an increase in dividend income significantly expanded the primary income surplus.

The goods balance, which accounts for the largest share of the current account surplus, led the surplus. In December last year, the goods balance surplus was $10.43 billion, expanding from $5.63 billion in the previous month. The goods balance has recorded a surplus for 22 consecutive months since March 2023. During this period, exports reached $63.3 billion, a 6.6% increase compared to the same month last year, driven mainly by semiconductors. Semiconductor exports in December last year (customs-cleared basis) were $14.62 billion, up 30.6% year-on-year. Information and communication devices also increased by 37.0% to $3.85 billion. Petroleum products (-11.9%), machinery and precision instruments (-6.3%), and passenger cars (-5.8%) showed reduced declines.

Imports amounted to $54.88 billion, a 3.3% increase compared to the same month last year. Although raw materials (-9.6%) continued to decline, capital goods such as semiconductor manufacturing equipment (24.4%) increased, and consumer goods (1.2%) turned to growth. Excluding energy (-18.2%), imports rose 12.2% year-on-year.

The services balance recorded a deficit of $2.11 billion, mainly due to travel and other business services. Overseas travel entered peak season during the year-end and winter vacation, increasing the travel deficit to $950 million in December from $760 million in the previous month. The primary income balance showed a surplus of $4.76 billion, mainly from dividend income on securities investments, the highest since December 2022 ($561.32 billion). The secondary income balance recorded a deficit of $710 million.

The net financial account, which is assets minus liabilities, increased by $9.38 billion. Direct investment saw an increase of $6.95 billion in Korean outbound investment and $1.23 billion in foreign inbound investment. Securities investment showed a $860 million increase in Korean outbound investment, mainly in stocks, while foreign inbound investment decreased by $3.8 billion, also mainly in stocks.

Export Growth Slowdown This Year... Surplus Expected at $80 Billion

The problem this year is the cloud hanging over the export front. The global low-growth trend and concerns over tariff bombs from the Trump administration's second term remain. The so-called "recession-type surplus," where both exports slow and imports of raw materials and consumer goods decline, is also a concern. The Bank of Korea forecasts this year's current account surplus at $80 billion. Although smaller than last year, it is still expected to remain at a high level. Shin explained, "Exports within the goods balance, which accounts for a large portion of the current account, have maintained growth for 15 consecutive months, and the export volume itself is at a high level, so it is technically inevitable that the growth rate will decline."

The biggest risk factor for this year's current account trend is the U.S. Trump administration's trade policy, and how major countries respond is also important. Shin said, "We need to continuously monitor the timing and intensity. If U.S. trade pressure increases, there is a possibility of increasing energy imports as a countermeasure, which will also affect the current account." He added, "The economic conditions of key export items such as semiconductors and IT, U.S.-China trade policies, the economic situation in China, the largest export market, and domestic demand will also have an impact."

Experts also expect this year's current account surplus to decrease compared to last year. Kim Sang-bong, professor of economics at Hansung University, said, "Last year, the current account surplus was driven by strong exports in semiconductors and ships, but this year the situation is not easy. There are tariff impacts from the Trump administration and exchange rate issues, so exports may decline." He explained that while the surplus trend will continue, the surplus margin will shrink. Kim Jeong-sik, emeritus professor of economics at Yonsei University, also said, "Exports are likely to decrease compared to last year, and with the economy in recession, imports may also decline. The surplus will be maintained, but the surplus margin may slightly decrease compared to last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)