Seeking a Breakthrough Amid Construction Machinery Stagnation

Expanding Overseas Markets and Investing in Infrastructure This Year

Aiming for 2.3 Trillion KRW in Sales by 2029

HD Hyundai Infracore recognizes its engine business as a mid- to long-term growth driver this year and is set to expand overseas markets and invest in infrastructure. This decision comes as the core construction machinery sector faces stagnation, prompting the need for a breakthrough.

According to industry sources on the 6th, HD Hyundai Infracore plans to accelerate its efforts to penetrate new overseas markets such as Africa, Eastern Europe, and Central Asia in its engine business division this year. As part of a mid- to long-term strategy to increase the proportion of overseas sales, the company is currently exploring markets centered around countries and cities where it already has regional offices on these continents. The company stated, "We will continue efforts to strengthen sales with existing customers and to discover additional customers in new markets."

HD Hyundai Infracore currently operates 12 locations worldwide, including production subsidiaries. Among these, the regional offices in Eastern Europe, Africa, and Central Asia?where the company aims to expand its market this year?are located in Russia, Ghana, and Dubai, respectively. HD Hyundai Infracore plans to use these offices as bases to pioneer new markets and establish dealer networks.

Additionally, HD Hyundai Infracore will invest 141.2 billion KRW in its Gunsan and Incheon plants to secure production infrastructure for the engine business division. In particular, in Gunsan, the company plans to invest 116.8 billion KRW by the end of 2027 to build a production plant for defense and ultra-large power generation engines and a battery packaging plant on approximately 19,000 pyeong (62,700㎡) of land within the site, establishing mass production facilities.

Once the new Gunsan plant is completed, the company expects total sales in the engine business division to rise to 2.3 trillion KRW by 2029. This represents about a 70% increase compared to last year's total engine business sales of 1.3597 trillion KRW. HD Hyundai Infracore anticipates cumulative sales of 4.5 trillion KRW over the next decade as a result.

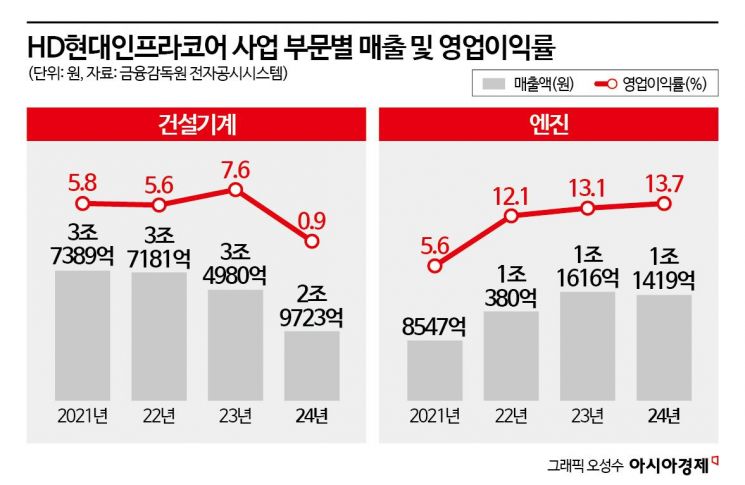

The reason HD Hyundai Infracore is focusing on the engine business division is believed to be due to the stagnation in the construction machinery sector, which has been considered its core business. The construction machinery division, which accounts for three-quarters of HD Hyundai Infracore's total business sales, experienced a decline last year due to a global economic slowdown and weak markets in North America and Europe. Sales dropped about 15% from 3.498 trillion KRW the previous year to 2.9723 trillion KRW, and operating profit fell by 90% to 27.5 billion KRW.

The market expects the construction machinery sector's downturn to continue this year. In emerging markets, infrastructure investment demand is likely to shrink due to a strong dollar and global economic uncertainty, while in advanced markets, North America faces challenges from rising construction-related costs such as labor and prolonged high interest rates. The European market is also experiencing ongoing recessions in France and Germany, with no construction stimulus measures in place.

On the other hand, the engine business division has shown steady growth despite the global economic slowdown. HD Hyundai Infracore's engine business sales have trended upward, recording 854.7 billion KRW in 2021, 1.038 trillion KRW in 2022, and 1.1616 trillion KRW in 2023. Although sales slightly dipped by 2% to 1.1419 trillion KRW last year compared to the previous year, HD Hyundai Infracore forecasts about 7% growth this year, as demand remains solid across various applications including power generators, defense, vehicles, and ships.

An HD Hyundai Infracore representative said, "The engine business is expected to continue steady growth due to stable sales in existing markets and expanding product demand in new markets. Through facility investments, we will establish a mid- to long-term growth foundation in defense, ultra-large power generation engines, and eco-friendly battery packs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.