Key Issues in Korea Zinc Injunction Lawsuit

Court’s Ruling on Corporate Form Under Commercial Act

Card Raised by Chairman Choi Yoonbeom’s Side

Validity of “Mutual Share Voting Rights Restriction” to Be Decided

Dispute Over Application of Korean Commercial Act to Foreign Corporation

The industry’s attention is focused on the temporary injunction lawsuit filed by the Youngpoong-MBK Partners alliance (hereinafter MBK alliance), which is engaged in a management rights dispute with Korea Zinc, at the Seoul Central District Court on the 31st of last month, requesting the suspension of the effectiveness of the resolution of the extraordinary general meeting of shareholders held excluding Youngpoong’s voting rights. This is because it is highly likely to become a turning point that will determine the future direction of the dispute, including whether it will be prolonged.

The main issue in the temporary injunction lawsuit centers on how the court will determine the legal form of Sun Metal Corporation (SMC), a grandchild company of Korea Zinc, under the Commercial Act. This is because the validity of the ‘mutual share voting rights restriction card’ raised by Chairman Choi Yoon-beom of Korea Zinc depends on whether SMC is a joint-stock company or a limited company.

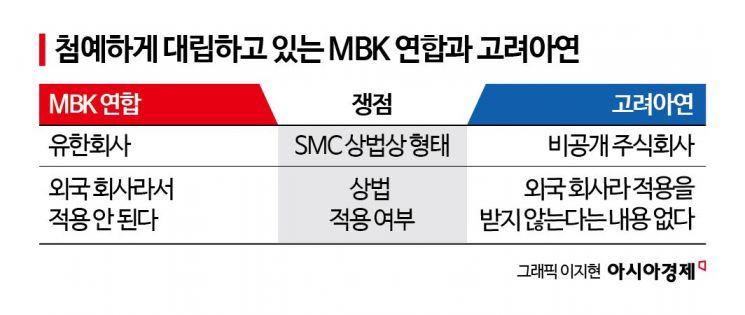

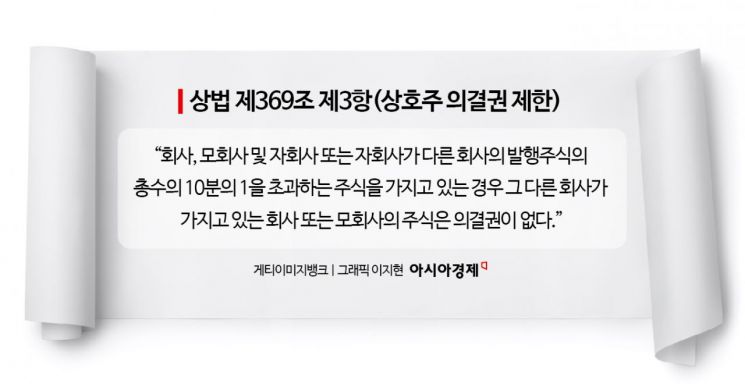

The mutual share voting rights restriction provision under the Commercial Act (Article 369, Paragraph 3) applies only to joint-stock companies where shares can be issued and transferred based on that issuance. Therefore, if SMC is a limited company, the resolution of the Korea Zinc extraordinary general meeting that restricted Youngpoong’s voting rights (25.4%) based on the mutual share voting rights restriction provision under the Commercial Act would be invalid or non-existent. Because of this, both sides are sharply divided over the legal form of SMC under the Commercial Act. The MBK alliance claims that SMC is a limited company, while Korea Zinc insists it is a joint-stock company.

Another issue in the temporary injunction lawsuit is whether SMC, a foreign corporation, is subject to Korean Commercial Act. The MBK alliance argues that since SMC is an overseas corporation established under Australian law, the Korean Commercial Act cannot be applied, and in particular, the mutual share voting rights restriction provision cannot be applied. On the other hand, Korea Zinc counters that “there is no provision stating that a domestic company’s overseas subsidiary is not subject to Article 369, Paragraph 3 of the Commercial Act.”

Whether the chairman of the shareholders’ meeting can restrict voting rights ex officio is also a point of contention. The Commercial Act stipulates the chairman’s authority to maintain order and manage proceedings, but there is no explicit provision regarding the restriction of voting rights. However, the Supreme Court has ruled in precedent that “a shareholder’s voting rights cannot be restricted by a shareholders’ meeting resolution or articles of incorporation except in cases prescribed by law.” This can be interpreted to mean that the chairman must have clear legal grounds or reasons to restrict voting rights. At the extraordinary general meeting last month, Park Ki-deok, President of Korea Zinc and chairman of the meeting, restricted Youngpoong’s voting rights ex officio without a court injunction prohibiting the exercise of voting rights, so there is interest in how the court will view this.

The ‘restriction of voting rights’ in question was reportedly carried out to defend management rights. The Supreme Court’s precedent holds that issuing new shares by third-party allotment solely for the purpose of securing management rights defense violates principles of good faith and other doctrines. This legal principle can also apply to the issuance of convertible bonds rather than new shares. In the case of Korea Zinc, there is no direct precedent regarding the restriction of mutual share voting rights for management rights defense. The key is whether the legal principles applicable to third-party allotment of new shares or issuance of convertible bonds can be extended or analogously applied to this case.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.