Reviewing Domestic Industries...

Continued Concerns Over Weakness in Automobiles and Others

Shipbuilding and Others Considered Tariff-Free Zones

Identifying Beneficiary Companies Amid Risks

Downward Pressure on the Korean Economy

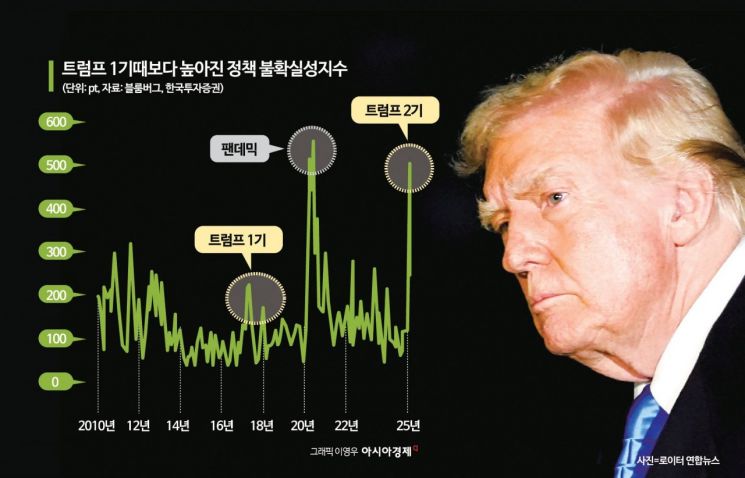

U.S. President Donald Trump has delayed the 25% tariffs on Mexico and Canada by one month, but downward pressure on the domestic stock market remains. Amid concerns that the so-called 'Trump tariffs' could be expanded to target South Korea at any time, weakness is expected to continue among domestic export companies, especially in automobiles, secondary batteries, and home appliances. On the other hand, financial stocks focused on domestic demand, shipbuilding and defense industries considered tariff-free zones, and internet gaming-related stocks have emerged as safe havens. In the case of the transportation industry, which is sensitive to economic cycles, some analyses suggest that for leading companies, these tariff risks could present an opportunity to raise freight rates.

On the 4th, Korea Investment & Securities Research Center released a report titled 'The Second Trade War: Implications by Korean Industry,' analyzing the potential impact of the Trump administration's tariff policies on the domestic stock market and industries. Researcher Kim Dae-jun pointed out that due to tariff risks, the domestic stock market showed weakness the previous day and re-entered undervalued territory, stating, "There is a possibility that South Korea could be next after the European Union (EU) in the sequence of tariff impositions. Until the (U.S.-originated) tariff risks are resolved, the environment will remain unfavorable for export stocks." Following the 30-day tariff delay decision on Mexico and Canada, the KOSPI opened higher that day, but the risk of a U.S.-originated trade war remains.

Reviewing Domestic Industries... Continued Concerns Over Weakness in Automobiles and Others

Specifically, companies supplying products from overseas despite the possibility of domestic production in the U.S. are expected to face pressure from general tariffs. Researcher Kim Dae-jun said, "Industries in South Korea that fall into this category include automobiles, secondary batteries, and home appliances," adding, "Weakness may continue until tariff issues officially come to the negotiation table."

Hyundai Motor and Kia, South Korea's leading automobile manufacturers, are expected to see a deterioration in operating profits this year due to Trump tariffs. Researcher Kim Chang-ho analyzed, "The risks facing the Korean automobile industry are general tariffs of 10% on Korean-made and 25% on Mexico-made vehicles," and "If tariffs are imposed, the impact on Hyundai Motor's operating profit is about 1.9 trillion KRW, which is 14% of the 2025 estimate." This figure assumes 550,000 units exported to the U.S., a tariff rate of 10%, and Hyundai Motor's average selling price (ASP) of 34 million KRW.

For Kia, the estimated operating profit deterioration due to 10% tariffs on Korean-made and 25% tariffs on Mexico-made vehicles is about 2 trillion KRW, approximately 16% of the 2025 estimate. He added, "If general tariffs are confirmed, this will be reflected in earnings estimates," and "Due to reduced valuation attractiveness, automobile-related stocks are likely to remain negative for the time being."

In the electrical and electronics sector, finished product companies are expected to be directly hit. Researcher Park Sang-hyung noted, "Tariff impacts are more direct on IT finished products than on parts suppliers," explaining, "While parts suppliers' customers are companies, IT finished products are sold to individuals. To sell products to U.S. customers, individuals must fully bear the tariffs imposed by the U.S." LG Electronics' sales proportion to the U.S. in 2023 is 24.2%.

However, he also mentioned that "a slowdown in finished product consumption leads to a decline in parts demand," indicating that even parts suppliers not directly subject to tariffs will inevitably be negatively affected by these tariff risks. Furthermore, he assessed that among the electrical and electronics sector, Chinese smartphone brands, which rely heavily on their domestic market, will be the least affected by U.S.-originated tariff risks.

In the semiconductor sector, it is expected that investment sentiment in related stocks will weaken as President Trump's tough stance on China continues. However, since most memory semiconductors are produced outside the U.S., the impact is expected to be limited. Researcher Chae Min-sook explained, "Memory semiconductors already experienced tariffs on China during Trump's first term," adding, "Since then, semiconductors produced in Chinese factories are consumed mostly within China, and exports to the U.S. are mostly supplied by Korean factories." She judged that SK Hynix, which has high sales proportions in AI-related memory such as High Bandwidth Memory (HBM) and B2B (business-to-business) sales, will be the most advantageous.

Shipbuilding and Others Considered Tariff-Free Zones

Industries relatively free from concerns about Trump-originated trade wars include shipbuilding, construction, and defense. Researcher Kim Dae-jun said, "There are products the U.S. needs but cannot produce domestically, such as shipbuilding, nuclear power plants, and power," adding, "There are no suitable alternatives outside South Korea, so imposing tariffs would yield no benefit. In other words, tariff risks are low, so if stock prices fluctuate, investors can respond by buying at low prices and holding on."

Researcher Kang Kyung-tae also maintained HD Hyundai Mipo as the top pick in the shipbuilding sector, stating, "Even if high tariff policies expand, shipbuilding is a tariff-free zone in the U.S." He noted that the U.S. does not import ships and that ships ordered by U.S. shipowners for strategic fleet participation will also be exempt from tariffs. Additionally, he analyzed that due to the composition of ship types, HD Hyundai Mipo Shipbuilding could benefit from U.S. ship-related policies. He also evaluated the construction sector as stable against changes in U.S. tariff policies, explaining, "Most orders, sales, and profits are generated domestically, and the U.S. contributes little to overseas performance."

In the internet and gaming sectors, no negative impact from tariffs is expected. On the contrary, a positive technological environment related to AI is being created, making these sectors beneficiaries in the recent macroeconomic environment. The defense industry was also cited as a sector with limited impact from Trump tariffs. Researcher Jang Nam-hyun explained, "There is no proportion of U.S.-bound weapon system exports in defense companies' performance," adding, "Future exports will mainly occur in the Middle East, Eastern Europe, and Southeast Asia." However, from a long-term perspective, if domestic defense companies attempt to enter the U.S. market, the Trump administration's America First policy could be an obstacle.

Additionally, in the steel industry, based on last year's data, South Korea's steel exports to the U.S. accounted for only 9.8%, so the impact of tariffs is expected to be limited. South Korea's steel export share to the U.S. has been steadily decreasing from 17.2% in 2014 to 11% in 2017, when Trump's first term began. Researcher Choi Moon-sun analyzed, "The main export item to the U.S. is automotive steel sheets," adding, "Considering the price gap between Korean and U.S. products, tariffs would need to exceed 20% for Korean supply prices to surpass local prices. Even with a 10% tariff, exports to the U.S. are expected to continue."

Identifying Beneficiary Companies Amid Risks

In the refining and chemical sectors, supply restructuring factors are considered more important than short-term tariff policy changes. Coupled with changes in the global energy market, the imposition of tariffs on Canadian crude oil by the U.S. is expected to bring a counter-effect.

The transportation industry, sensitive to economic cycles, is also expected to see opportunities for leading companies with sufficient logistics infrastructure and service competitiveness to raise freight rates amid ongoing supply bottlenecks since the pandemic. Researcher Choi Go-woon said, "While protectionism will reduce trade volumes in the mid-to-long term, freight rates could surge excessively during the initial transition period of policy implementation," predicting that Hyundai Glovis and Korean Air could strengthen their supplier dominance.

In the food and beverage sector, CJ CheilJedang, which has production facilities in the U.S., was identified as a beneficiary. Researcher Kang Eun-ji explained, "Benefits are expected from Trump's high tariff policy because the main competitors for large amino acid products produced by the bio division are Chinese companies." Nongshim also has production facilities in the U.S., but since competitors do as well, benefits are expected to be limited.

In addition, the securities sector received a conditionally negative evaluation. If investor sentiment worsens around export stocks and domestic stock trading volume shrinks, the outlook is negative. In 2019, when the impact of the 2018 U.S.-China trade dispute was fully reflected, the average daily domestic stock trading volume was 9.3 trillion KRW, down 19% from the previous year. In the financial sector, it was mentioned that if trade volume shrinks and the net export contribution to the domestic economy decreases, bond yields could face downward pressure.

Researcher Kim Dae-jun advised investors, saying, "Since tariffs are ultimately an export-related issue, it is wise to pay attention to domestic demand-related stocks in South Korea," recommending interest in financial stocks such as banks and insurance companies, as well as food and beverage stocks, which have increased valuation attractiveness.

Downward Pressure on the Korean Economy

High U.S. tariffs are expected to exert downward pressure on the overall Korean economy. Researcher Moon Da-woon said, "Although policies directly targeting South Korea have not yet been announced, the introduction of general tariffs and the possibility of prolonged high tariffs cannot be ruled out," expressing concerns about short-term volatility in exchange rates and financial markets, and mid-to-long-term reductions in global trade and exports to the U.S., leading to decreased export volumes. This pattern was also observed during Trump's first term. He assessed, "All of these will act as downward pressure on Korean exports and growth," adding, "While a lower growth trajectory is expected this year, depending on the development of Trump's policies, both the upper and lower growth forecasts could be lowered." Korea Investment & Securities projects South Korea's growth rate at 1.4% for this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)