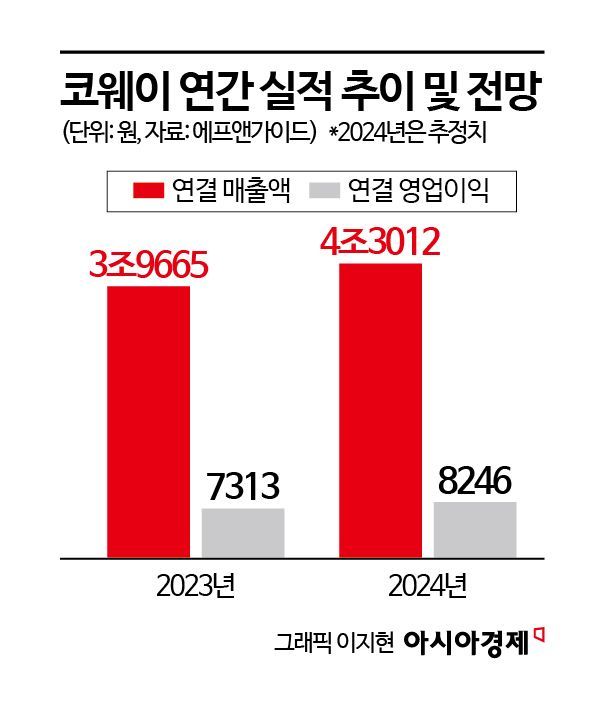

Estimated Sales of 4.301 Trillion KRW Last Year

Operating Profit of 825 Billion KRW

Results Achieved Through Business Diversification and Other Efforts

Coway, regarded as the leader in the home appliance rental market, recorded stable growth last year despite the market entry of traditional 'home appliance giants' such as LG Electronics. This is because it has already established a solid position in the small home appliance sector and is also achieving results in business diversification, including the launch of new brands.

According to FnGuide on the 3rd, Coway's estimated sales last year were 4.301 trillion KRW, up 8.41% from the previous year, and operating profit was 825 billion KRW, an increase of 12.86% year-on-year. In particular, growth in the 'financial lease' (long-term contract) sector stood out. The financial lease sector reached 1.2993 trillion KRW, a 40.0% increase compared to the previous year. Orin Ah, an analyst at LS Securities, said, "Coway's subscription-based revenue model shows stable performance," adding, "Especially this year, compared to last year, the number of accounts reaching ownership decreases, so as the net increase in accounts rises, continuous sales growth is expected."

The domestic home appliance rental market, which had previously formed a 'three-way battle' among Coway, SK Magic, and Cheongho Nice, saw intensified competition in the second half of 2023 as LG Electronics integrated rental and subscription services to fully launch its subscription service. As the rental and subscription market emerged as a new growth engine in the already 'red ocean' home appliance market, large corporations like LG Electronics began calculating their entry timing one by one. In particular, LG Electronics is putting great effort into the subscription business, selecting it as one of its future core businesses. LG Electronics entered the rental market with water purifiers in 2009 and has gradually expanded its service items, currently offering subscription services for 23 product categories.

Industry experts analyze that Coway's efforts to diversify its business stood out in the increasingly competitive domestic home appliance rental market. Having already secured a solid position in the small home appliance sector, Coway has continued aggressive investment in new businesses, such as launching the brand 'Birex' at the end of 2022, which handles mattresses and massage chairs. A Coway representative explained, "Since mattresses and massage chairs have relatively long replacement cycles, most users choose long-term contracts of 5 to 6 years or more," adding, "Judging from the significant growth in the financial lease sector in estimated sales, it can be seen that the stable maintenance of core products along with the advancement of Birex items drove the growth."

LG Electronics' strengthening of its subscription line centered on large home appliances such as TVs, refrigerators, and washing machines has also supported Coway's growth by preventing the competition from escalating into a direct confrontation between the two companies. Currently, Coway's sales proportion of small home appliances such as water purifiers, bidets, and air purifiers accounts for as much as 80% of the total, demonstrating its dominance. An industry insider said, "With LG Electronics fully entering the subscription market in the already red ocean home appliance market and Samsung Electronics also weighing its entry timing, the home appliance subscription market is expected to become increasingly competitive," adding, "However, since these two companies are expected to expand subscription services mainly for large home appliances with higher selling prices, the impact on Coway, which is earning stable income in the small home appliance sector, is not expected to be significant. Rather, it is likely to have a positive effect by expanding the overall pie of the home appliance subscription market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)