Fed Holds Rates Steady After Three Consecutive Cuts

FOMC Statement Removes "Progress on Inflation" Phrase

Powell Says "Rates Considerably Less Restrictive"... Defers Evaluation of Trump Policies

Financial Markets Remain Calm... Wall Street Expects Rate Cuts to Resume in May or June

The U.S. central bank, the Federal Reserve (Fed), held the benchmark interest rate steady at 4.25?4.5% per annum as expected. Despite public pressure from U.S. President Donald Trump to lower rates, Fed Chair Jerome Powell stated, "There is no need to rush," reaffirming a cautious monetary easing stance amid uncertainties surrounding Trump's second-term policies. President Trump harshly criticized Chair Powell, accusing the Fed of "failing to curb inflation." On Wall Street, there are forecasts that the Fed will resume rate cuts in May or June.

Fed Holds Rate at 4.25?4.5%... Removes "Progress on Inflation" Phrase

On the 29th (local time), following the first Federal Open Market Committee (FOMC) regular meeting of the year, the Fed announced in its policy statement that it had unanimously decided to keep the federal funds rate unchanged at 4.25?4.5% per annum. After lowering the rate from 5.25?5.5% in September last year by 0.5 percentage points for the first time in two and a half years to initiate monetary easing, the Fed further cut rates by 0.25 percentage points in both November and December, marking three consecutive cuts before this first hold. This maintained the interest rate gap with South Korea at 1.5 percentage points at the upper bound.

Chair Powell said at the post-FOMC press conference that the current rate is "considerably less restrictive," and that "policy and the economy are in a really good place, so there is no need to rush adjustments" to monetary policy.

The reason behind the Fed's rate hold was the possibility of inflation rebounding. Powell said, "We expect further progress on inflation," but added, "Being ready for further progress is one thing; actually achieving it is another." He also appeared concerned about inflation risks stemming from President Trump's policies such as tariff increases, immigration restrictions, and tax cuts. He indicated that the Fed would not immediately change its inflation target of 2%.

The latest FOMC policy statement also removed the phrase about progress on inflation, which was seen as somewhat hawkish (favoring monetary tightening). The statement described inflation as "somewhat elevated" but deleted the previous phrase that it "has made progress" toward the 2% target. The assessment of the employment situation also changed. In December last year, the labor market was described as having "generally eased" since early this year, but this time the wording was revised to "remain solid." However, Chair Powell explained at the press conference that the removal of the inflation phrase was not an intentional policy signal but merely a wording adjustment, partially easing market concerns.

"Will Do Our Job" Powell Avoids Direct Clash with White House... Trump Criticizes Powell Fiercely

During the press conference, reporters flooded Powell with questions about his stance on President Trump's pressure to cut rates. There were also inquiries about the impact of the second Trump administration's policies on the economy.

Powell said he had "not been in contact" with President Trump and that commenting on the president's remarks would be "inappropriate," which was interpreted as an attempt to avoid direct confrontation with the White House. However, he indicated that "the public should be confident that we will continue to do our job," implying that the Fed would maintain its independence in monetary policy despite Trump's pressure for rate cuts. Earlier, on the 23rd, President Trump had called for "immediate rate cuts" during a virtual speech at the World Economic Forum (WEF, Davos Forum) in Switzerland, saying, "Rates need to come down globally."

Powell deferred judgment on the economic impact of President Trump's policies. He said, "Before assessing the impact of tariffs, immigration, fiscal, and regulatory policies on the economy, the policies need to be concretized," adding, "There are too many variables related to policy, so we need to wait and watch." When asked about tariffs, he replied, "I would prefer to avoid even indirect references to tariffs," showing extreme caution in his remarks. He also drew a line on commenting about the potential inflation impact of Trump's energy policies, such as expanding fossil fuel production.

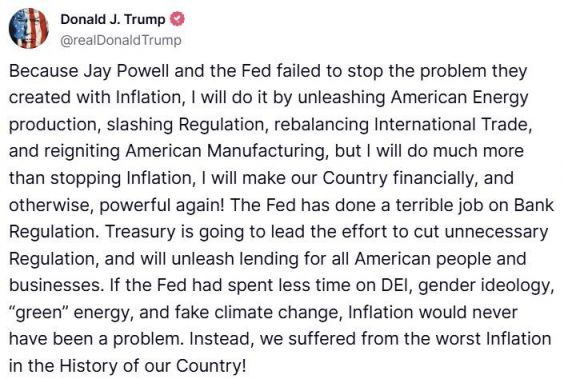

After the Fed held rates steady despite his calls for cuts, President Trump launched a fierce attack on Chair Powell and the Fed, accusing them of "failing to stop inflation." On his social media platform Truth Social, which he created, Trump claimed, "If the Fed had spent less time on diversity, equity, and inclusion (DEI), gender concepts, green energy, and fake climate change, inflation would never have happened," and added, "The Fed also did a terrible job regarding bank regulation." He emphasized, "I will do more than just stop inflation through revitalizing U.S. energy production, deregulation, rebalancing international trade, and reviving U.S. manufacturing," stressing, "I will make our country strong again financially and in other ways."

Financial Markets Relatively Calm... Wall Street Predicts Rate Cuts to Resume in May?June

Following the Fed's expected rate hold, financial markets responded relatively calmly. The New York stock market fell slightly, and the bond market showed little movement. On the New York Stock Exchange (NYSE) that day, the Dow Jones Industrial Average dropped 0.31% from the previous trading day, while the S&P 500 and Nasdaq indices fell 0.47% and 0.51%, respectively. U.S. Treasury yields, a global benchmark for bond yields, showed the 10-year Treasury at 4.53% and the 2-year Treasury, sensitive to monetary policy, at 4.22%, both slightly lower than the previous day.

Investors also lowered expectations for rate cuts, while Wall Street forecasts that the Fed will resume cutting rates in May or June. According to the Chicago Mercantile Exchange (CME) FedWatch tool, the federal funds futures market priced in a 77% chance that the Fed will hold rates at the March FOMC meeting, up from 68.5% the previous day. The probability of a rate hold in May also rose from 49% to 58.3%.

Citigroup stated, "The Fed will maintain a wait-and-see stance going forward," and predicted, "Starting from the May meeting, when inflation indicators can be confirmed over the next few months, rate cuts will resume."

Krishna Guha, Vice Chairman of Evercore ISI, said, "We still do not rule out a cut in March," but analyzed, "Powell's statement about watching the impact of Trump's policies shows that Fed officials are leaning more toward June as the next decision point for cuts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.