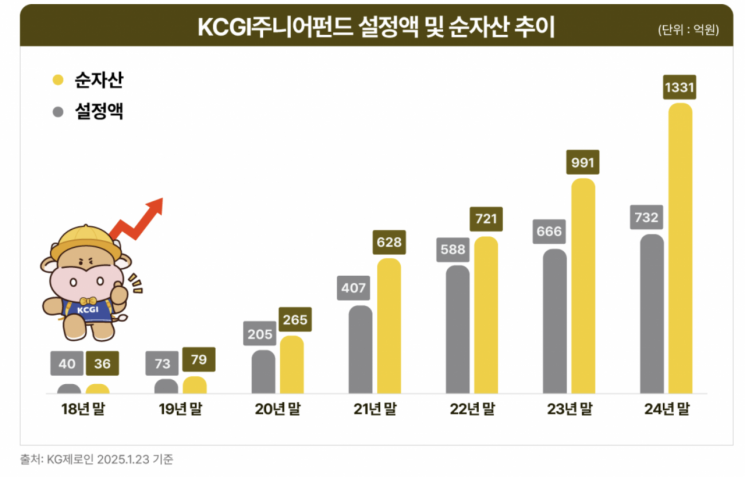

KCGI Asset Management announced on the 24th that the KCGI Junior Fund's assets under management reached 73.1 billion KRW as of the 23rd, marking an 18-fold growth in 7 years since its establishment at the end of 2018.

The number of accounts has surpassed 30,000. At the end of 2018, the assets under management were only 4 billion KRW. The current valuation has grown to 133.1 billion KRW.

The KCGI Junior Fund is a children’s fund available only to those aged 20 and under. It is an asset allocation fund that invests the majority of its assets in U.S. and Korean stocks and equity funds. For subscribing customers, it provides an operational report that explains the fund’s status in an easy-to-understand manner tailored to minors and clarifies financial terminology.

By offering differentiated services such as free gift tax filing services when certain conditions are met, it is emerging as a leading children’s fund in Korea.

More parents are spreading out or preemptively making gifts to their children to prepare for future housing gifts or inheritance. They also utilize advance gift tax filing for installment-type funds.

Advance gift tax filing for installment-type funds means agreeing to make installment payments into the fund for the child and filing a gift tax report. Compared to lump-sum gifting, this method reduces the financial burden, and there is no additional tax burden on the asset value increase of amounts paid after the filing. Since it allows gifting amounts exceeding the deduction limit at the time of filing, it offers significant tax-saving benefits.

If a parent decides to gift the child the gift tax exemption limit of 20 million KRW over 10 years and does so through an installment-type fund, they would need to pay about 189,000 KRW monthly. Even if the fund generates profits later, the assets under the child’s name can be used as income proof without additional gift tax filing.

When gifting through an installment-type fund, the gift amount is evaluated using the actuarial present value method with a discount rate applied, allowing gifting amounts greater than the gift tax exemption limit. To gift the child the 20 million KRW exemption limit over 10 years, theoretically, one must pay 166,000 KRW monthly, which is 1/120th of 20 million KRW. Using the actuarial present value method, paying 189,000 KRW monthly allows a total gift of 22.68 million KRW tax-free.

KCGI Asset Management offers a free advance gift tax filing agency service for customers who set up an installment-type fund with monthly payments of 189,000 KRW for more than 10 years.

A KCGI Asset Management official advised, "When selecting a fund, consider the investment period, investment style, and timing of fund needs, but it is beneficial for children to develop good investment habits by filing gift tax in advance and consistently making monthly payments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)