The Share of Those Aged 60 and Above Sees the Largest Increase Among All Age Groups

'Rich Baby Boomers' Actively Purchasing Apartments

The Proportion of Buyers Aged 20 and Under Hits a Record Low Since 2019

'Young Rich' Turn to Virtual Assets and U.S. Stocks Instead of Real Estate

Last year, one out of five people who purchased an apartment was aged 60 or older. Centered around the first baby boomer generation (1955?1963), the senior demographic actively bought homes, increasing the proportion of buyers aged 60 and above, while the share of apartment purchases by those aged 20 and under hit a record low since the first survey in 2019.

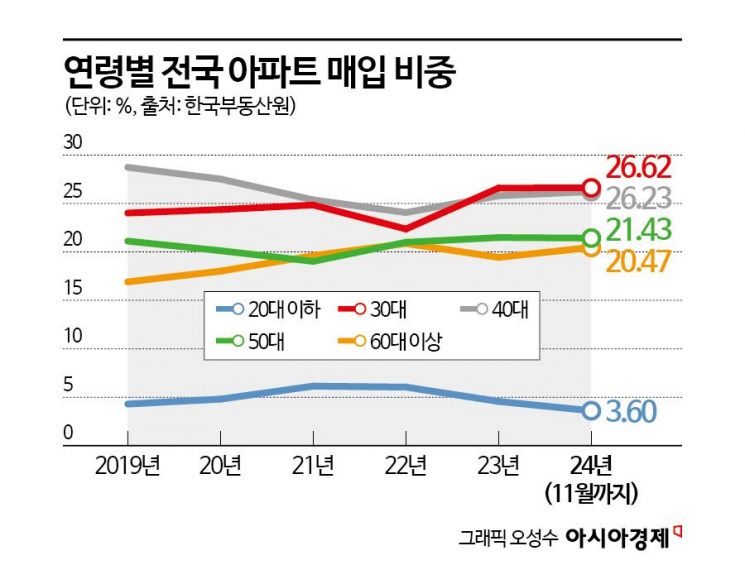

According to the age-specific apartment purchase proportions recently released by the Korea Real Estate Board on the 24th, the age group that bought the most apartments nationwide from January to November last year was those in their 30s, accounting for 26.62% of the total. The 30s, which took first place for the first time in 2023 with 26.60%, continued to show strength last year. This was followed by the 40s (26.23%), 50s (21.43%), 60 and above (20.47%), and 20 and under (3.60%). Notably, the 60 and above group was close to the record high proportion of 20.88% in 2022, while the share of those aged 20 and under was the lowest since the related statistics began.

'Rich Baby Boomers' Emerging as Major Players in the Apartment Market

The age groups with the most notable changes were those aged 60 and above and those in their 20s. The proportion of home purchases by those aged 60 and above rose by 1.03 percentage points from 19.44% in 2023 to 20.47% last year, marking the largest increase among all age groups. Since the first survey in 2019, which recorded 16.91%, this group has shown an upward trend. Compared to one year and five years ago, this age group shows the most significant change. Conversely, the share of those aged 20 and under fell by 0.94 percentage points compared to one year ago. The 30s, 40s, and 50s age groups saw changes of less than 1 percentage point.

Experts view the 'rich baby boomers,' who differ from past retired generations, as emerging major players in the apartment market. The number of financially capable senior buyers has increased significantly. Yang Ji-young, a researcher at Shinhan Investment Corp., said, "The current 60 and above age group has accumulated considerable assets and is in a position not to sell homes but rather to have the capacity to purchase more."

There is also analysis that a significant demand exists for buying apartments to gift to children or for downsizing (transitioning from ownership to renting or moving to cheaper housing). In fact, focusing only on Seoul, where housing prices are high, the proportion of buyers aged 60 and above was 14.55% in 2024, much lower than the national average of 20.47%. A notable point in the Seoul apartment market is that buyers in their 40s accounted for 31.91%, narrowly surpassing those in their 30s (31.90%) to rank first in purchase share. While the 30s have the highest share nationwide, in Seoul, the 40s remain the largest buyers.

'Young Rich' Focus on Virtual Assets and U.S. Stocks

On the other hand, the share of home purchases by those in their 20s fell below 3% for the first time. This is analyzed as a result of the 20s 'Young Chul Jok' (those who borrowed heavily to buy homes) who suffered from falling home prices and high interest rates after 2020 and 2021, becoming more cautious about apartment purchases. Additionally, the implementation of the second stage of loan regulations, the Debt Service Ratio (DSR), reduced borrowing capacity. Researcher Yang said, "With apartment prices rising significantly, especially in the Gangnam area, and high loan interest rates, it is difficult for young people aged 20 and under to purchase homes."

Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, said, "The jeonse rate (the ratio of jeonse price to sale price) is low, making it impossible to engage in the previously common no-capital gap investment," adding, "The 'young rich' focusing on virtual assets and U.S. stocks have relatively less interest in real estate, which also explains the reduced purchase share among those aged 20 and under." In 2024, Bitcoin more than doubled, recording the most overwhelming returns among major asset classes, while the S&P 500, the representative index of the U.S. New York Stock Exchange, rose by 23%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.