Tariff Impact Limited by Domestic Fee-Based Business Model

The securities industry is busy searching for 'tariff-safe' sectors. Although U.S. President Donald Trump has taken a more moderate stance on tariff policies than expected, leading related beneficiary stocks to rally in relief, there is a sense of crisis over the possibility that tariffs could be weaponized again at any time. Securities stocks, along with utilities, defense, and shipbuilding stocks, have been identified as safe havens from 'tariff risks.'

As tariff measures expected to be announced by President Trump from 'Day One' of his administration have been delayed, the domestic stock market has recently seen relief rallies in beneficiary stocks. Aerospace stocks rose following the announcement of Mars exploration, and buying interest also increased in shipbuilding and power equipment stocks. However, it is too early to be complacent. President Trump has announced plans to impose 25% tariffs on imports from Mexico and Canada and 10% tariffs on Chinese imports starting February 1. This would inevitably impact automobile and IT stocks such as Kia, Samsung Electronics, and LG Electronics, which have factories in Mexico.

Accordingly, sectors expected to be free from tariff risks, such as securities stocks, are gaining attention in the market. On the 23rd, NH Investment & Securities stated, "While the impact of Trump's tariffs varies by industry, the securities industry is expected to suffer little damage," naming Korea Financial Group, Samsung Securities, and Daishin Securities as investment destinations that can avoid tariff risks. Unlike manufacturing, which trades tangible goods, the securities industry primarily operates on a domestic fee-based business model, so the impact of tariff imposition is limited.

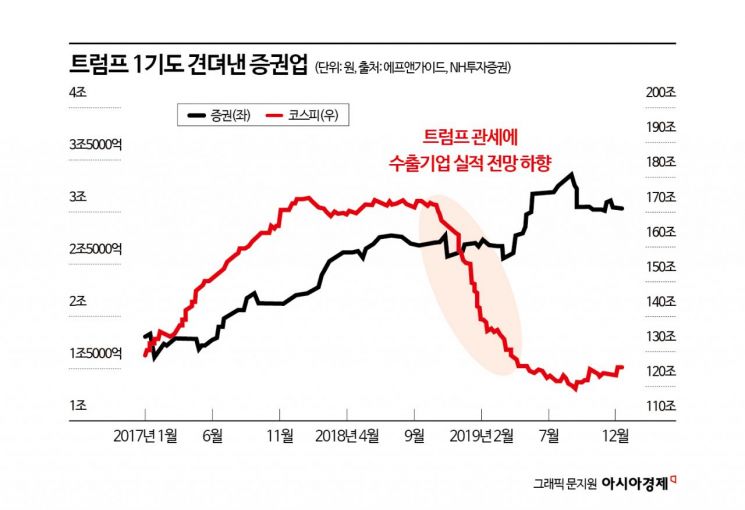

Yoon Yoo-dong, a researcher at NH Investment & Securities, explained, "During Trump's first term trade war, securities industry earnings forecasts rose based on similar logic and actually led to net profit growth. Even after last year's Trump attack incident, while earnings forecasts for export-oriented KOSPI companies were revised downward, the securities industry showed an upward trend."

The financial authorities' intention to continue the value-up program and the favorable environment created by the abolition of the financial investment income tax (hereafter, 'financial investment tax'), which is expected to expand trading volume, are also expected to act as upward momentum for securities stocks. This year, the second value-up disclosures of Kiwoom Securities and Mirae Asset Securities are scheduled, and Daishin Securities, which has maintained cash dividends for 26 consecutive years, has set a dividend payout ratio of 30-40% of net profit (based on separate financial statements).

Recently, the three major beneficiary sectors of Trump's second term?utilities, defense, and shipbuilding?are also evaluated as being free from tariff influence. In the case of utilities, the expansion of AI data centers and investment in SMRs (Small Modular Reactors) in the U.S. is expected to increase power demand, resulting in a positive spillover effect. Defense stocks benefit from the good news of increased defense cost-sharing by allied countries, which President Trump is pressuring for. Shipbuilding stocks are also expected to benefit as U.S. sanctions on Chinese shipyards are imminent and LNG (liquefied natural gas) carrier demand is expected to expand.

Park Sang-hyun, a researcher at iM Investment & Securities, said, "Although Trump is pursuing a flexible tariff policy early in his term, it is uncertain when he might wield tariffs as a weapon. Whether tariffs will be imposed on Mexico, Canada, and China on February 1 will be a crucial litmus test for Trump's second-term tariff policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.