Tokyo Kantei "2024 Annual Real Estate Market Trends"

Driven by Upper-Class Demand... Tokyo Metropolis Up 5% Year-on-Year

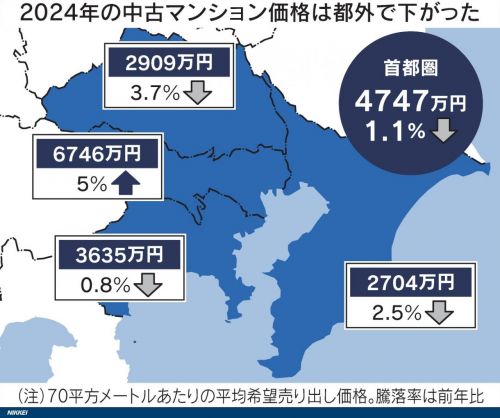

Real estate price trends in the Tokyo metropolitan area included in the "2024 Annual Real Estate Market Trends" by Tokyo Kantei, a Japanese real estate information company. Real estate prices in the three prefectures excluding Tokyo Metropolis declined compared to the previous year. Photo by Nihon Keizai Shimbun (Nikkei)

Real estate price trends in the Tokyo metropolitan area included in the "2024 Annual Real Estate Market Trends" by Tokyo Kantei, a Japanese real estate information company. Real estate prices in the three prefectures excluding Tokyo Metropolis declined compared to the previous year. Photo by Nihon Keizai Shimbun (Nikkei)

The polarization of housing prices became prominent even in Tokyo, Japan. While prices of older apartments continued to rise in the central Tokyo Metropolis, real estate prices in the three neighboring prefectures known as the Greater Tokyo Area (Saitama, Chiba, and Kanagawa) turned downward for the first time in 11 years since 2013.

On the 23rd (local time), according to Japan's Nihon Keizai Shimbun (Nikkei), Tokyo Kantei, a Japanese real estate information company, released its "2024 Annual Real Estate Market Trends," comparing prices of used condominiums of about 70㎡ (approximately 21 pyeong). In Japan, mansions (manshon) refer to multi-family housing similar to apartments in Korea.

The average asking price for properties in the Greater Tokyo Area, including Tokyo Metropolis and the three prefectures, was 47.47 million yen for 70㎡, down 1.1% from the previous year (2023). This is the first year-over-year decline since 2013. Japanese real estate prices had continuously risen since 2013, when Abenomics, which included a policy of yen depreciation, was introduced.

This decline was due to falling real estate prices in the three prefectures outside the central Tokyo Metropolis. In Saitama Prefecture, prices dropped 3.7% year-on-year to 29.09 million yen in 2024 from 30.20 million yen in the same period last year. Chiba Prefecture retreated 2.5% to 27.04 million yen, and Kanagawa Prefecture also fell 0.8% to 36.35 million yen.

On the other hand, prices in Tokyo Metropolis, reflecting strong demand from the upper class, continued to rise. The average asking price in Tokyo Metropolis for the same size was 67.46 million yen, up 5% from the previous year.

The cause is believed to be a decrease in actual purchase demand as real estate prices in the outskirts of Tokyo overheated. The main buyers in the surrounding prefectures are actual demand groups with relatively lower incomes compared to central Tokyo. Masayuki Takahashi, a senior researcher at Tokyo Kantei, explained, "With real wages not rising and the burden of interest rates increasing, housing purchase sentiment is cooling."

Nikkei noted, "With stagnant real wages and rising mortgage interest rates, purchasing has slowed down," adding, "Even in central Tokyo, people are becoming more cautious when evaluating listings, and the vitality of the used market may weaken in 2025."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)