SK Hynix Achieves Record-High Performance

Overcomes Memory Market Crisis with High Value-Added Products

HBM3E May Reach Up to 32 Stacking Layers

HBM4 Mass Production Planned for Second Half of the Year

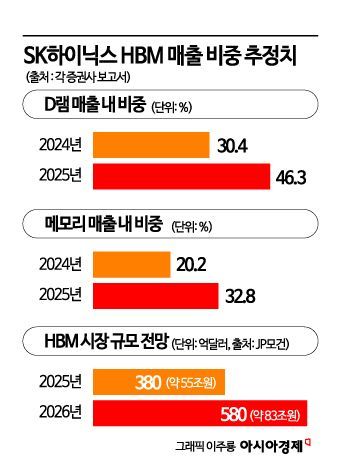

HBM Sales Share Expected to Reach Nearly Half

Global HBM Market Projected to Reach 83 Trillion Won Next Year

SK Hynix's record-high sales, operating profit, and net profit since its founding are the result of the company's flagship product, high-bandwidth memory (HBM), maintaining technological superiority alongside the rapid growth of the artificial intelligence (AI) market. The technological expertise painstakingly built over approximately 12 years since the first introduction of HBM in 2013 has come to fruition.

The actual HBM3E 16-layer product revealed at the SK exhibition booth preview event held on the 6th (local time) at the Las Vegas Convention Center (LVCC) Central Hall in Nevada, USA. Photo by Yonhap News

The actual HBM3E 16-layer product revealed at the SK exhibition booth preview event held on the 6th (local time) at the Las Vegas Convention Center (LVCC) Central Hall in Nevada, USA. Photo by Yonhap News

Following the earnings announcement, SK Hynix is expected to expand its technology development and profitability-focused management strategy centered on HBM. This is because the company has proven that it can achieve solid performance with high value-added HBM, overturning industry concerns about a crisis in the memory market due to the decline in DRAM prices at the end of last year, oversupply of HBM, and price competition from Chinese companies. In fact, it is reported that internally at SK Hynix, recent work and discussions have focused on developing HBM in new ways and finding ways to evolve it with other technologies.

Raising HBM3E Stacking Layers and Aiming for HBM4

To further solidify its leadership in the HBM market, SK Hynix is accelerating comprehensive development of next-generation HBM. The plan is to increase the number of stacking layers of the 5th generation HBM3E as much as possible. Currently, SK Hynix is mass-producing and supplying customers with the 12-layer HBM3E product, and in November last year, it officially announced the development of a 16-layer HBM3E product. Samples will be supplied and certification procedures will be conducted in the first half of this year. Furthermore, SK Hynix is targeting beyond 16 layers to 20, 24, and even 32 layers for HBM3E. Lee Kang-wook, Vice President in charge of package development, said in the keynote speech at the Semiconductor Exhibition (SEDEX) 2024 last October, “We are developing stacking technology centered on hybrid bonding because we do not know how far HBM will go?20 layers, 24 layers, or 32 layers.”

Based on this, SK Hynix’s blueprint is to take stable steps toward the 6th generation HBM, HBM4. SK Hynix plans to begin mass production of HBM4 as early as the second half of this year. This is in response to a special request from Jensen Huang, CEO of important customer Nvidia, who asked to advance the supply schedule by six months from the original plan. Recently, SK Hynix also improved the DRAM process technology that forms the basis for manufacturing HBM4. Starting next month, it will begin the world's first mass production of 10nm-class 6th generation (1c) DRAM. Specifically, it will start producing 16-gigabit (Gb) Double Data Rate (DDR)5. This product reportedly operates 11% faster than the previous generation and improves power efficiency by more than 9%. SK Hynix plans to utilize this product and DRAM process technology when manufacturing next-generation HBM product lines as well as advanced products such as LP (low power) DDR6 and GDDR7.

HBM Sales Share Expected to Approach Half

SK Hynix is expected to continue focusing its efforts on HBM, with the share of HBM in total sales likely to increase further. The proportion of HBM in DRAM sales, as revealed in SK Hynix’s earnings announcement, was about 40%. Industry and securities analysts predict this share will rise further this year, approaching half of DRAM sales. Securities firms estimated in reports that SK Hynix’s average HBM sales this year will reach 25.4155 trillion won, accounting for 46.3% of total DRAM sales (54.9253 trillion won).

There is a growing view that increasing the share of HBM is SK Hynix’s “survival strategy.” The strategy of securing demand and supply for the high value-added HBM product is seen as a source of consistently high profits regardless of fluctuations in the memory market. Youngho Ryu, a researcher at NH Investment & Securities, analyzed, “Because the proportion of high value-added products is higher than competitors, the impact of past downturn cycles is limited. Even if demand in the front-end industry deteriorates further, SK Hynix has the resilience to maintain a certain level of profitability through shipment adjustments.”

“HBM Market to Grow to 83 Trillion Won Next Year”

Global media and experts continue to offer optimistic forecasts for the HBM market. Following Nvidia, companies such as Google, Amazon, and Meta have decided to develop AI chips independently, which is expected to further increase demand for HBM. Global investment bank JP Morgan projected on the 21st that the HBM market size will reach $38 billion (approximately 55 trillion won) this year and $58 billion (approximately 83 trillion won) next year. Furthermore, while Nvidia remains a major customer in the HBM market, it is forecasted that by 2027, demand from other big tech companies such as Google and Amazon will account for about 29%. According to some foreign media and industry insiders, David Oliver Sacks, appointed as AI and cryptocurrency policy czar in the second Trump administration, recently identified “HBM semiconductor manufacturers” as the “theme stocks most likely to rise this year” during a meeting with influential investors including Jason Calacanis and David Freiberg at President Trump’s inauguration.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)