Donald Trump Declares "Mars Colonization"

Intuitive Machines and Rocket Lab Shares Surge for Consecutive Days

Lumir, Kenko Aerospace, HVM, and Others Join the Rally

Space-related stocks, which had been overlooked in the domestic stock market, are starting to stir. The trigger was U.S. President Donald Trump's statement at his inauguration on the 20th (local time) that "American astronauts will be sent to plant the flag on Mars." Related stocks surged in the New York stock market, and movements to find beneficiary stocks are continuing in the domestic stock market as well. Domestic stock market experts advised that the space industry, which has great future growth potential and is supported by policy backing, will provide attractive investment opportunities for both domestic and international investors in the long term.

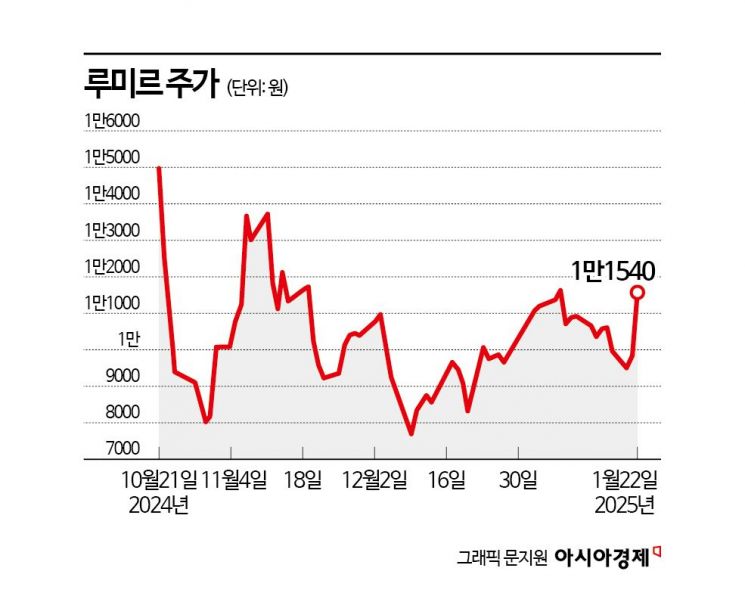

According to the financial investment industry on the 23rd, Lumir surged 16% the previous day. Kenko Aerospace, HVM, Contec, Hanwha, LK Samyang, and Satrec-I also rose sharply.

According to the "2025 Major Business Promotion Plan" announced by the Space Agency on the 21st, private-led space development will be accelerated. Space Agency Chief Yoon Young-bin said, "This year will be a fiercely competitive year among countries to secure leadership in aerospace," and "We will concentrate national capabilities and embark on a full-fledged flight toward becoming one of the top five aerospace powers."

Following President Trump's declaration of Mars colonization, government policies to foster the aerospace industry in various countries are expected to gain momentum. There is speculation that the Trump administration's second term is likely to abolish the 'White House National Space Council.' This is interpreted as an intention to promote the growth of the private space economy by abolishing the organization responsible for government oversight of corporate activities in space.

According to investment bank Morgan Stanley, the global space industry is expected to grow from $385 billion in 2020 to $590 billion in 2030 and $1.1 trillion in 2040. As the space development competition between the U.S. and China intensifies, the pace of industry growth is expected to accelerate. Lee Sang-heon, a researcher at iM Securities, predicted, "In the Trump 2.0 era, a stronger Space Force, the formation of an international environment favorable to American values, lunar and Mars exploration, and the rapid growth of the private space economy will be fully underway."

In the New York stock market, the stock price of aerospace company Intuitive Machines soared nearly ninefold from $2.56 at the end of 2023 to $22.94 on the 21st (local time). During the same period, Rocket Lab's stock price rose from $5.53 to $31.27. This was the result of a sharp rise in stock prices immediately after the news of President Trump's election.

Lee Jun-seok, a researcher at Hanyang Securities, said, "The DXYZ ETF, which has a SpaceX weighting of about 34.6%, rose from $11.59 after President Trump's election to a peak of $77.35," and analyzed, "With President Trump's inauguration, the global space industry has entered a full-fledged growth trajectory."

He added, "President Trump's policy support and the global increase in satellite demand act as major catalysts supporting the growth of domestic space-related companies," emphasizing, "Domestic space companies are strengthening their global competitiveness and establishing themselves as key players in the space industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.