Record-high Investment of 180 Billion KRW in the Global Fund

Unprecedented Contribution to the Local Era Venture Fund

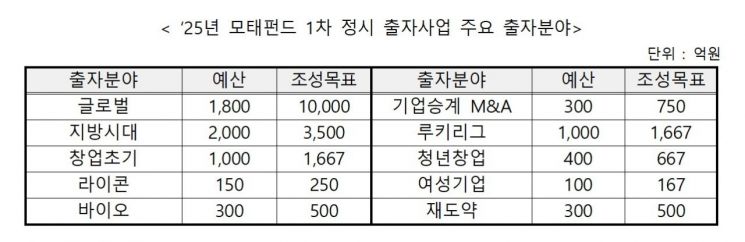

The Ministry of SMEs and Startups will invest 1 trillion KRW from the Korea Fund of Funds to create a total venture fund worth 1.9 trillion KRW. On the 22nd, the Ministry announced the '2025 Korea Fund of Funds 1st Regular Investment,' which includes this plan. This announcement represents the full 1 trillion KRW budget allocation for the Korea Fund of Funds this year, reflecting the government's intention to provide early seed moneyto support the recovery of venture investments and encourage active investment.

Record-high Investment in Global and Non-Capital Region Funds

First, the Ministry plans to invest a record-high 180 billion KRW in the 'Global Fund,' which supports domestic startups in attracting overseas investments, aiming to create a fund exceeding 1 trillion KRW. Starting this year, domestic venture capital (VC) firms are allowed to participate independently in the Global Fund investment project, enabling them to expand their global investment networks based on their experience managing the Global Fund.

The Ministry will also invest a record-high 200 billion KRW in the 'Local Era Venture Fund,' which focuses on venture and startup investments outside the capital region. The Korea Fund of Funds, local governments, regional banks, and regional anchor companies plan to jointly raise over 1 trillion KRW over three years from this year through 2027, with the 2025 fund-raising regions to be selected next month. The Korea Fund of Funds will provide incentives such as priority loss coverage and excess profit transfer to encourage private investors to take bolder steps in local venture investments.

Considering the recent contraction in early-stage investments, the Ministry will increase its investment in the startup early-stage sector by 25% from last year's 80 billion KRW to 100 billion KRW. The 'Lycon Fund,' established last year to nurture entrepreneur-type small business owners, will continue to be raised at a scale of 25 billion KRW. Starting this year, it will be raised as a fund investing nationwide in entrepreneur-type small business owners.

Investment policies in the bio sector will also be strengthened. The Ministry will invest 30 billion KRW in a bio fund to nurture early-stage pharmaceutical and bio venture companies before clinical trials, creating a new fund exceeding 50 billion KRW. Additionally, an M&A fund supporting business succession for SMEs will be established for the first time with a scale of at least 75 billion KRW. This reflects the situation where CEOs aged 60 or older account for about 30% of manufacturing SMEs, and many SMEs without successors require third-party M&A to ensure sustainable management.

The Ministry will also stably invest 10% of the investment budget, 100 billion KRW, in the 'Rookie League,' which supports the market entry and settlement of new and small venture capital firms. Support for investment blind spots will continue through the establishment of funds for women (16.7 billion KRW), youth startups (66.7 billion KRW), and business re-acceleration (50 billion KRW).

Meanwhile, the 'Startup Korea Fund' and 'LP First Step Fund,' jointly raised by the Korea Fund of Funds with large corporations, financial institutions, pension funds, and mutual aid associations, will begin investor participation surveys from the 24th. A separate announcement for the selection of fund managers will be made once investor participation consultations are completed.

Friendly Reforms to the Korea Fund of Funds Investment Projects

The Ministry of SMEs and Startups plans to reform the Korea Fund of Funds investment projects in a market-friendly manner so that venture capital firms can faithfully perform their core role of venture investment even during times of increased economic uncertainty. To promote a virtuous cycle of 'investment → recovery → reinvestment,' the Ministry will support the activation of the secondary market by temporarily allowing up to 20% of investments to be made for the primary purpose of purchasing existing shares over two years until 2026.

Fund managers actively engaging in early-stage investments will be preferentially treated. Managers proposing early-stage investment obligations will receive additional points during the selection evaluation for preferential selection, and companies within five years of establishment, which find it difficult to generate sales, will be exempt from management fee reductions even if their financial statements deteriorate after investment.

To dramatically expand investment opportunities for ventures and startups outside the capital region, investments in local areas by general funds, not just local-dedicated funds, will be recognized as 120% primary purpose investments. Local funds will preferentially select fund managers headquartered in local areas with abundant local investment records to nurture locally specialized managers. Furthermore, to strengthen the Korea Fund of Funds' role as patient capital, the current investment period limit of four years will be abolished, and funds operating for more than ten years in certain sectors such as early-stage startups and bio will be preferentially selected.

Additionally, to promote bold investments by venture capital firms, the impairment loss guidelines, which determine management fee payments, have been revised in a market-friendly manner. If management improvement of the invested company is expected, management fee reductions can be deferred under auditor review, and if investment funds are recovered after management fees have been reduced due to capital erosion of the invested company, previously reduced management fees will be retroactively paid. The management fee payment system will also be diversified to allow selection according to fund operation strategies.

Minister Oh Young-joo of the Ministry of SMEs and Startups said, "At CES 2025, 127 domestic SMEs and venture companies received innovation awards, imprinting Korea's presence on the global stage," adding, "The Korea Fund of Funds will support the steady growth of the domestic venture investment market so that these innovative SMEs and venture companies can grow through sufficient venture investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)