On the 19th, financial authorities announced that they have clarified the regulatory framework and finalized the integrated short-selling guidelines to establish order in short selling. Through amendments to the enforcement rules, the financial authorities plan to complete the computerization of the short-selling system by the end of March in accordance with this framework.

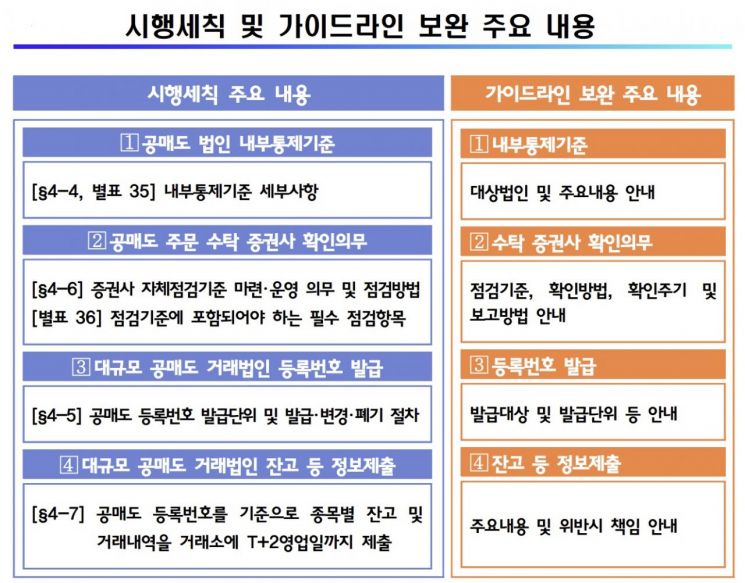

On the same day, the Financial Supervisory Service (FSS) and Korea Exchange (KRX) pre-announced amendments to the 'Enforcement Rules of the Financial Investment Business Act' and distributed the integrated short-selling guidelines. The main contents of the amended enforcement rules include ▲internal control standards for short-selling corporations ▲obligation for securities firms to verify short-selling orders ▲issuance of registration numbers for large-scale short-selling corporations ▲submission of information such as balances of large-scale short-selling corporations. Additionally, the guidelines were supplemented regarding internal control standards, verification obligations of securities firms, issuance of registration numbers, and submission of balance information.

The FSS decided to differentiate internal control standards for each corporation in proportion to the possibility of naked short selling. Large-scale short-selling corporations, which are institutions subject to short-selling reporting obligations or market makers (MM) and liquidity providers (LP) with short-selling balances of 0.01% of issued shares or KRW 1 billion or more, must establish an internal short-selling balance management system. Small-scale short-selling corporations that do not meet these criteria only need to prepare short-selling work rules.

The balance management system for large-scale short-selling corporations must include ▲real-time calculation of balances by stock ▲real-time blocking of orders exceeding balances ▲control devices for manual corrections.

To ensure thorough verification of naked short-selling prevention measures by securities firms entrusted with short-selling orders, inspection items and methods were specified. Inspection items include whether internal control standards are in place, clarity of task assignments, and whether requirements and operating conditions for internal balance management systems are met. The principle is that securities firms conduct direct inspections; however, indirect inspections are allowed if the need to maintain corporate management confidentiality of the short-selling corporation is recognized. Indirect inspection means the short-selling corporation conducts self-inspection, and the entrusted securities firm reviews its appropriateness. Securities firms must fulfill the verification obligation before accepting the first short-selling order and thereafter at least once a year periodically. Also, inspection results must be reported to the FSS within one month from the verification date.

An administrative procedure was also established to verify the substance of entities eligible for issuance of short-selling registration numbers. Eligible entities are large-scale short-selling corporations with balances of 0.01% or KRW 1 billion or more, or those performing MM or LP transactions, with issuance on a per-corporation basis as a principle.

To facilitate information linkage between large-scale short-selling corporations and the Korea Exchange's short-selling central inspection system (NSDS), each corporation is required to submit balances and transaction details for all stocks held to the exchange within two business days after each trading day.

The Korea Exchange Market Surveillance Committee was granted the authority to request data submission to verify the accuracy of information submitted to the NSDS.

The pre-announcement period for these enforcement rule amendments is until the 31st of this month, and after necessary administrative procedures, the amendments are planned to be completed by March. Ahead of the resumption of short selling, the FSS plans to strengthen communication with market participants to enhance understanding of regulations and reduce market uncertainty. First, an explanatory session will be held this month to improve understanding of the verification obligations regarding naked short-selling prevention measures by entrusted securities firms. Next month, an open forum with investors will be held on topics such as short-selling computerization and improvements to stock market infrastructure. In March, a ceremony for the launch of computer linkage between corporations and the exchange for the establishment of computer facilities to detect naked short selling, as well as an NSDS demonstration, will be held.

An FSS official stated, "Through clarification of regulations and enhancement of practical applicability, it is expected that the self-prevention function of the balance management system and the detection function of the NSDS will be strengthened," adding, "With detailed standards for NSDS operation established, the effectiveness of the system operation for detecting illegal short selling is expected to increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.