Activist fund Align Partners sent an open shareholder letter to Coway on the 16th, demanding capital structure optimization and enhancement of board independence. Align Partners holds a 2.843% stake in Coway.

On the same day, Align Partners stated, "Shareholder value has been significantly damaged since Netmarble's acquisition of Coway." They also requested a response to the open letter from Coway's board by the 3rd of next month.

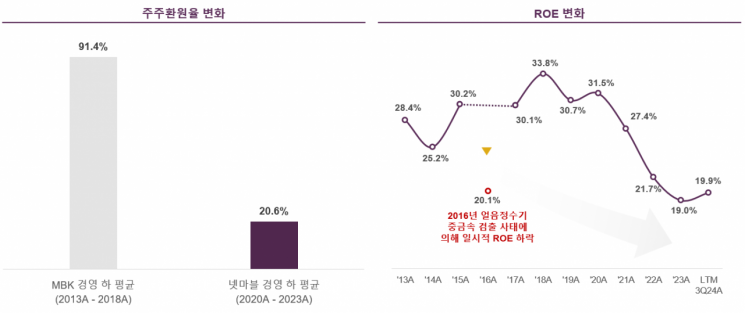

According to Align Partners, Coway's price-to-book ratio (PBR) has sharply declined from an average of 6.3 times during MBK Partners' management to the current 1.5 times. Return on equity (ROE) also dropped from 30.7% in 2019 to 19.9% in the third quarter of 2024.

Lee Chang-hwan, CEO of Align Partners, pointed out, "The core reason for Coway's undervaluation is the drastic reduction in shareholder returns immediately after Netmarble's acquisition of the stake," adding, "The shareholder return ratio shrank from an average of 91% during the MBK era to around 20% after Netmarble's acquisition."

In this shareholder letter, Align Partners demanded the introduction of a 'target capital structure policy' that maintains net debt to EBITDA at about twice the industry average. They also proposed ▲improving the shareholder return ratio ▲introducing cumulative voting ▲appointing outside directors recommended by shareholders.

Lee added, "Although Netmarble holds only a 25% stake, it effectively controls the board, marginalizing the opinions of general shareholders who hold over 70%. As a strategic investor, Netmarble has no plans to sell its shares and is not interested in stock price appreciation; rather, a lower stock price is advantageous for expanding its stake."

In response, a Coway official stated, "Coway is currently developing a value-up plan aimed at maximizing shareholder value through various approaches and will announce it soon."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)