Expansion of National Strategic Technology Tax Benefits

Overseas Equity TR ETFs to Face Operational Restrictions from July

Two-Year Resale Ban on Cars and Large Home Appliances Purchased with Employee Discounts

Landlords with Jeonse Deposits Over 1.2 Billion KRW Now Subject to Deemed Rental Income Tax

Overpayment Recovery Period for Earned Income Tax Credit Extended to 10 Years

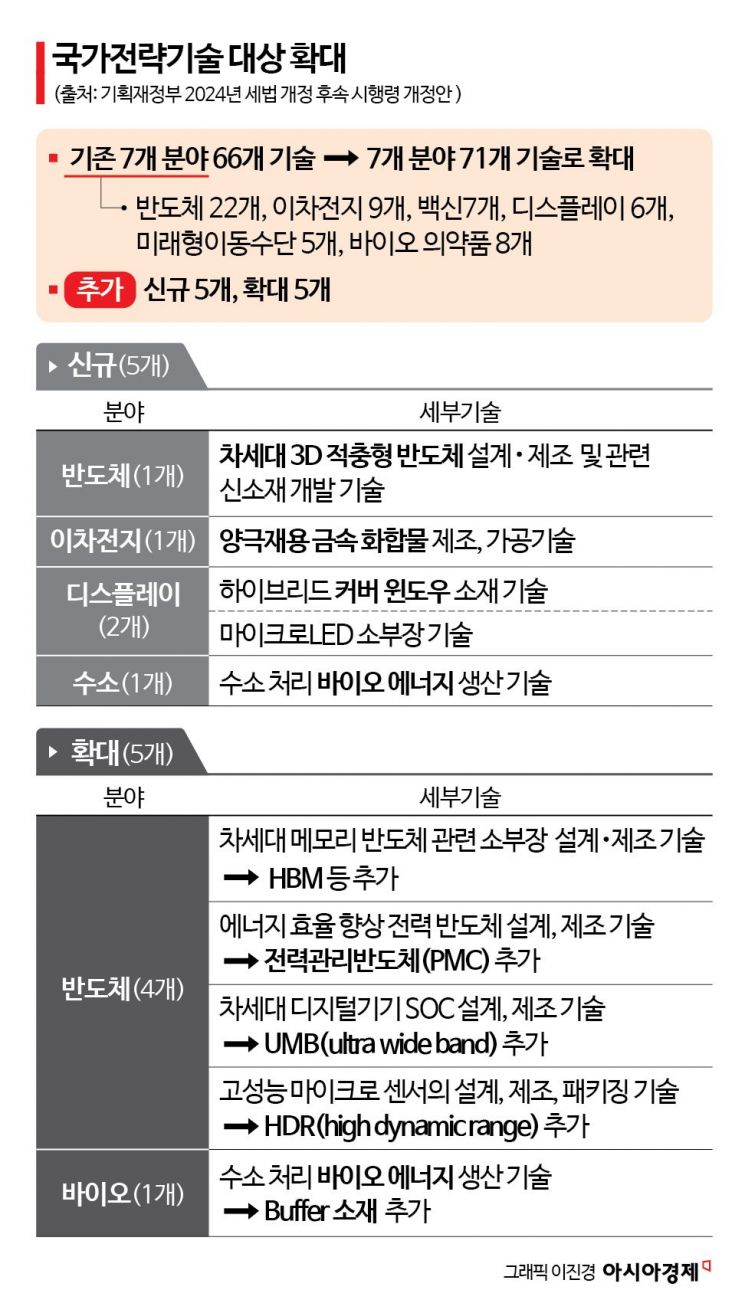

Starting this year, the scope of 'national strategic technologies' will expand from 66 to 71 items. When investing in detailed semiconductor materials, parts, and equipment technologies related to foundry high-bandwidth memory (HBM), more tax credits can be applied. From July, operating overseas equity Total Return (TR) Exchange-Traded Funds (ETFs) will become practically difficult. TR ETFs are products that reinvest dividends and interest generated from the included assets instead of distributing them to investors. Additionally, cars and large home appliances purchased with employee discount benefits will be prohibited from resale for two years.

On the 16th, the Ministry of Economy and Finance announced the '2024 Tax Law Amendment Follow-up Enforcement Decree Amendment.' The ministry expanded the existing national strategic technologies from 66 to 71 technologies across seven fields (semiconductors, secondary batteries, vaccines, displays, hydrogen, future mobility, and biopharmaceuticals). Newly added were next-generation 3D stacked semiconductor design and manufacturing and related new material development technologies, as well as microLED materials, parts, and equipment technologies. When designated as national strategic technologies, the R&D tax credit rate increases from 30-40% to 40-50% for small and medium enterprises. The facility investment tax credit rate also rises from 18% to 25%.

The Ministry of Economy and Finance added advanced technologies mainly in the semiconductor field. They explained that HBM-related technologies were added to the materials, parts, and equipment design and manufacturing technologies related to next-generation memory semiconductors. Jeong Jeong-hoon, head of the Tax Policy Bureau at the Ministry of Economy and Finance, said, "Basic HBM manufacturing technology was included last year, but we added foundry-related materials, parts, and equipment HBM technology."

To respond to the climate crisis, three new growth and fundamental technologies were newly established to expand tax benefits. The ministry newly established technologies such as ammonia fuel-based hydrogen production systems and fuel cell application technologies for ships, ammonia clean hydrogen production technology for hydrogen gas turbine combined power generation, and green hydrogen production marine platform design technology. New growth and fundamental technologies receive higher tax credit rates compared to general R&D (30-40% for SMEs, 20-30% for medium and large enterprises).

From July 1, only domestic equity TR ETFs can defer interest and dividends

From July 1, operating overseas equity TR ETFs will become difficult. Even if it is a TR ETF, investors must distribute all interest and dividends annually, and taxes must be imposed accordingly. TR ETFs are products that reinvest dividends and interest generated from the included assets instead of distributing them to investors.

General ETFs operate in a PR (Price Return) manner, distributing dividends from invested stocks or interest income from bonds as distributions. In contrast, the key feature of TR ETFs is that they do not pay distributions but automatically reinvest. Accordingly, dividend income tax on distributions can be deferred until the redemption point.

From July 1, operating overseas equity TR ETFs will become difficult. Since interest income tax and dividend income tax on distributions can no longer be deferred, overseas equity TR ETFs will practically become unmanageable. However, for domestic equity ETFs, investors can choose to defer interest and dividends, allowing TR-type ETF operation. Jeong said, "Overseas index-tracking ETFs have been continuously reinvesting without distributions or dividends under the guise of stock replacement, but from now on, they must distribute annually. To foster the domestic market, domestic equity ETFs are allowed to do this and will be taxed upon redemption later."

Resale of cars and large home appliances purchased with employee discounts prohibited for 2 years

Going forward, cars, large home appliances, and other items purchased with employee discount benefits cannot be resold for two years. The Ministry of Economy and Finance revised the Income Tax Act last year to set non-taxable criteria for employee discount benefits. The main point was to apply non-taxation up to the larger amount between 20% of the 'market price' or 2.4 million KRW annually. However, the specific standard for the market price was to be defined through enforcement decrees.

Through this enforcement decree amendment, the ministry specified the scope of the 'market price' standard. Basically, the market price will be judged based on the transaction price with the general public, not the transaction price with employees. Accordingly, if a company sells to the general public with a 20% discount but offers employees a 40% discount, employees will be considered to have received a 20% discount based on the market price.

The resale prohibition period for products purchased with employee discounts was also set. Durable goods such as cars, large home appliances, and high-priced goods cannot be resold for two years, and other goods cannot be resold for one year. Jo Man-hee, policy officer for income and corporate tax at the Ministry of Economy and Finance, explained, "If employees resell discounted products for profit instead of self-consumption or gifts, they will, in principle, be taxed."

Landlords with jeonse deposits over 1.2 billion KRW must also pay tax

From now on, landlords with two houses who receive jeonse deposits exceeding 1.2 billion KRW will also be subject to deemed rental income tax. Deemed rental income is calculated by considering the amount exceeding 300 million KRW in total deposits for the target houses, the rental period, and the fixed deposit interest rate (3.5%).

The Ministry of Economy and Finance decided to tax deemed rental income equivalent to the interest rate (3.5% fixed deposit interest rate) when the jeonse deposit exceeds 1.2 billion KRW. Until now, deemed rental income was not taxed on jeonse deposits for two-house owners regardless of the standard market price of the house.

However, through the 2023 tax law amendment, from 2026, two-house owners with high-priced houses exceeding 1.2 billion KRW in standard market price will be taxed on deemed rental income from jeonse deposits. Jeong explained, "We borrowed the 1.2 billion KRW standard for high-priced houses used in comprehensive real estate tax and capital gains tax."

Overpayment recovery period for earned income tax credit extended from 5 to 10 years

The recovery period for overpaid earned income tax credits will also be extended. Under the current system, when the earned income tax credit is overpaid, it has been deducted from the earned income tax credit for five years and then notified for income tax payment. However, going forward, the deduction period will be extended to 10 years when recovery amounts occur. Jeong explained, "Earned income tax credits are paid in the second half of the year based on income in the first half. Therefore, if income increases in the second half, overpayment occurs during the final settlement process, requiring recovery." He added, "We have operated this recovery system for five years, but considering the difficulties of people's livelihoods, we judged the period to be somewhat short and extended it to 10 years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)