Encouraging Firm Establishment of the New System in the Financial Sector

Continuous Monitoring of Implementation Planned

Over 106,600 Claims See Reduced Overdue Interest Burden Since Law's Enforcement

The government has extended the grace period for the Personal Debtor Protection Act by three months to ease the debt repayment and collection burdens on individual debtors who find it difficult to repay loans and to support their recovery. During the extended grace period until April 16, the government plans to continuously monitor the implementation status to ensure that the new system takes firmer root in the financial sector.

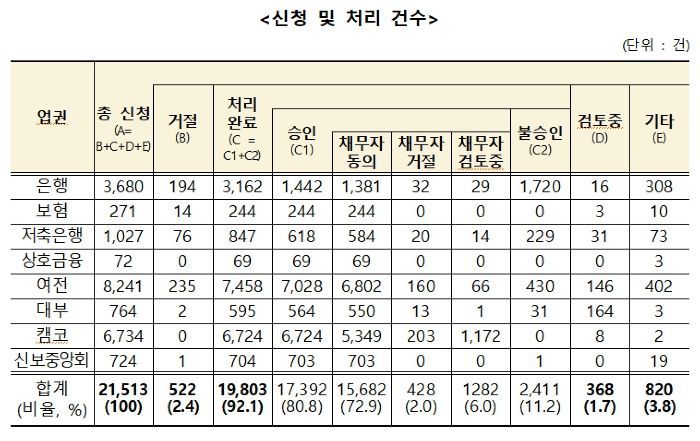

Since the law came into effect on October 17 last year, financial companies have processed about 21,500 applications for debt adjustment from individual debtors over two and a half months, alleviating the overdue interest burden on approximately 106,600 claims.

On the 15th, the Financial Services Commission held a regular meeting and decided to grant an additional grace period until April 16 to firmly establish the new system related to the Personal Debtor Protection Act. Although financial companies have prepared for the enforcement of the Personal Debtor Protection Act, there have been continuous opinions that the initial three-month grace period was insufficient, and that the grace period should be extended to allow active operation of debt adjustments without fear of sanctions.

The Financial Services Commission also considered opinions that, for debt adjustments, financial companies need to actively carry out debt restructuring to ensure substantial operation, and thus should be able to do so without fear of sanctions during the early stages of enforcement. Additionally, regarding collection-related regulations that directly affect debtors, the operation of the 'Personal Delinquent Debt Purchase Fund' has been extended by six months as a supplementary measure to mitigate excessive collection.

However, even during the grace period, sanctions can be imposed in cases where ▲ there is intentional or gross negligence in violations ▲ significant financial losses occur to individual financial debtors or market order is severely disrupted ▲ corrective actions are not taken despite supervisory agency demands.

The Personal Debtor Protection Act newly introduced rights such as the debtor’s right to request debt adjustment, reduction of overdue interest burden, and a limit of seven collection attempts within seven days. By the end of last year, 19,803 cases had been processed since the law’s enforcement. By type, principal and interest reduction accounted for 32.1%, extension of repayment period 27.1%, installment repayment 20.1%, refinancing loans 10.9%, and interest rate adjustment 9.1%. Since overdue interest can only be charged on delinquent debts, financial companies have alleviated the overdue interest burden on 106,646 claims related to debtors.

In cases where the debtor’s actual residence is a house valued at 600 million KRW or less, there were 262 cases where financial companies applied for auction six months after the reason for the auction application arose. Such houses can only be auctioned six months after the occurrence of the auction application reason to protect the debtor’s right to housing.

A Financial Services Commission official explained, "We will continue to operate a permanent monitoring team for the enforcement status of the Personal Debtor Protection Act and support the law’s establishment by promptly resolving difficulties in the field."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)