Collaboration SaaS Now Usable on Financial Institutions' Internal Networks

NHN Dooray announced on the 15th that Dooray! has been designated as the first domestic collaboration tool to receive the Financial Services Commission's 'Innovative Financial Service' certification. With this designation, four institutions?Woori Financial Group, Woori Investment & Securities, Shinhan Investment Corp., and IBK Industrial Bank?will start using the collaboration Software as a Service (SaaS) Dooray internally as early as this month.

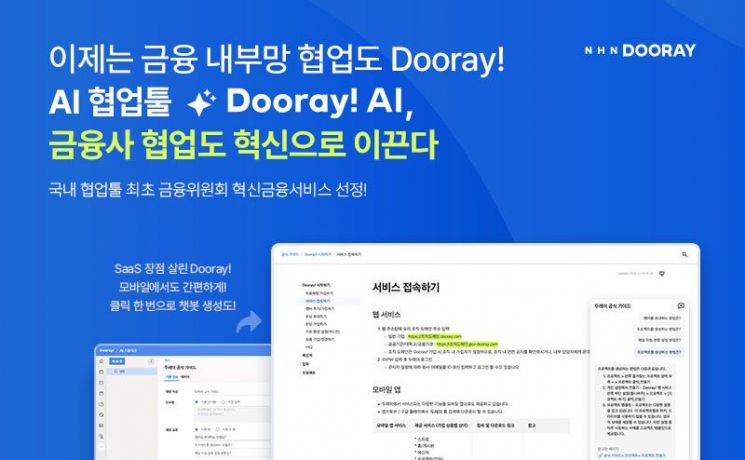

NHN DooRae has been designated as the first domestic collaboration tool by the Financial Services Commission as an 'Innovative Financial Service.' Provided by NHN

NHN DooRae has been designated as the first domestic collaboration tool by the Financial Services Commission as an 'Innovative Financial Service.' Provided by NHN

Dooray was listed under the 'Use of SaaS on internal work terminals' category among the new innovative financial services announced by the Financial Services Commission on December 24 last year. Providing a collaboration tool as SaaS on financial institutions' internal networks is the first of its kind in Korea. Dooray offers these four financial companies integrated functions including collaboration (project management), email, messenger, video conferencing, and knowledge management, along with Dooray's artificial intelligence (AI) features.

Dooray, introduced on financial institutions' internal networks, is expected to enhance overall corporate work efficiency through innovation in collaboration management tasks. It can reduce infrastructure and operational costs by integrating previously separate email systems used due to network separation regulations into one. Various collaboration functions can also be used in mobile environments.

Until now, financial institutions had to follow a network separation policy that completely isolated internal work systems connected to internal communication networks from internet networks connected externally. Due to these network separation regulations, collaboration services requiring online updates such as SaaS were limited in use, making it difficult to apply the latest technologies. Along with criticisms that productivity was not high compared to other sectors, the Financial Services Commission has supported financial companies to experience new services within the financial regulatory sandbox system.

NHN Dooray has been striving to establish collaboration SaaS within financial institutions' internal networks. In the first quarter of 2023, it became the first domestic SaaS company to receive a stability evaluation from a financial cloud service provider (CSP) and conducted preliminary tests for the introduction of generative AI. It has explored ways to leverage SaaS advantages by adding features such as mobile device authentication in the financial sector. Baek Chang-yeol, CEO of NHN Dooray, said, "With this designation as an innovative financial service, we will accelerate the expansion of our client base so that Dooray can contribute to fostering a digital-based work culture in financial institutions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)