Export and Import Price Index and Trade Index for December

Export and Import Prices Rise for Three Consecutive Months Due to Exchange Rate Increase

Export and Import Prices Based on Contract Currency Fall When Excluding Exchange Rate Effects

Following the emergency martial law situation, the won-dollar exchange rate surged significantly, causing import prices to rise for the third consecutive month. Going forward, the continued high exchange rate and rising international oil prices are expected to push import prices higher and exert upward pressure on consumer prices with a time lag.

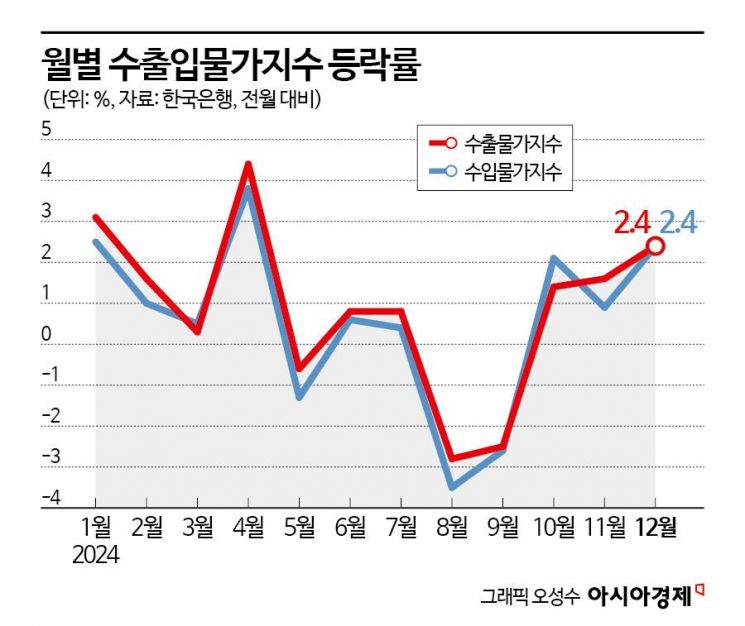

According to the "December 2024 Export and Import Price Index and Trade Index (Provisional)" released by the Bank of Korea on the 15th, last month’s import prices (based on the Korean won) rose 2.4% from the previous month and 7% year-on-year. Import prices have been on the rise for three consecutive months following increases of 2.1% in October and 0.9% in November.

The rise in import prices was due to significant increases in international oil prices and the won-dollar exchange rate. The monthly average price of Dubai crude oil rose 0.9% from $72.61 per barrel in November to $73.23 in December. The average won-dollar exchange rate increased 2.9% month-on-month from 1,393.38 won in November to 1,434.42 won in December, marking a 10% rise compared to the same month last year. By detailed item, raw materials including crude oil rose 3.0% month-on-month, mainly in mining products; intermediate goods such as chemical products and primary metal products increased 2.2%; capital goods and consumer goods each rose 2.1% month-on-month.

Lee Moon-hee, head of the Price Statistics Team at the Bank of Korea’s Economic Statistics Bureau, said, "The average exchange rate has risen compared to the previous month since January, and international oil prices are also increasing. These factors are expected to continue driving export and import price increases in January."

He added, "The rise in the won-dollar exchange rate can act as a factor pushing up import prices and, with a time lag, exert upward pressure on consumer prices. However, the timing of this pass-through to consumer prices may vary depending on corporate management conditions and pricing policies."

Export prices in December also rose 2.4% month-on-month due to the exchange rate increase. Export prices have been rising for three consecutive months, with increases of 1.4% in October and 1.6% in November. By item, agricultural, forestry, and fishery products rose 2.7% month-on-month, while manufactured goods, centered on chemical products and coal and petroleum products, increased 2.4%.

Excluding the exchange rate effect, export and import prices based on contract currency all declined. December export prices based on contract currency fell 0.3% month-on-month but rose 1.4% year-on-year. Import prices declined 0.2% month-on-month and 1.6% year-on-year.

Lee explained, "In October, international oil prices rose and the won-dollar exchange rate increased, causing import prices in won terms to rise by a similar level (2.1%) as in December. However, in December, the increase in oil prices was not significant, and unlike in October, some items declined in contract currency terms due to supply and demand conditions for natural gas and semiconductors."

The December export volume index, which shows export fluctuations, rose 6.5% year-on-year due to increases in computers, electronics and optical equipment, and primary metal products. The export value index rose 7.8% year-on-year. For the full year 2024, both the export volume index and value index increased 5.6% and 7.5%, respectively, compared to the previous year.

The December import volume index rose 5.5% year-on-year due to increases in computers, electronics and optical equipment, machinery, and equipment, while the import value index rose 1.9% year-on-year. For the full year 2024, the import volume and value indices declined 0.5% and 2.2%, respectively, compared to the previous year.

The net barter terms of trade index rose 4.8% year-on-year as import prices fell 3.5% but export prices rose 1.2%. The net barter terms of trade index measures the quantity of goods that can be imported per unit of export revenue.

The income terms of trade index rose 11.6% year-on-year, driven by increases in both the export volume index (6.5%) and the net barter terms of trade index (4.8%). The income terms of trade index measures the quantity of goods that can be imported with total export revenue.

For the full year 2024, both the net barter terms of trade index and the income terms of trade index rose 3.5% and 9.3%, respectively, compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.