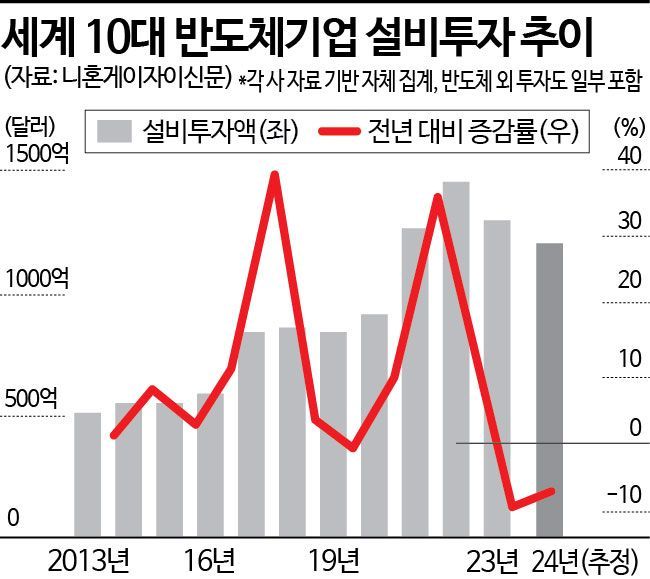

Last year, the capital expenditure of the world's top 10 semiconductor companies, including Samsung Electronics and Intel, decreased by 2% compared to the previous year. While some companies that have secured AI semiconductor demand continue aggressive investments, demand for other semiconductors such as those for electric vehicles remains stagnant. In particular, with the slowdown in new investments in China, some predict that semiconductor capital expenditure will continue to decline this year as well.

On the 14th, Nihon Keizai Shimbun (Nikkei) compiled the capital expenditures of 10 major semiconductor companies from the US, Europe, China, South Korea, Taiwan, and Japan, and found that the capital expenditure for the 2024 fiscal year was $123.3 billion (approximately 180.88 trillion KRW), down 2% from the previous year. This marks a decline for the second consecutive year following the previous year. Initially, in May last year, the plan was for capital expenditure to increase by 6% annually to $132.8 billion, but it was later revised downward by about $9.5 billion.

Looking at demand, there is a pronounced concentration on AI semiconductors, while other sectors including electric vehicles remain stagnant. Nikkei reported that unlike 2023, when semiconductor demand for devices such as smartphones and PCs sharply declined due to the pandemic and China's economic slowdown, companies had planned aggressive investments in 2024 expecting market recovery, but the situation changed.

Intel, a leading US semiconductor company, cut its annual capital expenditure plan by more than 20% from the initially planned amount exceeding $30 billion. Falling behind in the AI semiconductor competition, Intel has recently experienced its worst period since its founding due to rapidly increasing losses centered on foundry operations, which it re-entered in 2021.

Samsung Electronics also saw its annual investment scale decrease for the first time in five years. Last year's investment was estimated at around $35 billion, down 1% from the previous year. Nikkei noted, "This is $2 billion less than initially expected," adding, "Weak demand for PCs and smartphones had an impact. In the development of high-bandwidth memory (HBM) for AI, Samsung lost leadership to South Korea's SK Hynix."

In Europe and the US, demand for electric vehicles has slowed, leading to a reduction in related semiconductor investments. For example, Infineon Technologies, the world's largest automotive semiconductor company based in Germany, saw its capital expenditure for the 2024 fiscal year decrease by 8%. Additionally, with concerns about overproduction arising from aggressive semiconductor promotion policies in various countries, major companies had no choice but to reconsider their 2024 capital expenditure plans, Nikkei reported. According to the Semiconductor Equipment and Materials International (SEMI), the global semiconductor production facility utilization rate is around 70%, below the usual level.

Minamikawa Akira of the UK research firm Omnia stated, "The pace of new factory investments in China is slowing," and predicted, "Global semiconductor investments are likely to decrease in 2025 as well."

However, companies focusing on AI semiconductors continue bold investment moves. TSMC, the world's largest contract manufacturer, plans to invest more than $30 billion to expand AI semiconductor production capacity. SK Hynix has also set a large-scale investment plan totaling 103 trillion KRW, including 82 trillion KRW invested in AI business areas such as HBM.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.