No. 1 Player Halts Transactions with Chinese Daigou

Move to Strengthen Profitability... Competitors Weigh Pros and Cons

Dependence on Daigou Increased After COVID-19

Economic Downturn Makes Similar Decisions Difficult, Experts Say

Lotte Duty Free, the leading duty-free retailer in South Korea, is drawing attention as the duty-free market may be reshaped by its decision to completely halt transactions with 'Daigou' (Chinese personal shoppers), on whom it heavily depends for sales, and focus on strengthening profitability. Competitors, recognizing the strong influence of Daigou since the COVID-19 pandemic, are internally monitoring trends and carefully weighing the pros and cons of resetting their business relationships with Daigou.

Lotte Duty Free, the No. 1 domestic duty-free shop operator, has completely halted transactions with 'Daigong (Chinese peddlers),' on which it heavily depends for sales, and is focusing on strengthening profitability, drawing attention to whether the duty-free market will be reorganized. Yonhap News

Lotte Duty Free, the No. 1 domestic duty-free shop operator, has completely halted transactions with 'Daigong (Chinese peddlers),' on which it heavily depends for sales, and is focusing on strengthening profitability, drawing attention to whether the duty-free market will be reorganized. Yonhap News

According to industry sources on the 13th, Lotte Duty Free has reportedly stopped selling duty-free products mainly to major Chinese personal shoppers with large transaction volumes starting this year. This move is said to have been implemented by Kim Dong-ha, the CEO of Lotte Duty Free who took office at the end of last year, to recover accumulated losses. Earlier, in his New Year's address at the beginning of this year, CEO Kim stated, "If duty-free shops previously focused on volume-driven growth, now is the time to pursue management activities centered on profitability."

In the duty-free industry, Daigou has played the role of a major buyer. When the Chinese government banned group tourists from entering Korea due to conflicts surrounding the Terminal High Altitude Area Defense (THAAD) system in 2017, causing a sharp decline in tourists and a direct hit to the duty-free sector, Daigou opened new channels by distributing large quantities of domestic duty-free products to China and Southeast Asia. Even during the COVID-19 pandemic, when the tourism industry was on the brink of collapse, transactions through Daigou provided a lifeline. From the duty-free industry's perspective, Daigou served as a channel to reduce inventory burdens and continuously distribute products in large volumes.

However, there were also significant downsides. A representative example is that these personal shoppers, who held the upper hand in negotiations, demanded to distribute products about 40-50% cheaper than the regular price under the name of commissions or pressured to be supplied with popular products first. As a result, the duty-free industry was forced into a cutthroat competition where losses increased despite rising sales. Feeling the urgency, the industry reached an agreement to gradually reduce commissions for Chinese personal shoppers starting January 2023, lowering them to around 35% currently, but the commission rate still remains higher than the 20% profit margin threshold.

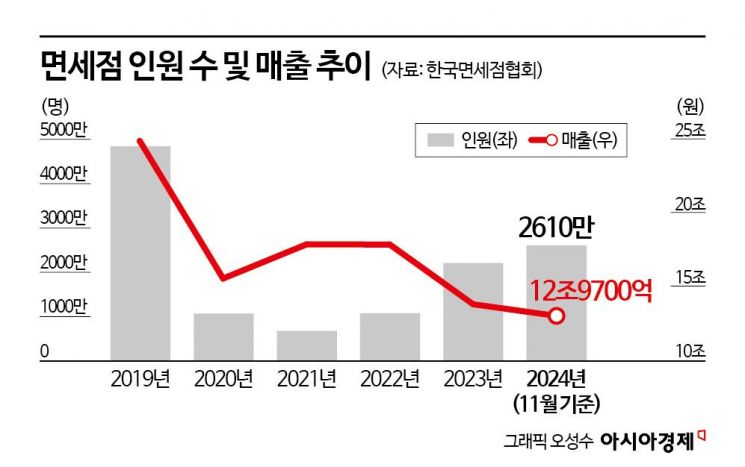

Meanwhile, the domestic duty-free market has been shrinking year by year. According to the Korea Duty Free Association, the duty-free market, which reached 24.86 trillion KRW before the COVID-19 outbreak in 2019, dropped to 15.51 trillion KRW the following year, slightly rebounded to 17.83 trillion KRW in 2021, but fell again to 12.97 trillion KRW as of November last year. The cumulative operating losses of the four major duty-free companies?Lotte, Shilla, Shinsegae, and Hyundai?amounted to 135.5 billion KRW from the first to third quarters of last year.

Therefore, since last year, the duty-free industry has been focusing all efforts on improving profitability by restructuring unprofitable business sites and workforce. Lotte Duty Free reduced its workforce by about 100 employees through voluntary retirement last year, and Shinsegae Duty Free will close its Busan branch at the end of this month.

An industry insider said, "After COVID-19, the duty-free industry, which faced blocked sales channels, reluctantly relied on Daigou to reduce inventory burdens and achieve some sales growth," but added, "Now, with the poor economic conditions in China and declining duty-free purchase rates, the effectiveness for the industry has diminished compared to before." The insider also noted, "Since Lotte Duty Free, the industry leader, has decided to stop transactions with Daigou, other competitors will also weigh the profits and losses that Lotte's choice will bring," and predicted, "It will not be easy for all duty-free companies to immediately follow Lotte's policy."

The duty-free industry is devising strategies such as strengthening marketing targeting individual tourists (FIT) to reduce dependence on Daigou, but even this is a concern because the purchasing power of the Chinese market, on which they heavily rely, is not what it used to be. An industry official said, "Although air routes connecting China have recovered to pre-COVID-19 levels and group tours between the two countries have normalized, the actual number of passengers is still below previous levels," adding, "Domestic travelers to China tend to be middle-aged and older, and their shopping preferences lean more toward visiting local stores rather than duty-free shops, which will make profitability improvement difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.