Jung Yong-jin to Acquire 10% of Emart Shares Held by Lee Myung-hee

Chairman Jung to Purchase Entire Stake for 214.1 Billion KRW

Acquisition Funded by Chairman Jung's Personal Assets

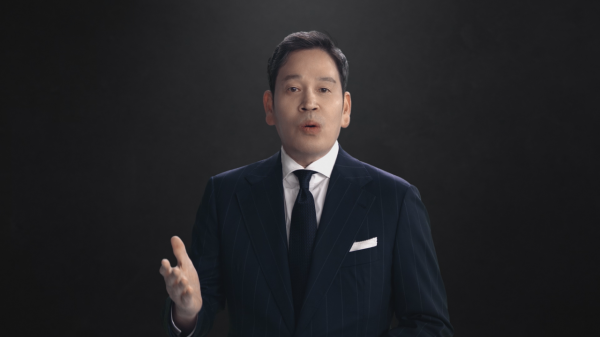

Jung Yong-jin, chairman of Shinsegae Group, will purchase all of the 10% stake in Emart held by his mother, Lee Myung-hee, the group’s executive chairwoman. This move follows quickly after Shinsegae Group announced its affiliate separation last October.

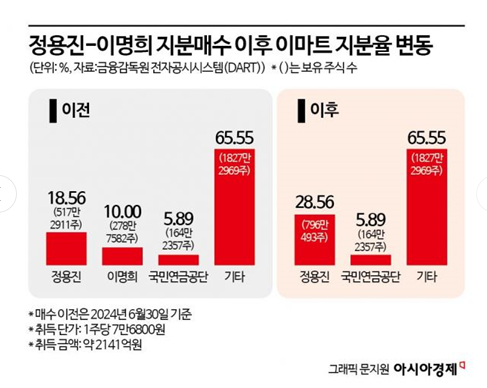

According to the Financial Supervisory Service’s electronic disclosure system on the 10th, Emart announced that Chairman Jung will acquire 2,787,582 shares of Emart stock held by Executive Chairwoman Lee through an over-the-counter transaction. The price per share is 76,800 KRW, totaling approximately 214.1 billion KRW. If Chairman Jung acquires all of Executive Chairwoman Lee’s shares, his total holdings will increase to 7,960,493 shares (28.56%).

Chairman Jung is using his personal assets to secure his mother’s stake. An Emart official stated, “This stock transaction plan is a measure for Chairman Jung, as Emart’s largest shareholder, to further strengthen responsible management based on performance principles. In the face of uncertain domestic and international environments, Chairman Jung’s decision to invest personal assets and take on the burden to purchase Emart shares demonstrates his sense of responsibility and confidence in enhancing Emart’s corporate value to the market.”

Earlier, Shinsegae Group officially declared its affiliate separation plan last October by promoting Jung Yoo-kyung, chairman of Shinsegae Department Store and younger sister of Chairman Jung, during the regular personnel reshuffle.

Since 2011, when Chairman Jung Yong-jin took charge of Emart and Jung Yoo-kyung took charge of the department store business, the siblings began managing the businesses separately and exchanged their shares in Shinsegae and Emart. Executive Chairwoman Lee laid the foundation for affiliate separation in 2020 by gifting Emart shares to Chairman Jung and Shinsegae shares to Jung Yoo-kyung.

Currently, Chairman Jung holds an 18.6% stake in Emart, and Jung Yoo-kyung holds an 18.6% stake in Shinsegae. Executive Chairwoman Lee has served as the link between the two companies by owning 10% stakes in both. With Executive Chairwoman Lee selling her Emart shares this time, the group’s affiliate separation is expected to accelerate.

Typically, affiliate separation in large conglomerates requires that “cross-shareholdings between listed companies be less than 3%” according to the Fair Trade Act’s conditions for family affiliate separation. This involves organizing shareholdings among major shareholders, applying for independent family management, and undergoing review by the Fair Trade Commission. Chairman Jung’s transaction of Executive Chairwoman Lee’s Emart shares is scheduled to take place from February 10 to March 11.

The remaining task is to organize the shareholdings of SSG.com, an affiliate jointly owned by Emart and Shinsegae. Emart holds 45.6% of SSG.com, while Shinsegae holds 24.4%.

However, Executive Chairwoman Lee is expected to retain her Shinsegae shares held by Jung Yoo-kyung. A Shinsegae official stated, “There is currently no decision regarding any plans to sell shares.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)