Lotte Holds First-Half VCM of the Year

Chairman Shin Orders Business Structure Reform and Global Expansion

Push for Restructuring Underperforming Affiliates and Financial Improvement

On the 9th, on the 31st floor of the Lotte World Tower office building in Songpa-gu, Seoul, attendees with stern expressions entered one by one. They were the presidents of Lotte Group affiliates attending this year's first VCM (Value Creation Meeting, formerly the CEO meeting) of Lotte Group, which was engulfed in liquidity crisis rumors last year. They firmly kept their mouths shut despite the reporters' continuous questions. The meeting, which lasted about four hours, was reported to have been conducted in a solemn atmosphere throughout.

Chairman Shin Dong-bin of Lotte views the current management situation of the group as an existential crisis. Attention is focused on whether the pace of structural reform across Lotte Group will accelerate as he orders a strong overhaul. In the new year, efforts are expected to focus on improving profitability through detailed initiatives such as business structure reorganization centered on strengthening core business competitiveness and pioneering global markets.

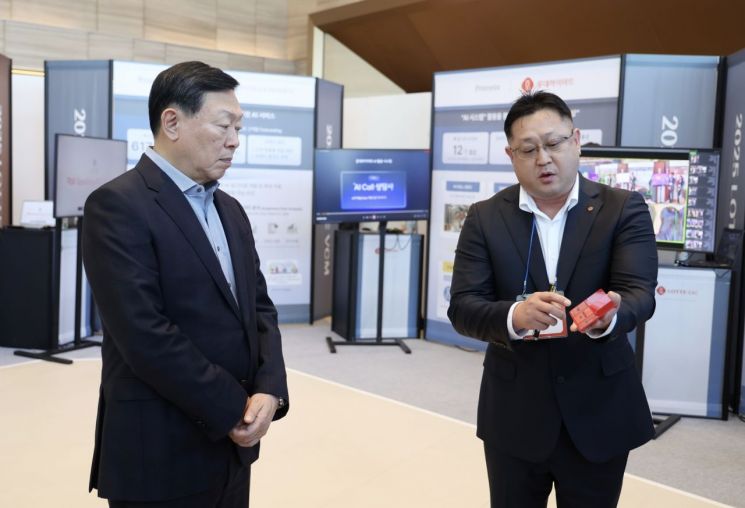

Shin Dong-bin, Chairman of Lotte (left), is listening to an explanation about Lotte Chemical's 'AI-based Color Prediction System' ahead of the 2025 first half VCM (Value Creation Meeting, formerly the Executive Meeting) held on the afternoon of the 9th at Lotte World Tower in Songpa-gu, Seoul. Photo by Lotte

Shin Dong-bin, Chairman of Lotte (left), is listening to an explanation about Lotte Chemical's 'AI-based Color Prediction System' ahead of the 2025 first half VCM (Value Creation Meeting, formerly the Executive Meeting) held on the afternoon of the 9th at Lotte World Tower in Songpa-gu, Seoul. Photo by Lotte

Shin Dong-bin: "Last year was the toughest year in the group's history"

According to industry sources on the 10th, Chairman Shin emphasized at the VCM, "Last year was the toughest year in the group's history," and stressed, "We must keep in mind that now is the last chance for change and turn this into an opportunity for a great innovation." Regarding the liquidity crisis surrounding Lotte Group at the end of last year, he referred to the IMF foreign exchange crisis and the COVID-19 pandemic, diagnosing the current situation as the most difficult challenge surpassing the obstacles Lotte has overcome so far.

The VCM is a biannual CEO meeting held by Lotte Group in the first and second halves of each year. About 80 people attended the day before, including the CEO and heads of departments of Lotte Holdings, general managers of business divisions, and presidents of affiliates. Shin Yoo-yeol, the eldest son of Chairman Shin and Vice President of Lotte Holdings' Future Growth Office, also returned immediately after attending CES 2025, the world's largest electronics and IT exhibition held in Las Vegas, USA, and appeared at the meeting that day.

Chairman Shin pointed out to the group CEOs that "now that crisis has become the norm, the fundamental cause of the difficulties we face is not the external environment but the decline in competitiveness of our core businesses." He urged, "If we do not reform and innovate now, we cannot survive," and called for redefining business models and attempting business adjustments from a new perspective, even for businesses with heritage that led the group's past growth.

Jung Junho, CEO of Lotte Department Store, is entering the 2025 first half VCM (Value Creation Meeting, formerly the Presidents' Meeting) held at Lotte World Tower in Songpa-gu, Seoul on the afternoon of the 9th. Photo by Lee Myunghwan

Jung Junho, CEO of Lotte Department Store, is entering the 2025 first half VCM (Value Creation Meeting, formerly the Presidents' Meeting) held at Lotte World Tower in Songpa-gu, Seoul on the afternoon of the 9th. Photo by Lee Myunghwan

As a concrete measure to overcome the crisis, Chairman Shin proposed 'selection and concentration' to efficiently utilize the group's assets. He also ordered overcoming the crisis through innovation in business structure and work methods, breaking away from inertia, and presented this year's management policies for fundamental reform as ▲ setting challenging goals ▲ business structure innovation ▲ global strategy establishment.

Asset Utilization 'Selection and Concentration'... Accelerating Overseas Expansion

Lotte Group already carried out a large-scale personnel overhaul through the year-end regular personnel reshuffle last year. The number of executives decreased by 13% compared to the end of last year, and CEOs of 18 out of 58 affiliates were replaced. In particular, in Lotte Chemical Group, which triggered liquidity crisis rumors due to poor performance, 30% of executives retired, achieving a generational change. About 80% of executives aged 60 and above stepped down from frontline management, laying the foundation for improving the group's structure through large-scale personnel changes.

Therefore, this year, Lotte is highly likely to reorganize its business structure by sorting out underperforming areas by affiliate. For example, Lotte Chemical, which is facing a crisis due to oversupply originating from China, proposed a plan to reduce the proportion of basic chemicals to below 30% by selling low-profit assets and increasing the share of advanced materials. Previously, Lotte Chemical's poor performance caused about 2 trillion KRW worth of corporate bonds to enter an event of default (EOD) status, triggering a liquidity crisis for the entire group. Because of this, Lotte Group announced it would provide the group's core asset, the 6 trillion KRW Lotte World Tower, as collateral to banks to strengthen the credit rating of corporate bonds.

Distribution affiliates are undertaking asset and store efficiency improvements. Lotte Shopping is conducting an asset revaluation for the first time in 15 years since 2009. Lotte Department Store has also started store efficiency work, including sales of and closures of lower-performing stores, with stores such as the Busan Centum City branch reportedly among those targeted for restructuring. The e-commerce platform Lotte ON, after conducting two rounds of voluntary retirement last year, moved its office to a shared office in Samseong-dong, Gangnam-gu, Seoul, to reduce costs.

Lotte Hotel is conducting high-intensity restructuring centered on its duty-free and hotel divisions. It is reported that they have proposed selling assets of hotel brands classified as 4-star hotels, such as 'L7' and 'City.' They are also considering restructuring to reduce hotel operating space within the World Tower to cut operating costs. Lotte Duty Free switched to an emergency management system last year, conducted voluntary retirement, and is reportedly reviewing plans to close underperforming overseas duty-free stores.

Additionally, Hotel Lotte plans to secure additional funds by selling a 56.2% stake in Lotte Rental, the top domestic car rental company, to a Hong Kong-based private equity fund (PEF) for 1.6 trillion KRW. They also decided to liquidate Lotte Healthcare due to low business viability and recently signed a contract to sell the site of the Lotte Mart Yeongtong branch in Suwon, Gyeonggi Province, which closed in September last year, for 87 billion KRW.

Furthermore, as Chairman Shin ordered the establishment of differentiated business strategies to overcome the limitations of the saturated domestic market due to domestic demand stagnation and demographic cliff, and to build competitiveness in the global market, overseas expansion is expected to be further expanded this year, focusing on the distribution and food business divisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.