Interest in Whether the IPO Market Will Rebound After Last Year's Slump

Key to Success Lies in LG CNS, a Leading AI, Cloud, and DX Company

Lotte Global Logistics, Former Doosan Machine Tools, and Other Major IPOs Expected to Launch

Leading the way with LG CNS, 'major' companies are set to go public (IPO) in the first half of this year. Market expectations for LG CNS, the first to go public, are quite high, drawing attention to whether the IPO market, which experienced a slump last year, will regain momentum.

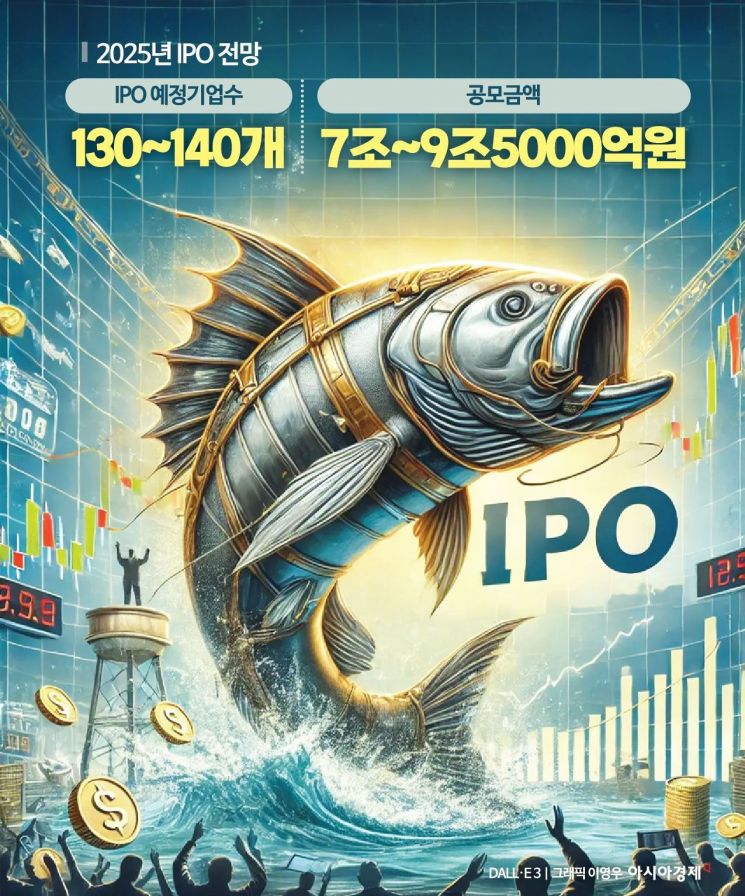

According to the financial investment industry on the 10th, the number of companies planning IPOs this year is estimated to be around 130 to 140. This maintains the recent five-year average (132 companies), and the amount raised through public offerings is expected to exceed last year's level (4.3 trillion KRW), reaching between 7 trillion and 9.5 trillion KRW.

Major IPO candidates in the first half include LG CNS, Lotte Global Logistics (formerly Hyundai Logistics), DN Solutions (formerly Doosan Machine Tools), and Seoul Guarantee Insurance.

The market particularly views the success of LG CNS's IPO as a key indicator that could influence the overall IPO market sentiment this year. An executive in charge of IPOs at a securities firm said, "If LG CNS does well, we expect a positive breeze in the market," adding, "Expectations for its success are quite high."

LG CNS, which submitted its securities registration statement on the 5th of last month, is conducting a demand forecast for institutional investors until the 15th. LG CNS is a leading domestic digital transformation (DX) specialist company, boasting outstanding capabilities in AI, cloud, smart factory, and traditional IT service sectors.

Through the IPO, it plans to offer a total of 19,377,190 shares, with a desired public offering price per share ranging from 53,700 to 61,900 KRW. The offering size is expected to be between 1.0405 trillion and 1.1994 trillion KRW, with a post-listing market capitalization potentially reaching up to approximately 6 trillion KRW.

Although the market contracted last year due to some companies, including K Bank, withdrawing their IPOs, the number of technology-special listing companies has been increasing recently, and major companies are also preparing IPOs in the first half, leading securities firms to cautiously anticipate a recovery in investor sentiment.

Recently, Lotte Global Logistics and DN Solutions passed the preliminary listing review. Lotte Group must successfully complete Lotte Global Logistics' IPO by April this year to avoid the put option of financial investors (FI). Unlike the optimistic market sentiment expecting LG CNS's IPO success, there are some concerns regarding Lotte Global Logistics. It is anticipated that setting a listing valuation that meets market expectations while satisfying FI's required rate of return will not be an easy process.

Considering the required rate of return, Lotte Global Logistics needs a listing valuation in the trillion KRW range. However, the average price-to-earnings ratio (PER) of peer listed logistics companies such as CJ Logistics, Hansol Logistics, and Taewoong Logistics is only about 6 times. Simply applying this to Lotte Global Logistics' controlling shareholder net profit of 46 billion KRW last year makes it difficult to justify even 300 billion KRW.

Lotte Global Logistics is the second-largest player in the domestic logistics market after CJ Logistics. However, there is a significant gap in market share in the parcel delivery sector compared to CJ Logistics. As of last year, the domestic parcel delivery market shares were CJ Logistics (33.6%), Coupang Logistics Service (24.1%), and Lotte Global Logistics and Hanjin Express each around 10%. After acquiring Hyundai Logistics in 2016, Lotte Group merged it with its affiliate Lotte Logistics to expand its scale. It operates in parcel delivery, production logistics, and global multimodal transport.

DN Solutions is also aiming to complete its listing in the first half. DN Solutions' parent company, DN Automotive, acquired 100% of DN Solutions' shares from MBK Partners in 2022. Considering DN Solutions' recent performance, a valuation in the 4 trillion KRW range is considered reasonable. Last year, DN Solutions reported consolidated sales of 2.1023 trillion KRW and operating profit of 436.2 billion KRW, representing increases of 10% and 97%, respectively, compared to 2021, just before DN Automotive's acquisition.

The biggest variable is the sentiment in the public offering market. Last year, the initial return rate compared to the public offering price was 65.2%, marking a decline from the previous year, indicating a sluggish market atmosphere. Additionally, various uncertainties such as the inauguration of the second Trump administration and domestic political instability are restraining investor sentiment. Na Seung-doo, a researcher at SK Securities, advised, "At the beginning of the year, newly listed companies centered on the KOSPI are likely to lead the IPO market sentiment," adding, "While investor attention is expected to focus on this, the proportion of distribution volume dominated by professional investors immediately after listing is a point to watch closely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.