KRX Semiconductor Index Up 24% in the Past Month

Memory Semiconductor Cycle Expected to Decline

Value Chain Benefits Anticipated from HBM Expansion

Attention is focused on whether the rebound of K-semiconductors will continue. The securities industry analyzed that, given the expected downturn in the memory market, investors should buy at the bottom when stock prices fall during this period. In particular, selective access to the high-bandwidth memory (HBM) value chain within the semiconductor sector is expected to be necessary.

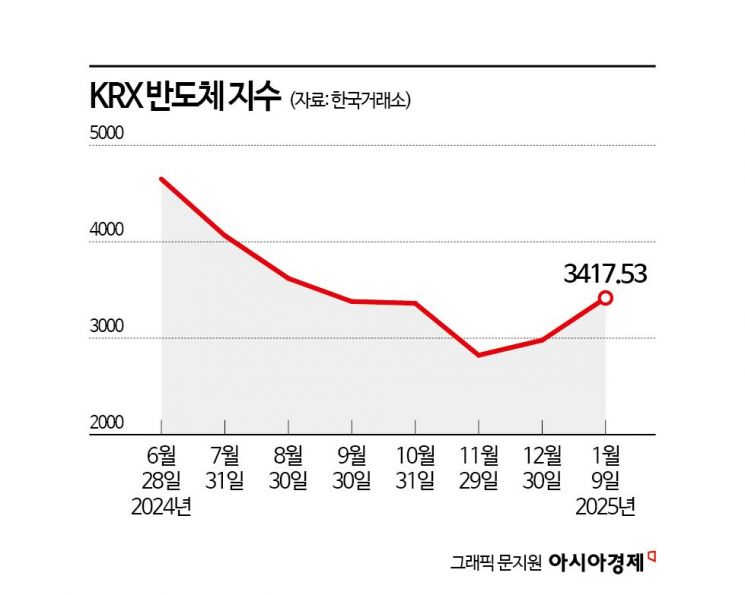

According to the Korea Exchange on the 10th, the KRX Semiconductor Index closed at 3,417.53 based on the previous trading day's closing price, rising 23.74% from last month's low. This index, which includes semiconductor companies ranging from memory to materials, parts, and equipment (SoBuJang), such as Samsung Electronics, SK Hynix, Hanmi Semiconductor, and Lino Industrial, had deepened its decline in the second half of last year but slightly rebounded this year as recognition of a stock price bottom spread.

The securities industry suggests that it is not yet the time to fully buy into the entire semiconductor sector. This is because the memory semiconductor cycle is expected to enter a downturn phase from the first quarter of this year, leading to a contraction in market size. Song Myung-seop, a researcher at iM Securities, said, "Until the fourth quarter of last year, the memory semiconductor upcycle continued as semiconductor companies reduced inventory while customers increased theirs. However, this year, due to customers reducing inventory, the shipment growth rate is expected to fall significantly below production and demand growth rates." He added, "Contrary to the inventory trends of the past two years, there will likely be a period when DRAM manufacturers' inventory increases while customers' inventory decreases. Moreover, since the first quarter is a seasonal off-season, shipments will decline compared to the previous quarter, and the average selling prices (ASP) of DRAM and NAND will fall."

Song further advised regarding major semiconductor stocks such as Samsung Electronics and SK Hynix, "If the semiconductor market downturn cycle has just begun, considering the possibility of downward revisions in future earnings expectations, I recommend a strategy of seeking buying opportunities at the bottom for the time being."

In particular, Samsung Electronics is expected to find it difficult to escape undervaluation until its competitiveness in artificial intelligence (AI) semiconductors and market recovery are confirmed. Kim Hyung-tae, a researcher at Shinhan Investment Corp., said, "If there are further downward revisions in profit estimates, the area near the previous low with clear downside rigidity will be a buying opportunity. The stock price will likely be influenced by improvements in technological competitiveness within the HBM market and the recovery of mobile demand. It is important to remember that the periods when Samsung Electronics showed a trend of rebound were after improvements in earnings were proven, not merely due to valuation attractiveness."

Meanwhile, expectations are rising that SK Hynix will increase its HBM production capacity (CAPA) this year, boosting profits across the related value chain. Ryu Hyung-geun, a researcher at Samsung Securities, said, "If SK Hynix expands CAPA by the end of this year, the effects will appear from the first half of next year. The expansion news is welcome from the value chain perspective. It will help restore the previously diluted HBM premium." He added, "This will positively impact the profit strength of Hanmi Semiconductor, PSK Holdings, and STI, which supply HBM-related equipment to SK Hynix, as well as the profit diversification of Solbrain and Dongjin Semichem, which supply chemical mechanical polishing (CMP) materials."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.