Steel Industry Halts Rebar Distribution Sales

Rebar Distribution Price at 600,000 KRW Range...Below Break-even Cost

Cost Pressure Rises Due to Electricity Rate Hikes and High Exchange Rates

Main Steelmakers' Operating Rates Fall Below 60%

Domestic steel manufacturers have taken drastic measures by halting the distribution and sale of rebar. Due to the economic downturn and a sharp drop in distribution prices, major companies have taken the extreme step of suspending supply to protect profitability. This is the first time since the 2008 financial crisis that producers have stopped distributing rebar.

According to the steel industry on the 10th, Hyundai Steel and Dongkuk Steel temporarily suspended rebar sales to distributors from mid-December last year. Both companies have significant market influence, accounting for about half of the domestic rebar supply.

An industry insider explained, "Currently, distribution prices are set excessively low (600,000 KRW), and this measure is to prevent distributors from stockpiling in advance." After this sales suspension, the distribution price of rebar slightly rose from around 600,000 KRW per ton to recently 705,000 KRW.

Rebar sales channels are mainly divided into direct transactions with construction companies and sales through distributors. Direct transactions reduce price volatility through contract formulas, while distributor sales are highly volatile depending on raw material prices and market demand. Especially during the off-season in winter, distributors buying large quantities of rebar at low prices and reselling them at higher prices during the peak season (March to April) further deteriorate the profitability of steelmakers. It is reported that transactions through distributors account for about 10% of total rebar sales.

Dongkuk Steel has introduced a minimum closing price for rebar sold to distributors starting this month to defend against price declines. They set a floor price of 700,000 KRW per ton and plan to increase it by 50,000 KRW monthly starting next month. The company stated that "the proposed price is below the total cost, including manufacturing costs and selling and administrative expenses, as well as below the marginal cost."

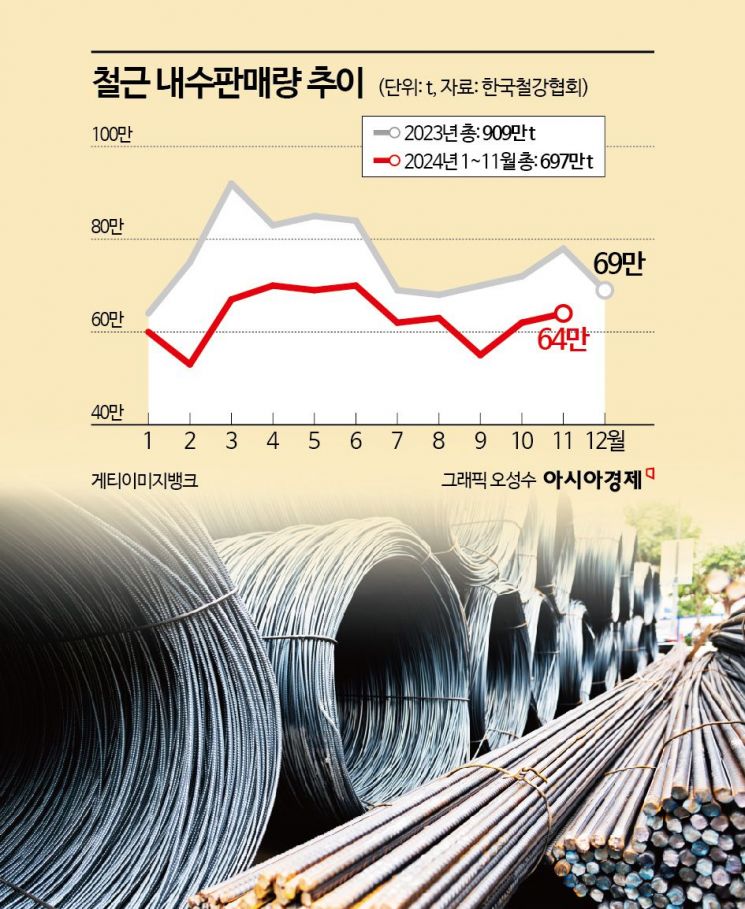

The industry is facing increased cost pressures due to the sharp drop in rebar prices during the off-season. Manufacturing costs have risen due to increased industrial electricity rates and exchange rate fluctuations. According to the Korea Iron & Steel Association, domestic rebar sales from January to November last year were 6.97 million tons, a 17% decrease compared to the same period a year earlier (8.4 million tons). Although December sales have not yet been tallied, the industry expects them to be below 600,000 tons. Considering the annual total production capacity of 13 million tons, steelmakers’ operating rates are below 60%.

Major steel manufacturers have started reducing production. Hyundai Steel attempted to close its Pohang Plant 2, which has a 1 million ton steel production line, in November last year, but the plan was ultimately scrapped after labor-management negotiations. They are now considering reducing operations from a four-shift system to a two-shift system. Dongkuk Steel, which began night shifts in April last year, has further cut production by reducing factory operating rates from 60% to 50% due to night shift operations.

Lee Gyu-ik, a researcher at SK Securities, said, "Rebar sales in December last year did not improve significantly compared to the previous quarter," adding, "Excluding the COVID-19 period, last year’s operating profit margin was the lowest ever." He further predicted, "This year, the recovery of operating profit margins will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.