Analysis of '2025 Apartment Market Outlook' by 10 Real Estate Experts

Interest Rate Cuts, Loan Regulations, and Political Uncertainty Cited as Key Variables

Concerns Over Polarization with Price Increases Limited to Seoul and Some Metropolitan Areas

Order of articles in '2025 Apartment Market Outlook'

① Sales Market (Seoul, Gyeonggi-do and Incheon, Provinces)

② Jeonse Market (Seoul, Gyeonggi-do and Incheon, Provinces)

▶③ Market Impact and Policy

"Apartment prices will fall in the first half due to the impeachment political situation, but if interest rates drop, it will become a factor for apartment price increases."

"Even if interest rates fall, if loan limits are reduced and the economy is bad, polarization could worsen like last year."

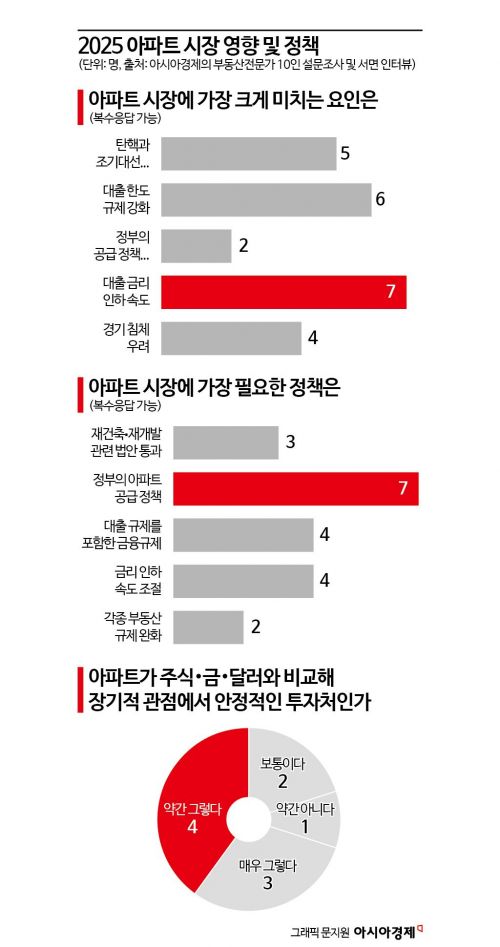

According to Asia Economy's '2025 Apartment Market Outlook' on the 8th, 7 out of 10 real estate experts cited the 'speed of loan interest rate cuts' as the biggest factor affecting this year's real estate market sentiment (multiple responses allowed). Strengthening loan limit regulations (6 experts), political uncertainty including impeachment (5 experts), and concerns about economic recession (4 experts) followed. This survey was conducted on the 27th of last month through questionnaires and written interviews.

With factors for both apartment price increases and decreases mixed, the market trend is expected to be determined by which influence is stronger. Ham Young-jin, head of the Real Estate Research Lab at Woori Bank, said, "If the Bank of Korea lowers the base interest rate, it is expected to be an upward factor for the housing market," but added, "However, it is intertwined with the economic ripple effects of the Trump administration's trade policies on the domestic market and the extent of the US base rate cuts."

Ham added, "If political instability continues and diplomatic responses are not well prepared, the economy will slow down, limiting housing purchase demand," calling this a downward factor for the market.

Yoon Soo-min, a real estate expert at NH Nonghyup, said, "This year is a mid-term period approaching the peak of supply shortage in 2026, so market anxiety will expand," adding, "Economic recession inevitably accompanies interest rate cuts, so the market situation is not good, but there is a possibility that apartment prices will rise only in some areas of Seoul."

Kim Kyu-jung, a real estate expert at Korea Investment & Securities, also predicted, "If the economic recession deepens, the entire housing construction industry will decline, but the preference for Seoul's 'smart one house' will be prominent as last year, and polarization of apartment prices may intensify following last year."

Kwon Young-sun, team leader of the Real Estate Investment Advisory Center at Shinhan Bank, said, "Currently, sales demand is temporarily suppressed, and how much jeonse prices rise and how much loan interest rates fall will be key to market changes."

'Supply Phobia' like last summer must be eliminated by the government

For policies needed to stabilize apartment prices this year (multiple responses allowed), real estate experts most frequently cited 'government apartment supply' (7 experts). In the same context, they also said that revitalizing maintenance projects, including passing laws related to reconstruction and redevelopment (3 experts), is necessary.

Professor Lee Chang-moo of Hanyang University's Department of Urban Engineering said, "To expand supply, an investment linkage must be created," adding, "It is important to establish a policy foundation so that redevelopment and reconstruction projects can proceed in areas lacking supply in downtown Seoul."

Kim Hyo-sun, a real estate expert at NH Nonghyup, said, "If 'supply phobia' affects the market like last summer, housing overheating in some areas will repeat and polarization will be exacerbated," adding, "Eliminating supply anxiety is the key." Ko Jong-wan, president of the Korea Asset Management Research Institute, said, "The government says it will increase supply, but even with the 3rd new town, four years have passed and progress is sluggish," adding, "This year should be the year to implement the plans announced so far."

Apartments remain a stable investment destination

When asked whether apartment sales prices are a stable investment destination compared to stocks, gold, and dollars from a long-term perspective, responses were in order of 'somewhat yes' (4 experts), 'very yes' (3 experts). A minority answered 'average' (2 experts) and 'somewhat no' (1 expert).

Kim Je-kyung, director of Toomi Real Estate Consulting, said, "If jeonse and monthly rent prices start to rise in the future, sales prices are likely to rise as well," adding, "Even if people make money with stocks or gold, they are likely to return to real estate eventually."

Yoon Ji-hae, research team leader at Real Estate R114, said, "Physical assets like apartments increase in price when inflation rises, so their value does not decline."

Park Won-gap, senior real estate expert at Kookmin Bank, who answered 'somewhat no,' said, "The causes are population decline and economic growth slowdown."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.