[South Korean Solar Power Gets a Boost] Accelerating Local Business in the US

"Trump Administration Makes Business Favorable"

"JV Establishment to Be Concluded Soon"

Likely to Build Production Infrastructure for Cells and Wafers in the US

OCI Holdings' establishment of a joint venture solar power company in the United States is reportedly imminent. If the joint venture is created around the launch of Donald Trump's second administration, vertical integration of ingots, wafers, and cells using polysilicon is expected to become possible.

On the 8th, OCI Holdings Chairman Lee Woo-hyun said in a phone interview with Asia Economy regarding the status of the joint venture, "We are in final discussions with two local companies in the U.S. and will reach a conclusion soon."

OCI Holdings currently operates its subsidiary Mission Solar Energy in Texas, which has an annual module production facility with a capacity of 500 MW. Separately, OCI Holdings plans to build production infrastructure through the establishment of a local joint venture, aiming to import polysilicon produced by OCI Holdings' Malaysia subsidiary to the U.S. and achieve vertical integration of solar power components such as ingots, wafers, and cells.

OCI Holdings is accelerating the establishment of the joint venture because it believes that local business conditions will improve after the Trump administration takes office. Chairman Lee said regarding the Trump administration's launch, "The policy clarity is good, making it easy to predict," and added, "Since he is a businessman, I see it as a better environment for companies to conduct business."

In particular, Chairman Lee views the Trump administration's anti-China stance as an opportunity for domestic solar companies. During the presidential campaign, Trump pledged to impose a high tariff of 60% on China. After his election, he appointed hawkish China experts to key cabinet positions, demonstrating a tough stance.

The U.S. has already strongly restrained Chinese solar products by imposing anti-dumping tariffs of up to 200%. In 2012, the U.S. imposed anti-dumping duties ranging from 18.32% to 249.96% and countervailing duties of 14.78% to 15.79% on Chinese solar cells and modules. In 2015, the scope of investigation was expanded to impose anti-dumping duties of up to 165% even on cells produced outside China but used in products imported into the U.S.

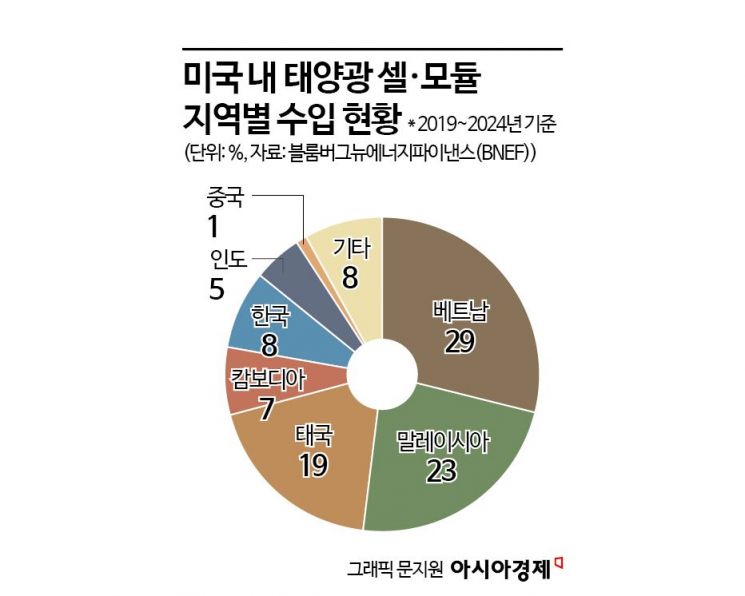

Chinese companies have been circumventing tariffs by exporting to the U.S. through Southeast Asia. According to Bloomberg New Energy Finance (BNEF), last year, 78% of cells and modules exported to the U.S. from four Southeast Asian countries were of Chinese origin, while only 1% were directly exported from China.

However, circumventing exports through Southeast Asia has become more difficult. The Biden administration ended tariff exemptions on imports routed through four Southeast Asian countries (Cambodia, Malaysia, Thailand, and Vietnam) in June last year and raised tariffs on Chinese solar products and polysilicon from 25% to 50% starting this month.

Because of this, expectations are rising that OCI Holdings' situation will improve this year. As tariff barriers on Chinese solar products strengthen, Korean companies are likely to gain a windfall benefit. Even if tariffs are imposed on polysilicon imported from Malaysia to the U.S., producing both cells and modules in the U.S. will maintain competitiveness.

Domestic companies are already making aggressive investments targeting the U.S. market. Especially since there is no production of wafers and cells in the U.S., Hanwha Q CELLS' ongoing U.S. Solar Hub project is expected to play an essential role in the U.S. solar supply chain. Hanwha Q CELLS operates a module production facility (8.4 GW capacity) in Georgia with a total investment of 3.2 trillion KRW and plans to expand ingot, wafer, and cell production capacities to 3.3 GW each by the second half of this year.

Solar installations in the U.S. are expected to continue even after the Trump administration takes office. The U.S. ranks second globally in solar installations after China. BNEF forecasted that 37 GW were newly installed last year, with 45 GW expected this year and 65 GW by 2030. Kang Jung-hwa, senior researcher at the Korea Eximbank Overseas Economic Research Institute, said, "Entering a global interest rate cut cycle will lower financing costs required for solar project construction, which will positively affect demand growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.