The North Face and New Balance Join the 1 Trillion Won Sales Club

Fashion Brands Face Consecutive Profit Declines Due to Consumer Slump and Abnormal Heat

Fashion Companies Struggle Despite Byun Woo-seok's Efforts

Outdoor brand The North Face and sports brand New Balance achieved sales of 1 trillion won last year, joining the '1 Trillion Club.' SPA (manufacturing and distribution integration) brand Uniqlo recorded sales in the 1 trillion won range, while TopTen is also on the verge of entering the 1 Trillion Club. Although the number of companies with sales in the 1 trillion won range has increased, the fashion industry, which is highly volatile depending on the economy, is experiencing intensified polarization, facing management difficulties due to poor performance and increased inventory.

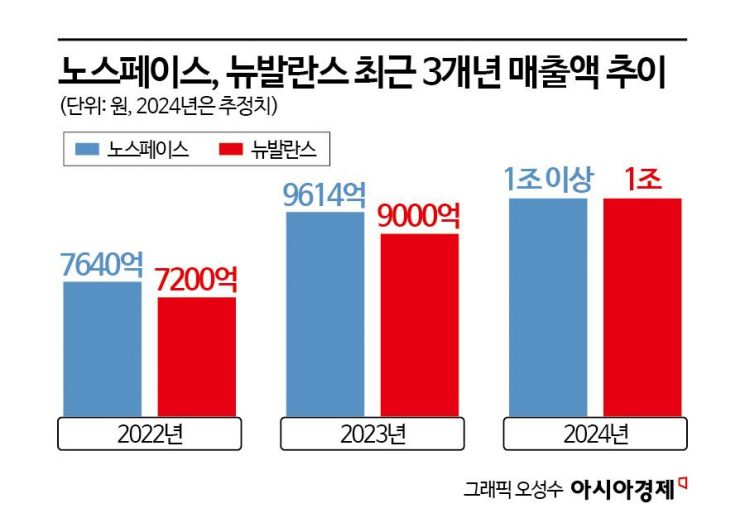

According to the fashion industry on the 8th, outdoor brand The North Face surpassed annual sales of 1 trillion won last year. Youngone Outdoor, which operates The North Face, recorded sales of 961.4 billion won in 2023, and consumer sales price-based sales reached 1 trillion won, joining the '1 Trillion Club' based on sales price. It is estimated that total sales exceeded 1 trillion won last year. Due to this achievement, Sung Ga-eun, Vice President of Youngone Outdoor in charge of The North Face business, was promoted to president on the 2nd. The new president Sung Ga-eun is the third daughter of Sung Ki-hak, chairman of Youngone Trading Group.

Youngone Outdoor used to operate the ski brand 'Goldwin' together, but now only operates The North Face. In October last year, Youngone Outdoor and Japan's Goldwin established Goldwin Korea, a corporation to develop Goldwin's distribution business, with 60% and 40% stakes respectively. Youngone Outdoor, which reduced its focus on Goldwin sales, also terminated its license agreement with Goldwin as of January 1 this year. It is estimated that all of Youngone Outdoor's sales last year came from The North Face.

The biggest contributor to The North Face's 1 trillion won sales is winter products. The peak season in the fashion industry is winter when product prices are high. Last year, fashion companies experienced poor winter clothing sales due to abnormal high temperatures. Normally, winter product sales start in earnest from September, but last year, warm weather around 20 degrees Celsius continued until November.

However, The North Face increased sales through department stores, agencies, home shopping, and e-commerce channels. This was thanks to the continued popularity of the down padding product 'Nuptse' from the previous year. According to the fashion resale platform Cream, The North Face was the top seller in the padding category in the second half of last year. Looking at the top-selling products in the past month, 6 out of 10 were The North Face products. Nike, Stussy, and Stone Island followed.

Sales of products from spring to summer seasons were also favorable. As of the third quarter last year, Youngone Outdoor's sales were 538.6 billion won, and net profit was 109.3 billion won. Compared to the cumulative sales (498.6 billion won) and net profit (93.6 billion won) for the third quarter of 2023, these figures represent growth of 8% and 16%, respectively. A fashion industry insider said, "In the case of The North Face, the steady winter seller 'Nuptse' performed well, avoiding a decline alone," adding, "With the continued trend of the 'Gorpcore' look, mountain jackets and bags like the 'Big Shot' also became popular products."

New Balance, operated by E-Land World’s fashion division, recorded annual sales of 1 trillion won for the first time last year. This is 40 times the sales of 25 billion won in its first year of business in 2008. New Balance’s success was attributed to launching apparel and shoes with colors and designs suited to domestic consumers. The growth of the 'Women's' line targeting female customers was key to entering the 1 Trillion Club. The 'Yuna Down' jacket from the Women's line, endorsed by ambassador Kim Yuna, sold 100,000 units since its launch in 2016. The increase in running shoe sales, driven by more people enjoying running, also contributed.

Following the strong dollar, the impeachment crisis, and the Jeju Air disaster, consumer sentiment is expected to weaken further, making the economy more difficult. On the last day of the year, the 31st, the streets of Myeongdong in Jung-gu, Seoul, appeared quiet and sparsely populated. Photo by Jo Yong-jun

Following the strong dollar, the impeachment crisis, and the Jeju Air disaster, consumer sentiment is expected to weaken further, making the economy more difficult. On the last day of the year, the 31st, the streets of Myeongdong in Jung-gu, Seoul, appeared quiet and sparsely populated. Photo by Jo Yong-jun

Other domestic single brands maintaining sales over 1 trillion won include Nike and Uniqlo. Nike recorded sales of 2 trillion won for the 2024 fiscal year. FAL Korea, which operates Uniqlo, recorded sales of 1.0601 trillion won for the 2024 fiscal year (September 1, 2023 ? August 31, 2024), rejoining the 1 Trillion Club. TopTen of Shinseong Tongsang is on the verge of surpassing 1 trillion won. TopTen recorded sales of 900 billion won in 2023 and is expected to record sales in the high 900 billion won range this time.

However, some companies saw significant declines in performance. F&F, which operates the outdoor brand 'Discovery,' is estimated to have recorded annual sales of 1.9238 trillion won and operating profit of 455.5 billion won last year, down 3% and 17% respectively from the previous year. Kolon Industries’ fashion division, which operates the outdoor brand 'Kolon Sport,' recorded sales of 1.215 trillion won, down 5%, and operating profit of 25.6 billion won, a sharp drop of about 44% during the same period. There was a lack of hit products to ignite consumer purchasing desire amid weakened consumer sentiment and abnormal high temperatures.

The industry expects consumer recovery to be difficult. According to the Industrial Activity Trend Retail Sales Statistics from Statistics Korea, clothing sales have been declining for 11 consecutive months from December last year (-0.7%) to October this year (-2.7%). Household trend survey results also show that spending on clothing and shoes accounts for 3.9% of total consumption expenditure, the lowest proportion since 2019.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.