4 Consecutive Years of Operating Surplus with Reserves at 30 Trillion Won, 'Record High'

Excluding 1.5 Trillion Won Advance Payment to Suryun Hospital, 3 Trillion Won Surplus

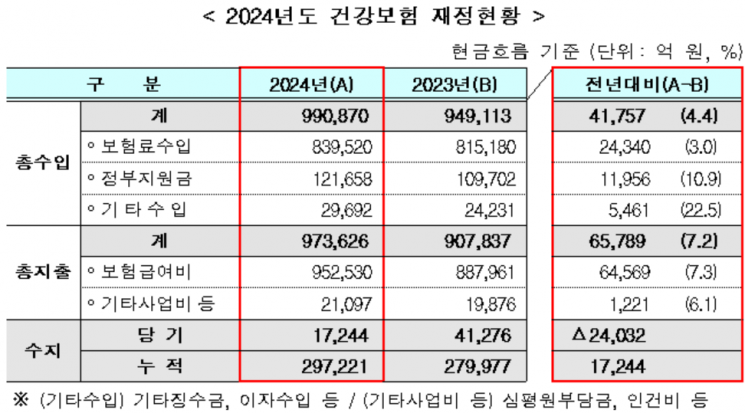

Despite support for the emergency medical system due to last year's medical crisis, the National Health Insurance (NHI) finances recorded a current account surplus of 1.7244 trillion KRW. With the NHI finances achieving a surplus for the fourth consecutive year, the accumulated reserves reached a record high of 29.7221 trillion KRW.

According to the National Health Insurance Service (NHIS) on the 7th, last year's total NHI revenue was 99.087 trillion KRW, an increase of 4.4% (4.1757 trillion KRW) compared to 2023. Although insurance premium income only increased by 3.0% (2.434 trillion KRW) year-on-year due to the freeze on health insurance premium rates and the easing of regional insurance premium burdens, the NHIS explained that total revenue increased thanks to increased government subsidies and strategic fund management.

Regarding premium income, workplace insurance premiums increased by 3.8% year-on-year due to a slowdown in the nominal wage growth rate and the resulting deceleration in the increase of workplace monthly remuneration. Regional insurance premiums decreased by 3.1% year-on-year due to the expansion of the basic deduction for property insurance premiums (from 50 million KRW to 100 million KRW) and the abolition of automobile insurance premium charges, both implemented from February last year. Additionally, government support for NHI last year was 12.2 trillion KRW, an increase of 1.1956 trillion KRW compared to the previous year, and interest income from accumulated reserves exceeded the target yield rate (3.43%), generating a total cash income of 830 billion KRW.

Total NHI expenditures amounted to 97.3626 trillion KRW, an increase of 7.2% (6.5789 trillion KRW) compared to the previous year. Although there was a tendency for training hospital benefit costs to decrease after the collective resignation of residents in February last year, emergency medical system support and advance payments to training hospitals led to a 7.3% (6.4569 trillion KRW) increase year-on-year.

The NHIS, together with the government, implemented a monthly emergency medical system support plan worth approximately 189 billion KRW from March last year to maintain the emergency medical system and encourage surgeries and inpatient care for severe and emergency patients, minimizing patient inconvenience. By November last year, the support funds invested in emergency medical care reached about 1.2585 trillion KRW. The NHIS also made advance payments (1.4844 trillion KRW) of up to 30% of the benefit costs from June to August of the previous year to 74 training hospitals nationwide facing financial difficulties to help maintain their medical systems. Excluding the advance payments, the NHI financial current account surplus for last year is estimated at 3.2088 trillion KRW.

Despite the insurance benefit costs increasing at a higher rate than the insurance premium income, the NHI finances achieved a surplus for the fourth consecutive year, accumulating reserves at a record high of 29.7221 trillion KRW, maintaining stable financial capacity. Based on this, the NHIS plans to steadily implement priority reform tasks such as essential medical support under the '2nd Comprehensive Health Insurance Plan (2024?2028)' and the '1st Medical Reform Implementation Plan,' including the structural transition of tertiary hospitals, while continuously striving for expenditure rationalization and optimal appropriate care provision through promoting rational medical use and adjusting oversupply of medical services throughout this year.

Jung Ki-seok, NHIS Director, stated, "Although mid- to long-term financial conditions are expected to be challenging due to demographic changes and economic uncertainties, we will maintain sound insurance finances by actively improving expenditure efficiency to prevent financial leakage and enhancing a transparent and trustworthy management and operation system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.