Provisional Results Announced on the 8th

Impact of Semiconductor Sector Weakness

IT Demand Slows and DRAM Prices Continue to Fall

HBM Supply Delays Hit Hard

Foundry and System LSI Also Expected to Post Losses

Target Prices Being Lowered One After Another

On the 8th, Samsung Electronics will announce its preliminary results for the fourth quarter of last year. The company's Q4 performance is expected to fall significantly short of market expectations. The main reasons cited are a decline in conventional memory demand due to inventory adjustments centered on mobile and personal computers (PCs), and a drop in legacy DRAM prices caused by a volume offensive from Chinese companies. Additionally, delays in HBM mass production are expected to keep operating profit in the 7 trillion won range.

According to financial information provider FnGuide on the 7th, Samsung Electronics' consensus revenue for Q4 last year was about 77.6289 trillion won, and the consensus operating profit was 8.2105 trillion won. This is about 4 trillion won lower than the forecast three months ago (12 trillion won). Most securities firms expect even lower results. Recent securities reports estimate Samsung Electronics' operating profit to be between 7.26 trillion and 7.9 trillion won, with no opinions predicting the 8 trillion won level.

The biggest reason for the lowered earnings expectations is the semiconductor sector's sluggishness. Major securities firms forecast Samsung Electronics' Device Solutions (DS) division's Q4 operating profit to be around 3 trillion won, a decrease compared to the previous quarter (3.9 trillion won).

As IT demand for smartphones and PCs continues to weaken, the profitability of legacy memory is deteriorating. Micron, known as the "weathervane" of the semiconductor industry, also announced disappointing earnings forecasts on the 20th of last month. Micron reported Q1 of fiscal year 2025 (September to November) revenue of $8.71 billion and earnings per share of $1.79, meeting market expectations, but Q2 (December to February) revenue is expected to be $7.9 billion and earnings per share $1.53, significantly below Wall Street estimates.

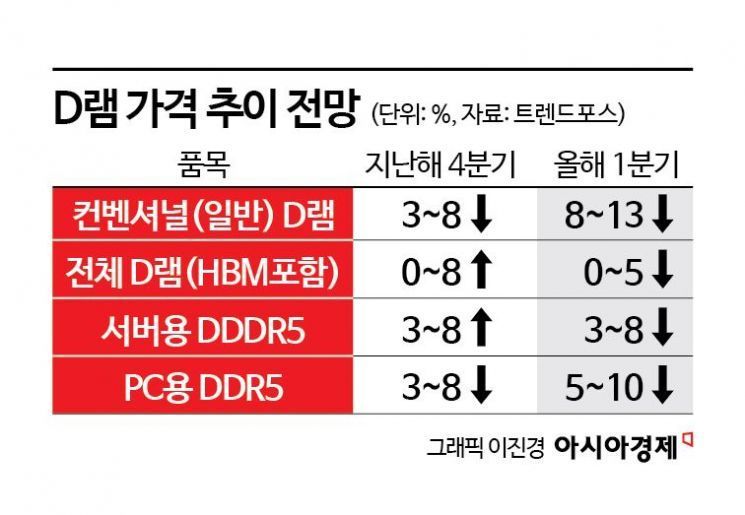

Furthermore, legacy DRAM prices continue to decline due to the low-price volume offensive by Chinese companies. According to market research firm TrendForce, conventional DRAM prices fell 38% in Q4 last year, and the decline is expected to widen to 8-13% in Q1.

In this situation, Samsung Electronics' poor HBM performance is even more painful. Last year, the memory semiconductor market showed polarization, with increased demand for advanced products such as artificial intelligence (AI), while demand for general DRAM used in PCs and smartphones decreased. Samsung Electronics failed to supply the 5th generation HBM, HBM3E, to Nvidia in Q4, resulting in sluggish sales of high value-added products.

Researcher Kim Young-geon from Mirae Asset explained, "Due to the decline in DRAM contract prices in Q4, the average selling price (ASP) of DRAM dropped by 3.3 percentage points, and there is a possibility of setting inventory valuation allowances. For HBM, considering the previously announced delay in supplying the North American customer-oriented HBM3E 8-stack product, we have lowered the bit growth forecast by 20 percentage points."

Foundry is also expected to have continued trillion-won-level losses following the previous quarter. This is due to sluggish orders from major customers and still low yield rates (good product ratio). The System LSI division is also expected to record trillion-won-level losses. The securities industry estimates that the foundry and System LSI divisions will incur operating losses of 1.4 trillion won. KB Securities researcher Kim Dong-won analyzed, "In Q4, the DS division is expected to see continued losses in System LSI and increased burdens from bonuses and development costs as memory bit growth guidance and ASP fall short of expectations."

In the financial investment industry, target prices for Samsung Electronics are being uniformly lowered. Just yesterday, Hana Securities (95,000 → 84,000 won), DS Investment & Securities (93,000 → 77,000 won), SK Securities (86,000 → 77,000 won), and Sangsangin Securities (85,000 → 77,000 won) all lowered their target prices.

Samsung Electronics' annual performance outlook for this year is also negative. The annual consensus for Samsung Electronics this year is revenue of 320.5629 trillion won and operating profit of 37.7575 trillion won, nearly a 30% decrease from the operating profit forecast of 56.2161 trillion won three months ago.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)