Coupang December MAU 32 Million... 7% Increase

Ali 7.2 Million · Temu 6.2 Million Around 30% Surge

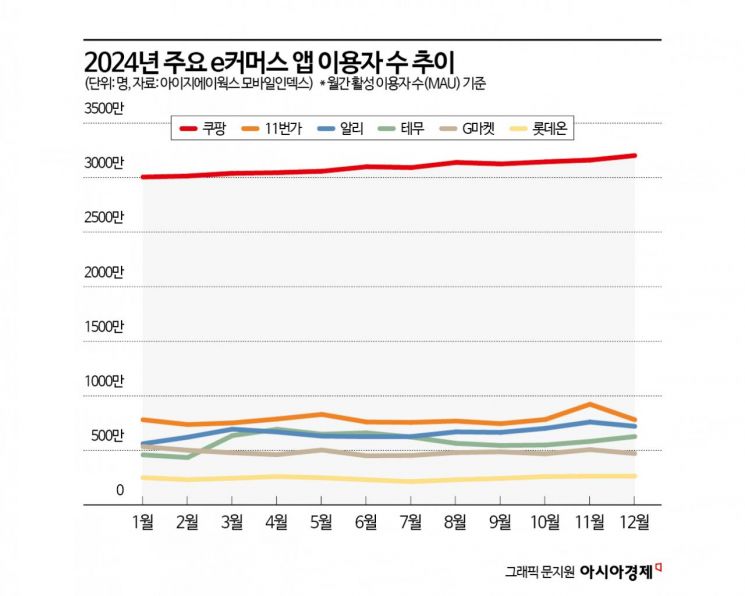

Among major e-commerce app services last year, Coupang and C-Commerce (Chinese e-commerce) saw a significant increase in app users. Amid fluctuations in e-commerce user numbers due to the unresolved settlement issues of Tmon and Wemakeprice (Timep) last year, these apps are interpreted to have benefited from a spillover effect.

According to Mobile Index, a data analysis solution by IGAWorks, Coupang's monthly active users (MAU) as of December last year were approximately 32.02 million. This represents about a 7% increase compared to December of the previous year (approximately 29.9 million) and is the first time the MAU exceeded 32 million based on Mobile Index's data. Coupang had maintained an MAU in the early 30 million range throughout last year.

Ray Jang, CEO of AliExpress Korea, is giving a presentation at the 'AliExpress Korea Seller Forum.' Photo by AliExpress

Ray Jang, CEO of AliExpress Korea, is giving a presentation at the 'AliExpress Korea Seller Forum.' Photo by AliExpress

Among major distribution industry apps last year, C-Commerce had the highest monthly user growth rate. In December last year, AliExpress and Temu recorded MAUs of 7.21 million and 6.27 million, respectively. Compared to January last year, AliExpress increased by 28.5%, and Temu by 36.5%. C-Commerce companies have rapidly penetrated the domestic e-commerce market since early last year by leveraging ultra-low prices and low commission rates. In particular, AliExpress recorded 7.6 million monthly users in November, when the biggest annual discount event for C-Commerce, 'Guanggunjie,' took place. This was the third highest among all e-commerce apps that month.

Domestic native e-commerce services maintained similar levels of MAU while experiencing ups and downs last year. 11st attracted an average of 7.8 million users per month, followed by Gmarket (4.8 million) and Lotte ON (2.45 million). Auction and SSG.com recorded average MAUs in the 2 million range last year. Tmon and Wemakeprice, e-commerce platforms affiliated with Qoo10 that faced unresolved settlement issues with vendors, had user numbers in the 4 million range before the incident but sharply declined to below 500,000 as of December last year.

These services also showed short-term user increases during discount periods. 11st's MAU surged to 9.23 million in November last year, when the largest annual discount event, 'Grand 11th,' was held. Gmarket, part of the Shinsegae group, also recorded its highest MAU of the year with 5.07 million users in November during the group's largest discount event, 'SSG Day.' Other Shinsegae group services, SSG.com and Auction, showed similar trends.

This year, the e-commerce market is expected to continue Coupang's dominance while C-Commerce attempts to catch up. Coupang plans to invest more than 3 trillion KRW in logistics-related facilities by 2027 to expand the so-called 'Cusegwon'?areas eligible for Rocket Delivery. Once this investment is completed, Rocket Delivery will be available in about 230 local governments. AliExpress also plans to invest 1.5 trillion KRW to expand logistics facilities domestically and strengthen customer services. AliExpress is expected to announce detailed plans regarding logistics center investments as early as the first half of this year.

The sudden collaboration between Shinsegae Group and Alibaba is also a noteworthy factor. On the 26th of last month, Shinsegae announced the establishment of a joint venture with Alibaba International, a subsidiary of Alibaba. The investment ratio is 50:50, with Shinsegae Group participating by contributing Gmarket as an in-kind investment. Through the joint venture, AliExpress Korea and Gmarket will operate under one roof, combining their user bases to approximately 12 million as of last year. This creates the second-largest e-commerce giant following Coupang.

However, as the market expresses skepticism about the collaboration, concrete cooperation plans to overcome this are expected to be presented within this year. While the two companies have formed a partnership, they have not disclosed specific business directions for the joint venture. Kim Myung-joo, a researcher at Korea Investment & Securities, said, "It is positive that Gmarket, which lacked a clear strategic direction, has secured a strategic partner," but added, "At this point, it is difficult to predict clear synergy effects from the joint venture establishment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)